Fillable Online Affidavit of ResidenceEnrollment Fax Email Form

Understanding the K210 Tax Form

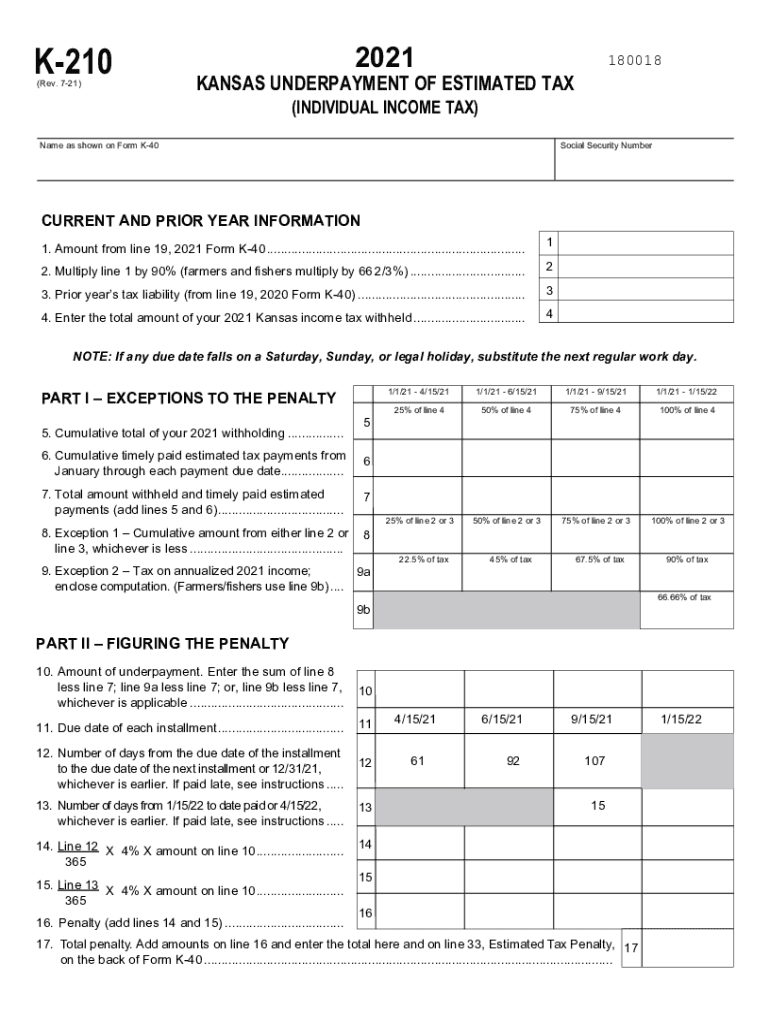

The K210 tax form, also known as the Kansas K210 tax form, is utilized by taxpayers in Kansas to report underpayment of taxes. This form is specifically designed for individuals and businesses who may not have met their tax obligations throughout the year. It is essential for ensuring compliance with state tax regulations and avoiding potential penalties.

Steps to Complete the K210 Tax Form

Filling out the K210 tax form involves several key steps to ensure accuracy and compliance. Start by gathering necessary financial documents, including income statements and previous tax returns. Next, carefully fill in your personal information, such as your Social Security number and address. Calculate your total tax liability and any payments made during the year. Finally, review the form for any errors before submitting it to the Kansas Department of Revenue.

Filing Deadlines for the K210 Tax Form

It is crucial to be aware of the filing deadlines associated with the K210 tax form. Typically, the form must be submitted by April 15 of the following year. If you miss this deadline, you may incur penalties and interest on any unpaid taxes. Consider checking the Kansas Department of Revenue website for any updates or changes to deadlines.

Penalties for Non-Compliance with the K210 Tax Form

Failure to file the K210 tax form on time or to pay the required taxes can result in significant penalties. The state of Kansas imposes fines that can accumulate over time, leading to increased financial burdens. Additionally, non-compliance may result in legal action or collection efforts by the state. It is advisable to address any tax obligations promptly to avoid these consequences.

Legal Use of the K210 Tax Form

The K210 tax form is legally binding, provided it is completed and submitted in accordance with Kansas tax laws. When signing the form, ensure that you provide an electronic signature if submitting online, as this is recognized under the Electronic Signatures in Global and National Commerce Act (ESIGN). Maintaining compliance with legal requirements is essential for the validity of the form.

Digital vs. Paper Version of the K210 Tax Form

Taxpayers have the option to complete the K210 tax form either digitally or on paper. The digital version offers advantages such as ease of submission, automatic calculations, and enhanced security features. Conversely, the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the chosen format, ensure that all information is accurate and complete to avoid complications.

Who Issues the K210 Tax Form

The K210 tax form is issued by the Kansas Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. For any questions or clarifications regarding the form, individuals can contact the department directly or visit their official website for additional resources and guidance.

Quick guide on how to complete fillable online affidavit of residenceenrollment fax email

Finalize Fillable Online Affidavit Of ResidenceEnrollment Fax Email effortlessly on any gadget

Online document administration has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, enabling you to access the correct form and securely keep it online. airSlate SignNow equips you with all the resources necessary to design, modify, and electronically sign your documents swiftly without complications. Manage Fillable Online Affidavit Of ResidenceEnrollment Fax Email on any device using airSlate SignNow’s Android or iOS applications and enhance any document-focused process today.

The most efficient way to modify and electronically sign Fillable Online Affidavit Of ResidenceEnrollment Fax Email with ease

- Find Fillable Online Affidavit Of ResidenceEnrollment Fax Email and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark pertinent sections of your documents or obscure confidential information using tools that airSlate SignNow has specifically designed for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device you choose. Modify and electronically sign Fillable Online Affidavit Of ResidenceEnrollment Fax Email to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable online affidavit of residenceenrollment fax email

The best way to make an electronic signature for your PDF document online

The best way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to generate an e-signature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The way to generate an e-signature for a PDF file on Android OS

People also ask

-

What is the kansas k210 tax and who needs to file it?

The kansas k210 tax is a tax return form that businesses in Kansas use to report their income and calculate their tax obligations. It is essential for any business entity doing business in Kansas and whose income exceeds the state's tax threshold. If you're operating a business in this region, understanding how to file the kansas k210 tax is crucial for compliance.

-

How can airSlate SignNow help with kansas k210 tax documentation?

airSlate SignNow provides an efficient way to eSign and send documents related to the kansas k210 tax. With secure electronic signatures, you can sign tax documents quickly and reduce the time spent on paperwork. This saves businesses considerable time, ensuring that they can focus more on their core operations rather than administrative tasks.

-

What features of airSlate SignNow are useful for handling kansas k210 tax forms?

Key features include customizable templates, automatic reminders, and secure storage for all your kansas k210 tax documentation. These tools streamline the preparation and signing process of your tax forms. Additionally, the user-friendly interface simplifies collaboration with accountants or teams involved in the filing process.

-

Is there a cost associated with using airSlate SignNow for kansas k210 tax documents?

Yes, airSlate SignNow offers several pricing plans tailored to different business needs, allowing you to choose the one that suits your operation best. These plans provide excellent value for securely managing and eSigning kansas k210 tax forms. The investment can signNowly expedite documentation processes, making it worthwhile for businesses of any size.

-

Can airSlate SignNow integrate with other tax software for a streamlined kansas k210 tax filing?

Absolutely, airSlate SignNow seamlessly integrates with various accounting and tax software. This integration allows users to import data directly into their kansas k210 tax forms, reducing errors and enhancing efficiency. By using our platform in conjunction with these tools, you ensure a smooth filing process.

-

What are the benefits of using airSlate SignNow for kansas k210 tax documents?

Using airSlate SignNow for your kansas k210 tax documents provides numerous benefits including enhanced security, increased efficiency, and better compliance. Electronic signatures not only speed up the signing process but also ensure that your documents are safeguarded. Additionally, the platform’s compliance features give users peace of mind when managing sensitive tax information.

-

Are there any customer support options available for questions related to kansas k210 tax?

Yes, airSlate SignNow offers comprehensive customer support to assist users with any questions related to the kansas k210 tax. Our support team is available via chat, email, and phone to ensure you receive timely assistance. This means you can confidently handle your documentation needs without worrying about unresolved issues.

Get more for Fillable Online Affidavit Of ResidenceEnrollment Fax Email

- Amendment to lease or rental agreement colorado form

- Warning notice due to complaint from neighbors colorado form

- Lease subordination agreement colorado form

- Apartment rules and regulations colorado form

- Colorado cancellation form

- Amendment of residential lease colorado form

- Agreement for payment of unpaid rent colorado form

- Commercial lease assignment from tenant to new tenant colorado form

Find out other Fillable Online Affidavit Of ResidenceEnrollment Fax Email

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter