Form AST 3, Virginia Aircraft Sales and Use Tax Return

What is the Form AST 3, Virginia Aircraft Sales And Use Tax Return

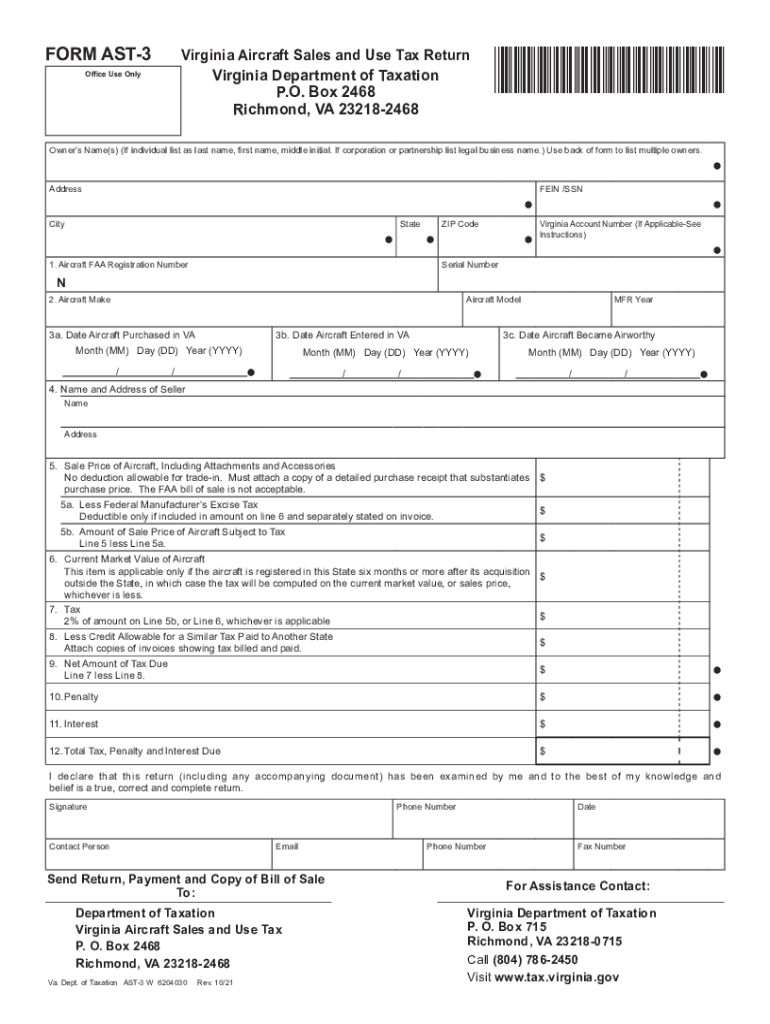

The Form AST 3 is a tax document used in Virginia for reporting and paying the aircraft sales and use tax. This form is essential for individuals and businesses that purchase aircraft within the state. It ensures compliance with Virginia tax laws regarding the acquisition of aircraft, which may include planes, helicopters, and other flying vehicles. The form captures critical information about the buyer, the aircraft, and the transaction details, allowing the Virginia Department of Taxation to assess the appropriate tax liability.

Steps to complete the Form AST 3, Virginia Aircraft Sales And Use Tax Return

Completing the Form AST 3 involves several key steps to ensure accuracy and compliance. Start by gathering necessary information, including the buyer's details, aircraft specifications, and purchase price. Next, fill out the form with accurate data, ensuring that all sections are completed, including the calculation of the sales and use tax owed. After completing the form, review it for any errors or omissions. Finally, submit the form along with any required payment to the Virginia Department of Taxation by the specified deadline.

Key elements of the Form AST 3, Virginia Aircraft Sales And Use Tax Return

The Form AST 3 includes several important elements that must be accurately reported. Key sections include:

- Buyer Information: Name, address, and contact details of the purchaser.

- Aircraft Details: Make, model, year, and identification number of the aircraft.

- Transaction Information: Purchase price, date of sale, and any trade-in details.

- Tax Calculation: Calculation of the sales and use tax based on the purchase price.

Each element is crucial for determining the correct tax liability and ensuring compliance with state regulations.

Legal use of the Form AST 3, Virginia Aircraft Sales And Use Tax Return

The Form AST 3 is legally binding and must be used in accordance with Virginia tax laws. Proper use of this form ensures that the buyer fulfills their tax obligations when purchasing an aircraft. The form provides a record of the transaction, which may be required for audits or other legal purposes. It is important to understand that failure to submit the form or inaccuracies in reporting can lead to penalties or legal consequences.

Filing Deadlines / Important Dates

Timely filing of the Form AST 3 is critical to avoid penalties. The form must be submitted within a specific timeframe following the purchase of the aircraft. Typically, the deadline is set for thirty days after the transaction date. It is advisable to check the Virginia Department of Taxation's official guidelines for any updates or changes to these deadlines to ensure compliance.

Form Submission Methods (Online / Mail / In-Person)

The Form AST 3 can be submitted through various methods to accommodate different preferences. Options include:

- Online Submission: Many taxpayers prefer to file electronically through the Virginia Department of Taxation's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Department of Taxation.

- In-Person: Taxpayers may also choose to deliver the form in person at local tax offices.

Each submission method has its own requirements and processing times, so it is important to choose the one that best fits your needs.

Quick guide on how to complete form ast 3 virginia aircraft sales and use tax return

Complete Form AST 3, Virginia Aircraft Sales And Use Tax Return effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-conscious substitute for traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and electronically sign your documents quickly without delays. Manage Form AST 3, Virginia Aircraft Sales And Use Tax Return on any platform with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to modify and eSign Form AST 3, Virginia Aircraft Sales And Use Tax Return effortlessly

- Locate Form AST 3, Virginia Aircraft Sales And Use Tax Return and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize signNow sections of the documents or conceal sensitive information using the tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Stop worrying about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form AST 3, Virginia Aircraft Sales And Use Tax Return and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ast 3 virginia aircraft sales and use tax return

How to generate an electronic signature for your PDF document in the online mode

How to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the form ast 3 and how can it benefit my business?

The form ast 3 is a crucial document used for various business compliance needs, and airSlate SignNow simplifies its signing and distribution. By utilizing our platform, you can easily send, eSign, and manage the form ast 3, saving time and enhancing collaboration. Our solution is designed to streamline your document processes, making compliance easier and more efficient.

-

How much does it cost to use airSlate SignNow for the form ast 3?

airSlate SignNow offers flexible pricing plans suitable for all business sizes, starting with a free trial. Pricing varies based on features and team size, but you can manage the cost effectively while ensuring you have the necessary tools for the form ast 3. Check our pricing page for detailed information on subscriptions and available features.

-

Can I customize the form ast 3 with airSlate SignNow?

Yes, airSlate SignNow allows for extensive customization of the form ast 3 to meet your specific needs. You can add fields, change templates, and adapt workflows to ensure the document serves its purpose effectively. Furthermore, our user-friendly interface makes customization straightforward and quick.

-

What features does airSlate SignNow provide for handling the form ast 3?

Our platform includes a wide range of features for managing the form ast 3, such as document tracking, automated reminders, and secure eSignature capabilities. These tools allow you to keep your signing processes organized and on schedule, ensuring compliance and reducing paperwork delays. Experience the convenience of handling the form ast 3 efficiently with our all-in-one solution.

-

Does airSlate SignNow integrate with other software for processing the form ast 3?

Yes, airSlate SignNow seamlessly integrates with a variety of software applications like Google Workspace, Salesforce, and others. This integration capability enhances workflows by allowing you to manage the form ast 3 directly within the tools you already use. Increase efficiency and reduce manual tasks with our automation features.

-

How can airSlate SignNow improve the workflow for the form ast 3?

With airSlate SignNow, you can automate many aspects of the workflow associated with the form ast 3. Features like bulk sending, predefined templates, and real-time notifications ensure that everyone stays informed and engaged. This optimization leads to faster turnaround times and improved productivity for your team.

-

Is training or support available for using airSlate SignNow with the form ast 3?

Yes, airSlate SignNow provides excellent customer support and training resources to help you effectively use our platform for the form ast 3. Our dedicated support team is available to assist you with any questions or technical issues you may encounter. Additionally, we offer tutorials and user guides to enhance your experience.

Get more for Form AST 3, Virginia Aircraft Sales And Use Tax Return

- Subcontractors package arkansas form

- Ar minors form

- Arkansas theft form

- Arkansas deceased form

- Identity theft by known imposter package arkansas form

- Organizing your personal assets package arkansas form

- Essential documents for the organized traveler package arkansas form

- Essential documents for the organized traveler package with personal organizer arkansas form

Find out other Form AST 3, Virginia Aircraft Sales And Use Tax Return

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document