Fillable Online Supporting Childrens Writing in Reception Form

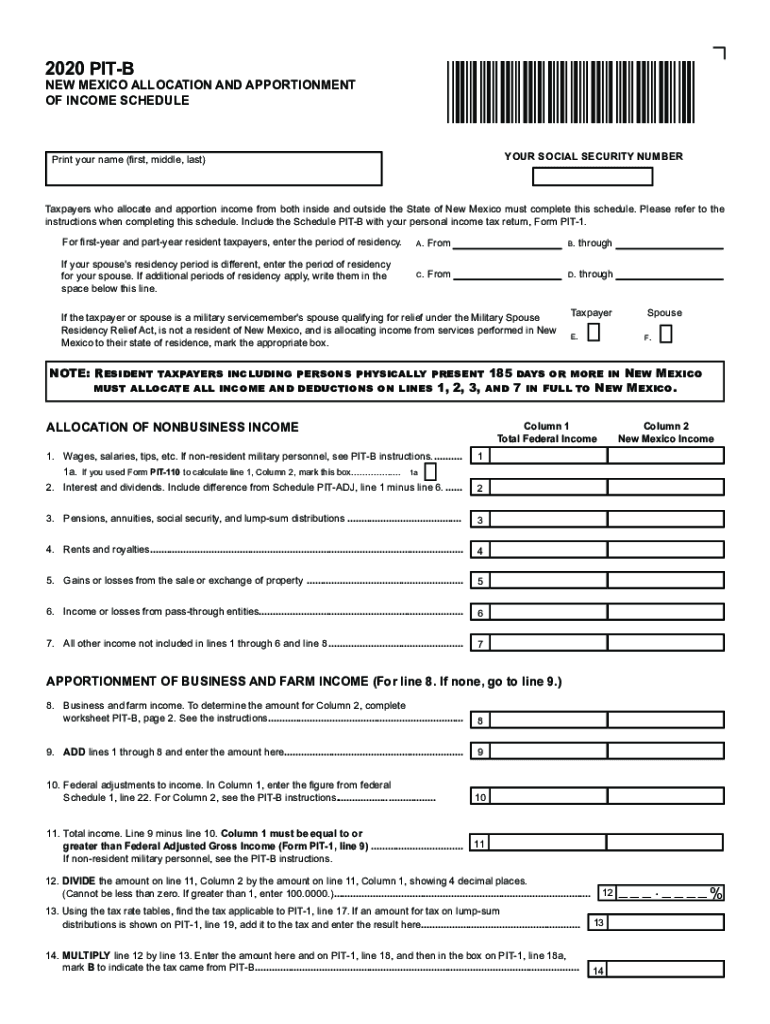

Understanding the PITB Apportionment Form

The PITB apportionment form is a crucial document used in the state of New Mexico for reporting income that is subject to apportionment. This form is essential for businesses that operate in multiple states, as it helps determine the portion of income that is taxable in New Mexico. Understanding the specifics of this form can aid in accurate tax reporting and compliance with state regulations.

Steps to Complete the PITB Apportionment Form

Filling out the PITB apportionment form involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Identify the income that is subject to apportionment and calculate the total income.

- Fill in the required sections of the form, including business information and apportionment calculations.

- Review the completed form for accuracy before submission.

Legal Use of the PITB Apportionment Form

The legal validity of the PITB apportionment form is supported by compliance with state tax laws. This form must be completed accurately to ensure that the income reported aligns with New Mexico's tax regulations. Failure to comply with these requirements can result in penalties or disputes with tax authorities.

Filing Deadlines for the PITB Apportionment Form

It is important to be aware of the filing deadlines associated with the PITB apportionment form. Generally, the form must be submitted by the due date of the business's tax return. Late submissions may incur penalties, so staying informed about these deadlines is essential for compliance.

Required Documents for the PITB Apportionment Form

To complete the PITB apportionment form, businesses must have several supporting documents ready, including:

- Financial statements that detail income and expenses.

- Records of any income earned in other states.

- Prior year tax returns for reference.

Examples of Using the PITB Apportionment Form

Businesses that operate in multiple states often use the PITB apportionment form to allocate income appropriately. For instance, a company that generates revenue in both New Mexico and Texas will use this form to determine how much of its income is taxable in New Mexico, ensuring compliance with state tax laws.

Digital vs. Paper Version of the PITB Apportionment Form

Businesses can choose between submitting the PITB apportionment form digitally or via paper. The digital version offers the advantage of easier tracking and faster processing times, while the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the method chosen, ensuring that the form is filled out correctly is paramount.

Quick guide on how to complete fillable online supporting childrens writing in reception

Complete Fillable Online Supporting Childrens Writing In Reception effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents promptly without interruptions. Manage Fillable Online Supporting Childrens Writing In Reception on any device using airSlate SignNow's Android or iOS applications and streamline your document-driven tasks today.

How to alter and eSign Fillable Online Supporting Childrens Writing In Reception without hassle

- Locate Fillable Online Supporting Childrens Writing In Reception and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize key parts of the documents or redact sensitive data with tools that airSlate SignNow provides specifically for this function.

- Generate your eSignature with the Sign feature, which takes just seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow manages all your document management requirements in just a few clicks from any device of your choice. Modify and eSign Fillable Online Supporting Childrens Writing In Reception while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable online supporting childrens writing in reception

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an e-signature for signing PDFs in Gmail

The best way to generate an e-signature from your smart phone

The way to create an e-signature for a PDF document on iOS

The best way to generate an e-signature for a PDF file on Android OS

People also ask

-

What is nm b allocation in airSlate SignNow?

The term 'nm b allocation' refers to how airSlate SignNow helps users allocate resources effectively for document management. This feature allows businesses to streamline their workflows and assign tasks efficiently, ensuring that all documents are handled promptly and accurately.

-

How does airSlate SignNow support nm b allocation?

airSlate SignNow supports nm b allocation by providing tools that automate document routing and signing processes. This automation minimizes delays and increases productivity, allowing teams to focus on critical tasks while ensuring compliance and accuracy throughout the document lifecycle.

-

Is airSlate SignNow affordable for small businesses considering nm b allocation?

Yes, airSlate SignNow offers competitive pricing plans that cater to small businesses while facilitating nm b allocation. With flexible subscription options, small companies can leverage our features without breaking the bank, making document management accessible and efficient.

-

What features does airSlate SignNow provide for nm b allocation?

AirSlate SignNow includes various features to enhance nm b allocation, such as customizable templates, automated reminders, and tracking capabilities. These features help businesses maintain clarity and control over their document workflows, fostering better collaboration among team members.

-

Can airSlate SignNow integrate with other software to assist with nm b allocation?

Yes, airSlate SignNow seamlessly integrates with numerous third-party applications, making nm b allocation easier than ever. By connecting with CRM systems, project management tools, and more, you can streamline your workflows and ensure critical documents are processed efficiently.

-

What benefits does nm b allocation offer to enterprises using airSlate SignNow?

Enterprises benefit from nm b allocation as it allows for centralized document management and better utilization of resources. This leads to reduced operational costs and enhanced efficiency, ensuring that teams can collaborate more effectively and meet business objectives.

-

How does airSlate SignNow ensure security while managing nm b allocation?

AirSlate SignNow prioritizes security in nm b allocation through advanced encryption methods and compliance with industry standards. We provide secure access controls and audit trails to guarantee that all documents remain confidential and protected throughout the signing process.

Get more for Fillable Online Supporting Childrens Writing In Reception

Find out other Fillable Online Supporting Childrens Writing In Reception

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF