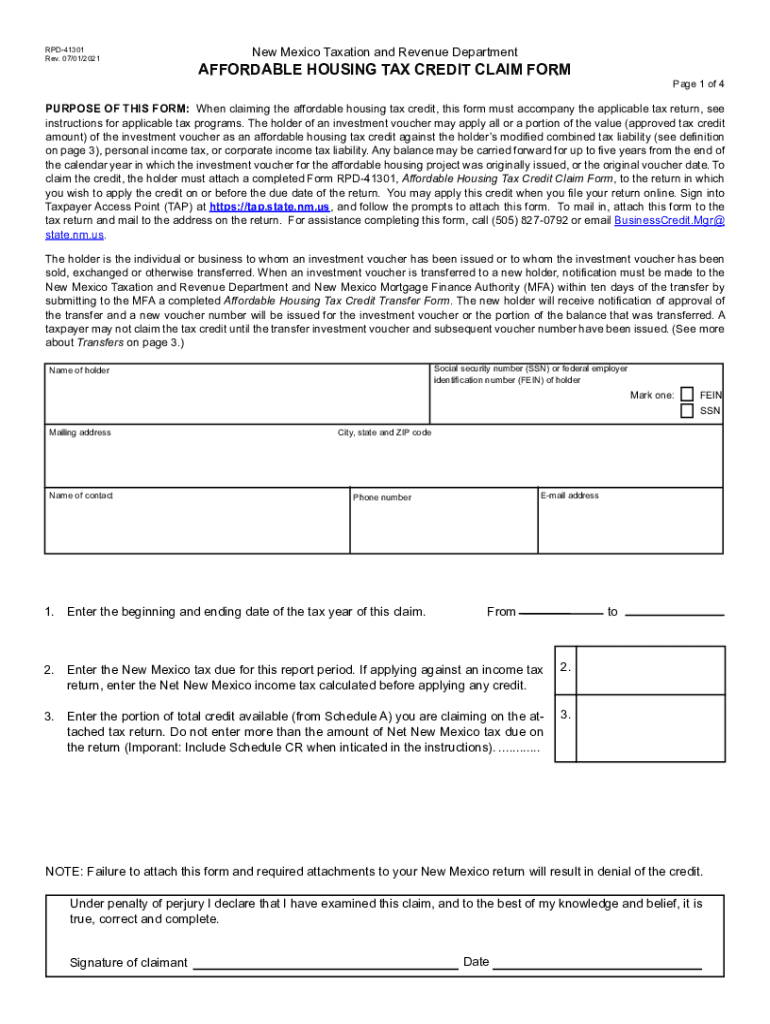

PURPOSE of THIS FORM When Claiming the Affordable Housing Tax Credit, This Form Must Accompany the Applicable Tax Return, See

Purpose of the NM Tax Credit Claim Form

The NM tax credit claim form is essential for individuals and businesses seeking to claim the Affordable Housing Tax Credit in New Mexico. This form must accompany the applicable tax return to ensure that the credit is accurately calculated and applied. The Affordable Housing Tax Credit is designed to incentivize the development and rehabilitation of affordable housing, making it a critical tool for promoting housing accessibility in the state.

Steps to Complete the NM Tax Credit Claim Form

Completing the NM tax credit claim form involves several key steps to ensure accuracy and compliance:

- Gather necessary documentation, including income statements and proof of residency.

- Fill out the form with accurate personal and financial information.

- Attach any required supporting documents, such as tax returns and proof of eligibility.

- Review the completed form for errors or omissions.

- Submit the form along with your tax return by the designated deadline.

Eligibility Criteria for the NM Tax Credit Claim

To qualify for the Affordable Housing Tax Credit, applicants must meet specific eligibility criteria. These typically include:

- Being a resident of New Mexico.

- Meeting income limits set by the state.

- Occupying a dwelling that meets the definition of affordable housing.

Understanding these criteria is crucial for ensuring that your claim is valid and can be processed without issues.

Required Documents for Submission

When preparing to submit the NM tax credit claim form, it is important to gather all required documents. Commonly needed documents include:

- Proof of income, such as pay stubs or tax returns.

- Documentation of residency, like a utility bill or lease agreement.

- Any additional forms or schedules that may be relevant to your tax situation.

Having these documents ready can streamline the submission process and help avoid delays.

Form Submission Methods

The NM tax credit claim form can be submitted through various methods, ensuring flexibility for taxpayers. Options include:

- Online submission via the state tax department's website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax offices.

