Quarter # Form 941ME 99 *2106200* Maine Revenue

Understanding the 2021 Maine Form Withholding

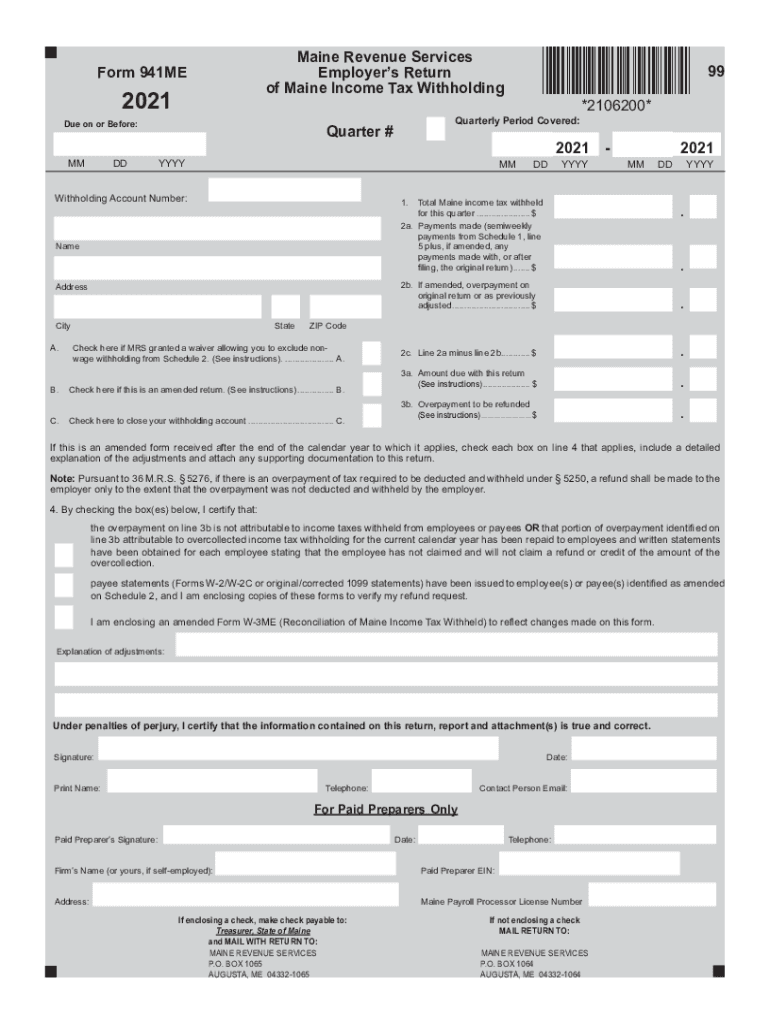

The 2021 Maine Form Withholding, often referred to as the 941ME, is a crucial document for employers in Maine to report income tax withheld from employees’ wages. This form is essential for ensuring compliance with state tax laws and helps in accurately calculating the amount of tax owed to the state. Employers must understand the specific requirements and guidelines associated with this form to avoid penalties and ensure proper filing.

Steps to Complete the 2021 Maine Form Withholding

Completing the 2021 Maine Form Withholding involves several key steps:

- Gather necessary information, including employer identification details and employee wage information.

- Fill out the form accurately, ensuring that all required fields are completed.

- Calculate the total amount of withholding based on the wages paid during the reporting period.

- Review the form for accuracy before submission to avoid errors that could lead to penalties.

Filing Deadlines for the 2021 Maine Form Withholding

It is important to be aware of the filing deadlines associated with the 2021 Maine Form Withholding. Generally, employers must submit this form quarterly. The specific due dates for each quarter are:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31 of the following year

Legal Use of the 2021 Maine Form Withholding

The legal use of the 2021 Maine Form Withholding is governed by state tax regulations. This form must be filed by all employers who withhold income tax from employee wages. Failure to file or inaccuracies in the form can result in penalties, including fines and interest on unpaid taxes. Understanding the legal implications is vital for maintaining compliance and avoiding legal issues.

