Overview of Arkansas Retirement Tax Friendliness Form

Overview of Arkansas Retirement Tax Friendliness

The Arkansas Retirement Tax Friendliness is a crucial aspect for individuals planning their financial future in the state. Arkansas offers various tax benefits for retirees, which can significantly impact their overall financial health. Understanding these tax advantages is essential for effective retirement planning. The state does not tax Social Security benefits, which is a significant relief for many retirees. Additionally, there are exemptions available for certain types of retirement income, making Arkansas an attractive option for those looking to retire comfortably.

Steps to Complete the Overview of Arkansas Retirement Tax Friendliness

To fully benefit from the tax advantages offered in Arkansas, individuals should follow a clear process. First, gather all relevant financial documents, including retirement account statements and Social Security benefit letters. Next, familiarize yourself with the specific exemptions available for retirement income, such as pensions and annuities. It is advisable to consult with a tax professional who understands Arkansas tax laws to ensure compliance and maximize benefits. Completing the necessary forms accurately will help in claiming the appropriate deductions and exemptions.

Eligibility Criteria for Arkansas Retirement Tax Friendliness

Eligibility for the tax benefits related to retirement in Arkansas generally depends on age and income sources. Individuals aged sixty-five and older are typically eligible for certain tax exemptions. Additionally, the type of retirement income received—such as Social Security, pensions, or withdrawals from retirement accounts—can influence eligibility. It is essential for retirees to review their income sources and consult with a tax advisor to determine which benefits apply to their specific situation.

Filing Deadlines / Important Dates

Understanding the filing deadlines for Arkansas taxes is vital for retirees. The state generally follows the federal tax deadline, which is April fifteenth. However, retirees should be aware of any specific deadlines related to retirement income reporting. It is advisable to keep track of any changes in tax laws that may affect filing dates. Early preparation can help ensure that all necessary documentation is submitted on time, avoiding potential penalties.

Form Submission Methods for Arkansas Retirement Tax Friendliness

Retirees in Arkansas have multiple options for submitting their tax forms. The state allows for online submissions, which can streamline the process and reduce the likelihood of errors. Alternatively, individuals can choose to mail their forms or submit them in person at designated tax offices. Each method has its advantages, and retirees should select the one that best fits their needs and comfort level with technology.

IRS Guidelines Related to Arkansas Retirement Tax Friendliness

When navigating retirement taxes in Arkansas, it is crucial to consider IRS guidelines. The IRS provides specific rules regarding the taxation of retirement income, including distributions from retirement accounts and Social Security benefits. Retirees should ensure they are in compliance with federal regulations while taking advantage of state-specific benefits. Staying informed about IRS updates can help retirees make informed decisions regarding their tax obligations.

Penalties for Non-Compliance with Arkansas Retirement Tax Regulations

Failure to comply with Arkansas retirement tax regulations can result in penalties, including fines and interest on unpaid taxes. It is essential for retirees to understand their responsibilities and ensure that all required forms are filed accurately and on time. Consulting with a tax professional can help mitigate the risk of non-compliance and ensure that retirees maximize their benefits while adhering to all legal requirements.

Quick guide on how to complete overview of arkansas retirement tax friendliness

Complete Overview Of Arkansas Retirement Tax Friendliness effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It provides an optimal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate form and safely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents quickly without delays. Manage Overview Of Arkansas Retirement Tax Friendliness on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Overview Of Arkansas Retirement Tax Friendliness with ease

- Locate Overview Of Arkansas Retirement Tax Friendliness and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or black out confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, laborious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your device of choice. Alter and eSign Overview Of Arkansas Retirement Tax Friendliness to guarantee exceptional communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the overview of arkansas retirement tax friendliness

The best way to generate an e-signature for a PDF document in the online mode

The best way to generate an e-signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

How to create an e-signature from your mobile device

How to create an e-signature for a PDF document on iOS devices

How to create an e-signature for a PDF file on Android devices

People also ask

-

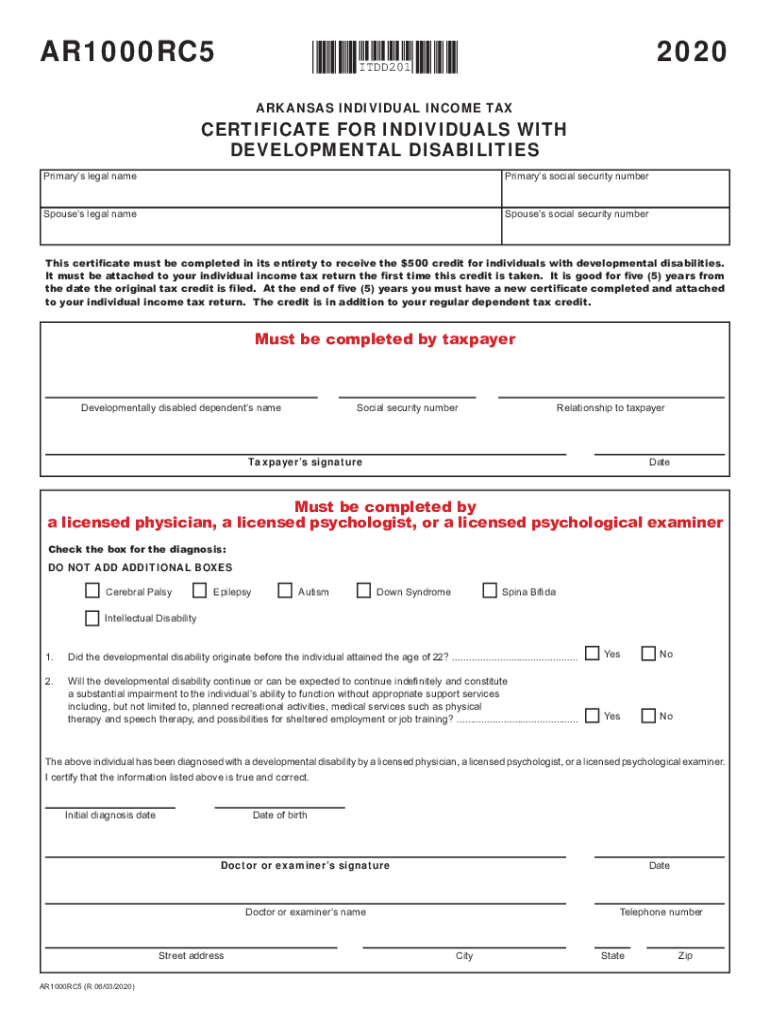

What is the ar1000rc5 2021 and how does it work?

The ar1000rc5 2021 is a cutting-edge document management solution that allows users to send and electronically sign documents seamlessly. It streamlines the signing process, making it efficient and user-friendly. By using the ar1000rc5 2021, businesses can increase productivity and reduce the time spent on manual paperwork.

-

What are the key features of the ar1000rc5 2021?

The ar1000rc5 2021 offers a range of features including customizable templates, real-time tracking of sent documents, and secure cloud storage. Additionally, it supports various file formats for convenience. These features make the ar1000rc5 2021 an essential tool for any business looking to improve their document workflow.

-

How much does the ar1000rc5 2021 cost?

Pricing for the ar1000rc5 2021 varies based on the subscription plan chosen. The plans are designed to cater to different business sizes and needs, ensuring a cost-effective solution. For detailed pricing information, it's best to visit the airSlate SignNow website or contact sales.

-

What are the benefits of using the ar1000rc5 2021?

Using the ar1000rc5 2021 allows businesses to enhance their efficiency by minimizing paperwork and speeding up the signing process. It also ensures the security of documents through encryption and secure access. Overall, the ar1000rc5 2021 signNowly contributes to smoother business operations.

-

Is the ar1000rc5 2021 suitable for small businesses?

Absolutely, the ar1000rc5 2021 is ideal for small businesses looking to optimize their document management. With its user-friendly interface and customizable options, small businesses can easily adapt the solution to their needs. It provides an affordable way to reduce costs associated with traditional document signing.

-

Can I integrate the ar1000rc5 2021 with other software?

Yes, the ar1000rc5 2021 supports integrations with various popular software platforms such as CRM systems and document storage solutions. This flexibility allows businesses to enhance their workflows by connecting different tools seamlessly. Check the integration capabilities on the airSlate SignNow website for more details.

-

What security features does the ar1000rc5 2021 provide?

The ar1000rc5 2021 prioritizes the security of your documents with features such as encryption, secure access controls, and audit trails. These measures help ensure that sensitive information remains protected throughout the signing process. Businesses can trust that the ar1000rc5 2021 meets high security standards.

Get more for Overview Of Arkansas Retirement Tax Friendliness

- Ak widow 497295213 form

- Legal last will and testament form for widow or widower with minor children alaska

- Legal last will form for a widow or widower with no children alaska

- Legal last will and testament form for a widow or widower with adult and minor children alaska

- Legal last will and testament form for divorced and remarried person with mine yours and ours children alaska

- Legal last will and testament form with all property to trust called a pour over will alaska

- Written revocation of will alaska form

- Last will and testament for other persons alaska form

Find out other Overview Of Arkansas Retirement Tax Friendliness

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online