Choosing the right submission method can depend on personal preference and the urgency of your claim.

IRS Guidelines for the NM Tax Credit Claim Form

It is essential to adhere to IRS guidelines when completing the NM tax credit claim form. This includes:

- Following the instructions provided with the form.

- Ensuring that all information is accurate and complete.

- Submitting the form by the IRS filing deadline to avoid penalties.

Staying informed about IRS requirements can help ensure that your claim is processed smoothly.

Quick guide on how to complete purpose of this form when claiming the affordable housing tax credit this form must accompany the applicable tax return see

Finalize PURPOSE OF THIS FORM When Claiming The Affordable Housing Tax Credit, This Form Must Accompany The Applicable Tax Return, See effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage PURPOSE OF THIS FORM When Claiming The Affordable Housing Tax Credit, This Form Must Accompany The Applicable Tax Return, See on any device using airSlate SignNow applications for Android or iOS and enhance any document-related workflow today.

The easiest method to modify and eSign PURPOSE OF THIS FORM When Claiming The Affordable Housing Tax Credit, This Form Must Accompany The Applicable Tax Return, See with ease

- Find PURPOSE OF THIS FORM When Claiming The Affordable Housing Tax Credit, This Form Must Accompany The Applicable Tax Return, See and click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or disorganized documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device you prefer. Edit and eSign PURPOSE OF THIS FORM When Claiming The Affordable Housing Tax Credit, This Form Must Accompany The Applicable Tax Return, See and guarantee exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the purpose of this form when claiming the affordable housing tax credit this form must accompany the applicable tax return see

How to make an e-signature for your PDF file in the online mode

How to make an e-signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is the new mexico affordable housing tax?

The New Mexico affordable housing tax is a tax incentive designed to encourage property development and renovations aimed at providing affordable housing options. It benefits both developers and low-income residents by facilitating more accessible housing opportunities. Understanding this tax can help you make informed decisions when investing in property in New Mexico.

-

How can airSlate SignNow help with new mexico affordable housing tax documentation?

AirSlate SignNow simplifies the process of handling documents related to the new mexico affordable housing tax. With our eSignature capabilities, you can quickly prepare, send, and sign tax-related agreements and forms. This efficiency helps you comply with tax requirements while saving time and reducing paper waste.

-

Are there any costs associated with using airSlate SignNow for new mexico affordable housing tax documents?

Yes, while airSlate SignNow offers competitive pricing, the cost of using our platform for managing new mexico affordable housing tax documents varies based on features and usage. We strive to provide an affordable solution that meets your needs for eSigning and document management without hidden fees. Visit our pricing page to find the best plan for you.

-

What features does airSlate SignNow offer for new mexico affordable housing tax management?

AirSlate SignNow includes features like customizable templates, bulk sending, and advanced tracking capabilities tailored for new mexico affordable housing tax management. These tools ensure that you can efficiently create and manage necessary documents while also keeping track of signing progress. Our platform is designed for ease of use, making your tax management process seamless.

-

Can airSlate SignNow integrate with other software for new mexico affordable housing tax purposes?

Absolutely! AirSlate SignNow offers integrations with various software solutions, making it easier to manage your new mexico affordable housing tax processes. Whether you're using CRMs, project management tools, or accounting software, our integrations help create a cohesive workflow that enhances productivity and keeps your data organized.

-

What are the benefits of using airSlate SignNow for new mexico affordable housing tax documents?

Using airSlate SignNow for your new mexico affordable housing tax documents brings several benefits, including faster processing times, reduced paper-related expenses, and enhanced compliance. Our platform ensures your documents are legally binding and secure, which gives you peace of mind. Additionally, our user-friendly interface makes the entire process straightforward for all users.

-

Is airSlate SignNow suitable for individual users dealing with new mexico affordable housing tax?

Yes, airSlate SignNow is suitable for individual users as well as businesses dealing with new mexico affordable housing tax documents. Whether you are a property owner or a tax professional, our cost-effective solution provides the necessary tools to manage your documentation efficiently. Our pricing plans cater to both individuals and teams, ensuring everyone can benefit.

Get more for PURPOSE OF THIS FORM When Claiming The Affordable Housing Tax Credit, This Form Must Accompany The Applicable Tax Return, See

Find out other PURPOSE OF THIS FORM When Claiming The Affordable Housing Tax Credit, This Form Must Accompany The Applicable Tax Return, See

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form