Form Submission Methods for the 2021 Maine Form Withholding

Employers have several options for submitting the 2021 Maine Form Withholding:

- Online submission through the Maine Revenue Services website.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if applicable.

Key Elements of the 2021 Maine Form Withholding

The key elements of the 2021 Maine Form Withholding include:

- Employer information, including name, address, and identification number.

- Employee wage details and the amount withheld for state income tax.

- Signature of the employer or authorized representative to certify the accuracy of the information.

Quick guide on how to complete 2021 2021 quarter form 941me 99 2106200 maine revenue

Fulfill Quarter # Form 941ME 99 *2106200* Maine Revenue seamlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Quarter # Form 941ME 99 *2106200* Maine Revenue on any gadget with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign Quarter # Form 941ME 99 *2106200* Maine Revenue with minimal effort

- Obtain Quarter # Form 941ME 99 *2106200* Maine Revenue and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device you prefer. Adjust and eSign Quarter # Form 941ME 99 *2106200* Maine Revenue and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2021 2021 quarter form 941me 99 2106200 maine revenue

The way to create an e-signature for your PDF file online

The way to create an e-signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

The way to create an e-signature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

The way to create an e-signature for a PDF on Android devices

People also ask

-

What is the 2021 Maine form withholding and why do I need it?

The 2021 Maine form withholding is a tax form required for employers to report and withhold income taxes from their employees' wages. Completing this form accurately ensures compliance with state tax laws and prevents potential penalties. Using airSlate SignNow simplifies this process by allowing you to easily manage and eSign your documents online.

-

How can airSlate SignNow help with the 2021 Maine form withholding?

airSlate SignNow provides a user-friendly platform for businesses to create, send, and eSign the 2021 Maine form withholding. Our solution saves time and reduces errors by streamlining the document management process, ensuring that all forms are completed accurately and efficiently.

-

Are there any costs associated with using airSlate SignNow for the 2021 Maine form withholding?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. You can find a plan that fits your budget while gaining access to efficient tools for managing your 2021 Maine form withholding alongside other document needs. We offer competitive pricing to ensure you get the best value for your investment.

-

Can I integrate airSlate SignNow with other software for managing the 2021 Maine form withholding?

Absolutely! airSlate SignNow integrates seamlessly with a variety of popular business applications, allowing you to streamline the management of your 2021 Maine form withholding and other documents. This compatibility ensures that you can work efficiently within your existing system without losing valuable time.

-

Is it secure to use airSlate SignNow for the 2021 Maine form withholding?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents like the 2021 Maine form withholding. Our platform uses industry-standard encryption and provides user authentication to protect your data and ensure that only authorized individuals can access it.

-

How do I get started with airSlate SignNow for the 2021 Maine form withholding?

Getting started with airSlate SignNow is simple. Sign up for an account on our website, choose the right pricing plan for your needs, and you can start creating and eSigning the 2021 Maine form withholding right away. Our user-friendly interface makes the whole process quick and intuitive.

-

Can I customize the 2021 Maine form withholding in airSlate SignNow?

Yes, airSlate SignNow allows for customization of the 2021 Maine form withholding to fit your business requirements. You can add your company branding, adjust the form fields, and ensure that all necessary information is captured, making the process as personalized and efficient as possible.

Get more for Quarter # Form 941ME 99 *2106200* Maine Revenue

- Quitclaim deed from 497298349 form

- Special warranty deed from individual to individual california form

- Family limited partnership form

- Quitclaim deed for a time share two individuals or husband and wife to one individual california form

- Grant deed from two trusts to three trusts california form

- California trust company form

- Warranty deed from two individuals to an individual california form

- California road agreement form

Find out other Quarter # Form 941ME 99 *2106200* Maine Revenue

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy