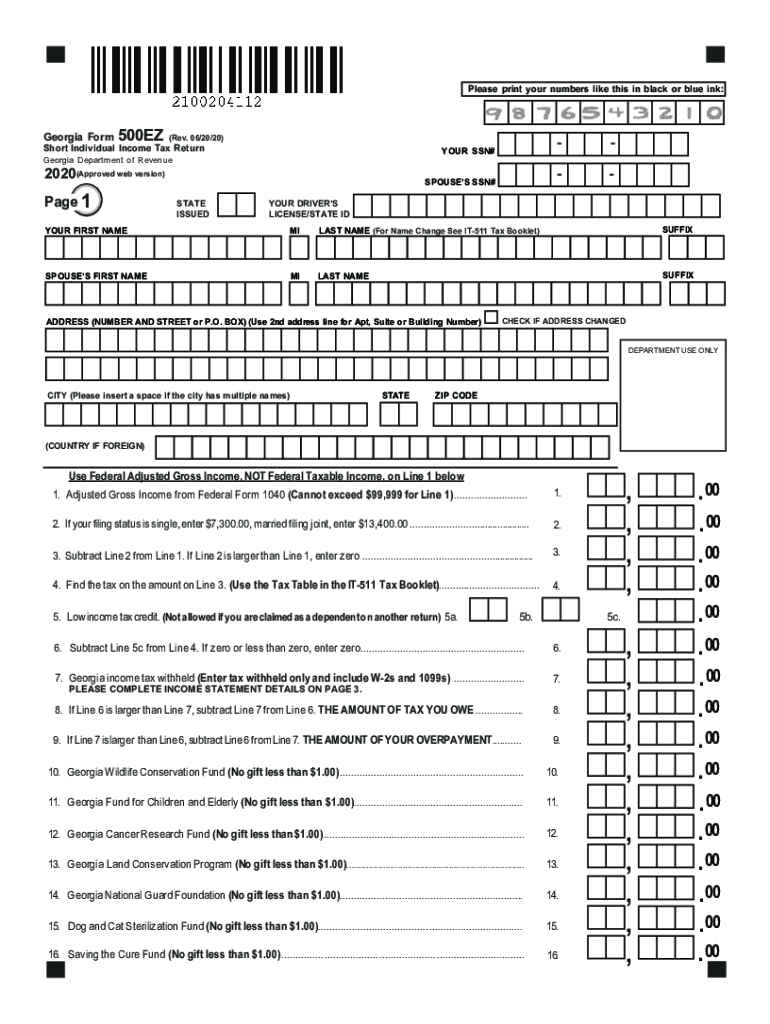

Georgia Form 500EZ Short Individual Income Tax Return

What is the Georgia Form 500EZ Short Individual Income Tax Return

The Georgia Form 500EZ is a simplified version of the state income tax return designed for individuals with straightforward tax situations. This form is specifically tailored for taxpayers who have a limited number of income sources and deductions. It allows for a more streamlined filing process, making it easier for eligible individuals to report their income and calculate their tax liability.

How to use the Georgia Form 500EZ Short Individual Income Tax Return

Using the Georgia Form 500EZ involves several key steps. First, ensure that you meet the eligibility criteria, which typically include having a total income below a specified threshold and not claiming certain deductions or credits. Once eligibility is confirmed, you can download the form from the Georgia Department of Revenue website or access it through approved tax software. Fill out the required sections, including personal information, income details, and any applicable tax credits. After completing the form, review it for accuracy before submitting it to the state.

Steps to complete the Georgia Form 500EZ Short Individual Income Tax Return

Completing the Georgia Form 500EZ involves the following steps:

- Gather necessary documents, such as W-2 forms and any other income statements.

- Download the form or access it through tax software.

- Fill in personal information, including your name, address, and Social Security number.

- Report your total income from all sources.

- Calculate your adjusted gross income and any applicable deductions.

- Determine your tax liability based on the provided tax tables.

- Sign and date the form before submission.

Eligibility Criteria

To file the Georgia Form 500EZ, taxpayers must meet specific eligibility criteria. Generally, you must be an individual taxpayer with a total income below a certain limit, typically set by the Georgia Department of Revenue. Additionally, you cannot claim certain deductions, such as those related to business income or rental properties. It is essential to review the current guidelines to ensure compliance with all requirements before filing.

Required Documents

When preparing to complete the Georgia Form 500EZ, gather the following documents:

- W-2 forms from employers

- 1099 forms for any additional income

- Records of any tax credits you intend to claim

- Identification information, such as your Social Security number

Form Submission Methods (Online / Mail / In-Person)

The Georgia Form 500EZ can be submitted through various methods. Taxpayers have the option to file online using approved tax software, which often provides a guided process for completion. Alternatively, you can print the completed form and mail it to the appropriate address provided by the Georgia Department of Revenue. In-person submissions are also accepted at designated locations, allowing for direct interaction with tax officials if needed.

Quick guide on how to complete georgia form 500ez short individual income tax return

Effortlessly Prepare Georgia Form 500EZ Short Individual Income Tax Return on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct forms and securely store them online. airSlate SignNow equips you with all the resources necessary to swiftly create, modify, and electronically sign your documents without delay. Manage Georgia Form 500EZ Short Individual Income Tax Return on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-centric task today.

The Optimal Method to Modify and Electronically Sign Georgia Form 500EZ Short Individual Income Tax Return with Ease

- Find Georgia Form 500EZ Short Individual Income Tax Return and click Obtain Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of your documents or redact confidential information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Finish button to save your modifications.

- Choose your preferred method to share your form, whether by email, SMS, or a shared link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document management with just a few clicks from your preferred device. Modify and electronically sign Georgia Form 500EZ Short Individual Income Tax Return to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the georgia form 500ez short individual income tax return

The way to create an electronic signature for a PDF online

The way to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

The way to make an e-signature right from your smartphone

The best way to create an e-signature for a PDF on iOS

The way to make an e-signature for a PDF on Android

People also ask

-

What is the Georgia Form 500?

The Georgia Form 500 is the state tax return form that individuals and corporations use to report their income and calculate their tax liability. Completing the Georgia Form 500 accurately is essential for compliance with state tax laws.

-

How can airSlate SignNow assist with the Georgia Form 500?

airSlate SignNow provides an efficient platform to send, eSign, and manage the Georgia Form 500. Our solution simplifies the document preparation process, making it easy for users to fill out and sign the form digitally.

-

What are the pricing options for using airSlate SignNow to complete the Georgia Form 500?

airSlate SignNow offers flexible pricing plans tailored to meet different business needs. Our cost-effective solutions make it easy to manage your Georgia Form 500 submissions without breaking the bank.

-

Are there features in airSlate SignNow that enhance my experience with the Georgia Form 500?

Absolutely! airSlate SignNow includes features like document templates, reminders, and real-time collaboration, which streamline the completion of your Georgia Form 500, ensuring that you don't miss any important deadlines.

-

Is airSlate SignNow compliant with Georgia tax regulations for the Form 500?

Yes, airSlate SignNow is designed to comply with all applicable Georgia tax regulations, including those related to the Georgia Form 500. We ensure that your data is securely managed and compliant with state laws.

-

Can I integrate airSlate SignNow with other accounting software for Georgia Form 500 processing?

Yes, airSlate SignNow supports various integrations with accounting software that can help streamline the processing of the Georgia Form 500. This allows for seamless data transfer and improved efficiency in finishing your tax filings.

-

What benefits does airSlate SignNow provide when filling out the Georgia Form 500?

Using airSlate SignNow to fill out the Georgia Form 500 offers numerous benefits including decreased turnaround time, secure eSigning, and an intuitive user interface. These features make it easier to meet the tax filing deadlines stress-free.

Get more for Georgia Form 500EZ Short Individual Income Tax Return

Find out other Georgia Form 500EZ Short Individual Income Tax Return

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document