FORM AlAbAmA D PPT Alabama Department of Revenue

What is the Alabama D PPT Form?

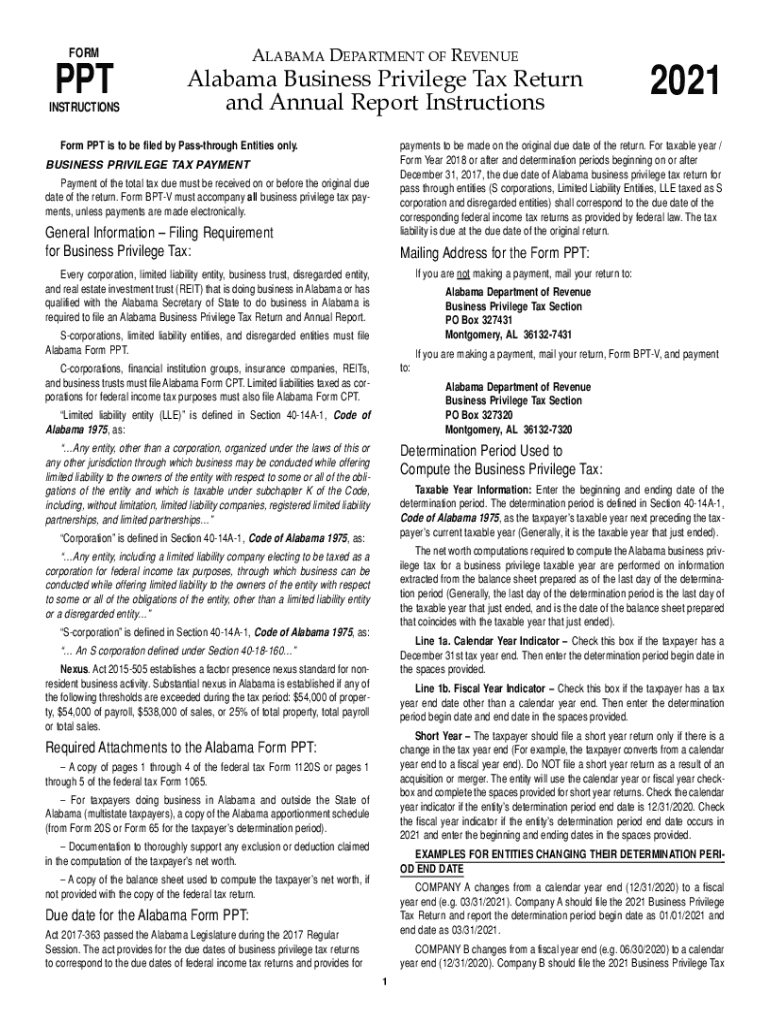

The Alabama D PPT form, also known as the Alabama Department of Revenue Business Privilege Tax form, is a document required for businesses operating within the state of Alabama. This form is essential for reporting and paying the business privilege tax, which is levied on entities conducting business in Alabama. The tax is based on the entity's net worth and is applicable to various business structures, including corporations, limited liability companies (LLCs), and partnerships.

Steps to Complete the Alabama D PPT Form

Completing the Alabama D PPT form involves several key steps to ensure accuracy and compliance. Start by gathering the necessary financial information, including your business's net worth and any relevant financial statements. Next, fill out the form with your business details, including the legal name, address, and entity type. Make sure to calculate the business privilege tax owed based on the instructions provided on the form. Finally, review the completed form for accuracy before submitting it either online or by mail.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with the Alabama D PPT form. Generally, the form is due on the fifteenth day of the third month following the end of your business's fiscal year. For businesses operating on a calendar year, this means the form is typically due on March 15. Late submissions may incur penalties, so timely filing is essential to avoid additional fees.

Required Documents for Submission

When preparing to submit the Alabama D PPT form, several documents may be required to support your filing. These include financial statements that reflect your business's net worth, previous tax returns, and any additional documentation that may be requested by the Alabama Department of Revenue. Having these documents ready will streamline the submission process and help ensure that your form is processed without delays.

Penalties for Non-Compliance

Failure to comply with the requirements of the Alabama D PPT form can result in significant penalties. Businesses that do not file the form by the deadline may face late fees, which can accumulate over time. Additionally, non-compliance may lead to interest charges on any unpaid taxes. It is advisable to stay informed about the obligations associated with this form to avoid potential financial repercussions.

Digital vs. Paper Version of the Form

Businesses have the option to complete the Alabama D PPT form either digitally or on paper. The digital version allows for easier submission and may include electronic signature capabilities, making the process more efficient. On the other hand, some businesses may prefer the traditional paper method for record-keeping purposes. Regardless of the method chosen, it is important to ensure that all information is accurately provided to avoid issues with the Alabama Department of Revenue.

Quick guide on how to complete form alabama d ppt 2019 alabama department of revenue

Complete FORM AlAbAmA D PPT Alabama Department Of Revenue effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without interruptions. Manage FORM AlAbAmA D PPT Alabama Department Of Revenue on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign FORM AlAbAmA D PPT Alabama Department Of Revenue smoothly

- Obtain FORM AlAbAmA D PPT Alabama Department Of Revenue and click Get Form to begin.

- Utilize the tools we offer to submit your document.

- Highlight critical sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign FORM AlAbAmA D PPT Alabama Department Of Revenue and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form alabama d ppt 2019 alabama department of revenue

How to make an e-signature for a PDF document online

How to make an e-signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

The best way to make an e-signature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What are the Alabama PPT instructions for using airSlate SignNow?

The Alabama PPT instructions for using airSlate SignNow provide a step-by-step guide on eSigning documents effectively. Users can easily upload their forms, invite signers, and track document status. Following these instructions ensures a smooth signing process that complies with state regulations.

-

How much does airSlate SignNow cost for Alabama users?

The pricing for airSlate SignNow varies based on the plan you choose, catering to different business needs. Alabama users can benefit from cost-effective solutions that include flexible pricing tiers. Each plan offers unique features, ensuring you find the best option for your eSigning requirements.

-

What features does airSlate SignNow offer for Alabama residents?

airSlate SignNow provides numerous features for Alabama residents, including document templates, custom workflows, and real-time tracking of eSigned documents. The platform is user-friendly, allowing anyone to navigate easily. With its robust feature set, it enhances your document management experience.

-

Are the Alabama PPT instructions included with my airSlate SignNow subscription?

Yes, the Alabama PPT instructions are included with your airSlate SignNow subscription. These are accessible via the help center and ensure you can utilize all the features effectively. Whether new or experienced, these instructions are an excellent resource for maximizing your usage.

-

Can airSlate SignNow integrate with other tools I use in Alabama?

Absolutely! airSlate SignNow offers integrations with a variety of tools, making it easy to streamline your workflow. These integrations help connect your existing systems, allowing you to utilize airSlate SignNow for your Alabama PPT instructions seamlessly across different platforms.

-

What are the benefits of using airSlate SignNow for eSigning documents in Alabama?

Using airSlate SignNow for eSigning documents in Alabama provides several benefits, such as increased efficiency and compliance with state laws. The platform simplifies the signing process, reduces turnaround time, and enhances overall productivity. This makes it an ideal choice for businesses and individuals alike.

-

Is airSlate SignNow secure for handling sensitive documents in Alabama?

Yes, airSlate SignNow prioritizes security and ensures that all documents, including sensitive ones, are protected with advanced encryption. The Alabama PPT instructions emphasize secure handling practices that maintain compliance with privacy regulations. Your documents are safe throughout the entire signing process.

Get more for FORM AlAbAmA D PPT Alabama Department Of Revenue

- Letter from tenant to landlord with demand that landlord repair broken windows alaska form

- Letter from tenant to landlord with demand that landlord repair plumbing problem alaska form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy form

- Letter from tenant to landlord with demand that landlord repair unsafe or broken lights or wiring alaska form

- Letter from tenant to landlord with demand that landlord repair floors stairs or railings alaska form

- Letter from tenant to landlord with demand that landlord remove garbage and vermin from premises alaska form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles alaska form

- Letter from tenant to landlord about landlords failure to make repairs alaska form

Find out other FORM AlAbAmA D PPT Alabama Department Of Revenue

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer