Cca Form 2013-2026

What is the CCA Form?

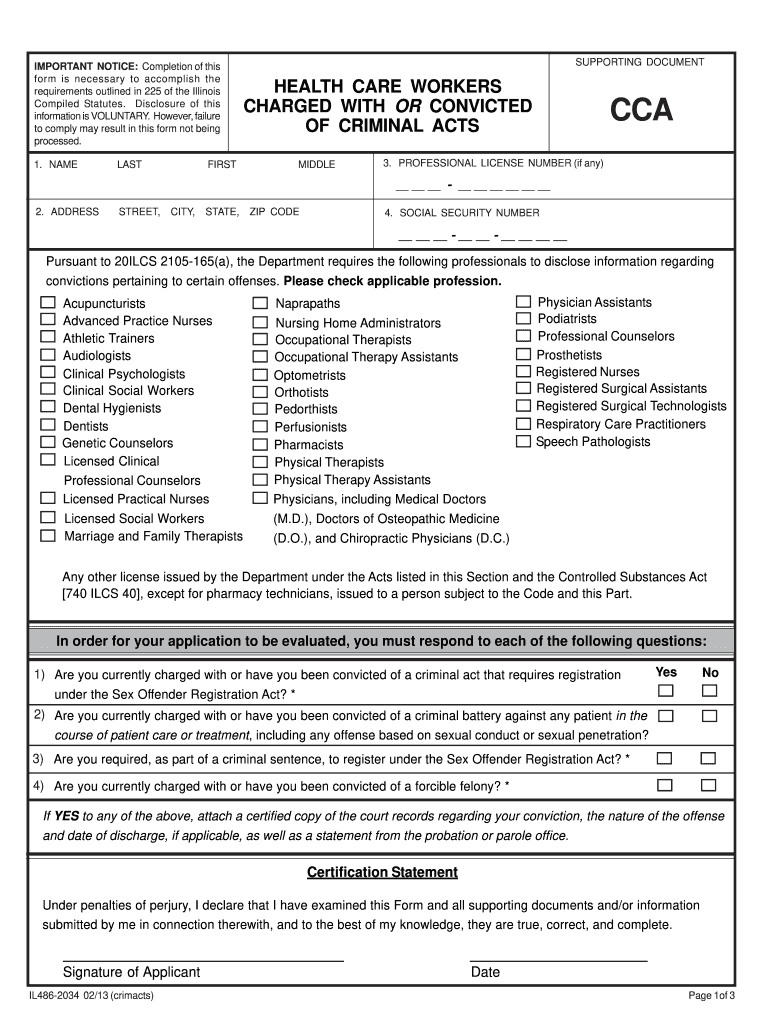

The CCA form in Illinois, also known as the Conviction Certification Application form, is a legal document used by individuals seeking to obtain a certification regarding their criminal history. This form is essential for those who have been convicted of crimes and wish to clarify their status, especially when applying for jobs, licenses, or other opportunities that may require a background check. The CCA form serves as a formal request to the Illinois Department of Financial and Professional Regulation (IDFPR) for the release of information pertaining to an individual's criminal record.

How to Obtain the CCA Form

Obtaining the CCA form is a straightforward process. Individuals can access the form through the official website of the Illinois Department of Financial and Professional Regulation. The form is available in a downloadable format, allowing users to print it for completion. Additionally, physical copies may be available at IDFPR offices or other designated locations. It is important to ensure that you are using the most current version of the form to avoid any issues during submission.

Steps to Complete the CCA Form

Completing the CCA form requires careful attention to detail. Here are the steps to follow:

- Download or obtain the CCA form from the IDFPR website.

- Fill out your personal information accurately, including your full name, address, and contact details.

- Provide details regarding your conviction history, including the nature of the offenses and dates of conviction.

- Sign and date the form to certify that the information provided is true and complete.

- Submit the completed form according to the instructions provided, either online, by mail, or in person.

Legal Use of the CCA Form

The CCA form is legally recognized in Illinois and is essential for individuals who need to disclose their criminal history for employment or licensing purposes. It is important to understand that the information provided in the form must be truthful, as providing false information can lead to legal consequences. The form helps ensure compliance with state regulations regarding the disclosure of criminal records.

Key Elements of the CCA Form

Several key elements are crucial when filling out the CCA form:

- Personal Information: Accurate details about the applicant.

- Conviction Details: A comprehensive list of all convictions, including dates and nature of offenses.

- Signature: A declaration that the information is correct and complete.

- Submission Method: Instructions for how to submit the form, whether online, by mail, or in person.

Form Submission Methods

The CCA form can be submitted through various methods, depending on the preferences of the applicant:

- Online: Some applicants may have the option to submit the form electronically through the IDFPR website.

- By Mail: Completed forms can be mailed to the appropriate IDFPR office, as indicated in the submission instructions.

- In-Person: Applicants can also deliver the form in person at designated IDFPR locations.

Quick guide on how to complete form charged

Explore the simpler approach to managing your Cca Form

The traditional methods of finalizing and endorsing documents consume an excessive amount of time compared to modern document management tools. Previously, you would look for appropriate social forms, print them, fill in all the details, and mail them. Now, you can access, fill out, and sign your Cca Form all within a single browser tab using airSlate SignNow. Preparing your Cca Form has never been more straightforward.

Steps to fill out your Cca Form with airSlate SignNow

- Navigate to the relevant category page and locate your state-specific Cca Form. Alternatively, utilize the search bar.

- Ensure the version of the form is accurate by reviewing it.

- Select Get form to enter the editing interface.

- Fill in your document with the required details using the editing tools.

- Review the information added and click the Sign option to authenticate your form.

- Choose the most suitable method to create your signature: generate it, sketch your signature, or upload an image of it.

- Hit DONE to finalize the modifications.

- Download the document to your device or proceed to Sharing settings to send it electronically.

Robust online platforms like airSlate SignNow simplify the process of completing and submitting your documents. Give it a try to discover how long document management and approval procedures are truly meant to take. You will conserve a signNow amount of time.

Create this form in 5 minutes or less

FAQs

-

How can my employer charge me taxes when I didn't fill out any form (like W2, W4, or W9)?

**UPDATE** After my answer was viewed over 4,100 times without a single upvote, I revisited it to see where I might have gone wrong with it. Honestly, it seems like a reasonable answer: I explained what each of the forms asked about is for and even suggested getting further information from a licensed tax preparer. BUT, I’m thinking I missed the underlying concern of the querent with my answer. Now I’m reading that they don’t care so much about the forms as they do about the right or, more accurately, the obligation of their employer to withhold taxes at all.So let me revise my answer a bit…Your employer doesn’t charge you taxes - the government does. The government forces employers to withhold (or charge, as you put it) taxes from the earnings of their employees by threatening fines and even jail time for failing to do so (or for reclassifying them as independent contractors in order to avoid the withholding and matching requirements). Whether you fill out any forms or not, employers will withhold taxes because they don’t want to be fined or go to jail.Now the meta-question in the question is how can the government tax its citizen’s income? Well, that’s a big debate in America. Tax is the only way governments make money and they use that money to provide services for their constituency. Without funding, no federal or state or county program, or employee, would exist. But still, some people believe taxation is illegal, unjustified, and flat out wrong. They believe that free market forces should fund the military, the Coast Guard, Department of Defense, Veterans Affairs, Border Patrol, the FBI, CIA, DEA, FDA, USDA, USPS, the Federal Prison Complex, the National Park Service, the Interstate Highway System, air traffic control, and the Judiciary (just to name a few things). They even believe paying politicians for the work they do, like the President and Congress, is wrong.Others (luckily, most of us) appreciate paying taxes, even if they seem a bit steep at times. We’re happy to benefit from all the things our tax dollars buy us and we feel what we pay gives us back returns far greater than our investment. If you’re on the fence about this issue, consider how expensive health care is and how much you’re getting out of paying for it privately (out of your own paycheck). Same with your education or that of your children. Do you pay for private schools? Private colleges? Do you pay for private child care too? All expensive, right?Well what if we had to pay for private fire fighting? Or all mail had to be shipped via FedEx or UPS? Or if the cost of a plane ticket to anywhere doubled because we had to pay out-of-pocket for air traffic control? What about the military, border control and veterans? How much are you willing to pay out of every paycheck DIRECTLY to the department of defense AND veterans affairs? If we privatized the military, would we still be able to afford $30 billion dollar fighter jets? Who would pay to defend us?I bet people living paycheck to paycheck would be hard pressed to find extra money to pay for the military, when they’re already spending so much for teachers, schools, health care, local emergency response, food safety inspections, social workers, the criminal justice system, road repairs and construction, bridge inspection and maintenance, and natural disaster remediation (just to name a few things).Think about if all the national and local parks were privatized. Visiting one would cost as much or more than it does to go to Disneyland. Think about how much more food would cost if farmers weren’t subsidized and food wasn’t inspected for safety. Imagine how devastating a pandemic would be without the Center for Disease Control to monitor and mitigate illness outbreaks.We all take for granted the myriad of benefits we get from paying taxes. We may like to gripe and moan but taxes aren’t just for the public good, they’re for our own. (That rhymes!)**END OF UPDATE**W-9 forms are what you fill out to verify your identification, or citizenship status, for your employers. They have nothing to do with payroll taxes other than being the primary tool to from which to glean the correct spelling of your name and your Social Security number.W-2 forms are issued by employers to employees for whom they paid the required payroll taxes to the government on their behalf. The W-2 also details the amount of a person’s pay was sent to the government to fund their Social Security and Medicare accounts. W-2 forms are necessary for people when filing their personal income taxes so they can calculate if they under or overpaid.W-4 forms are filled out by employees to assure that the appropriate amount of pay is being withheld (and transferred on their behalf) by their employers to the government. If you don’t fill out a W-4 then your employer withholds the standard default amount for a single individual. You can update your W-4 at any time with your employer and you may want to when the size of your household changes.Even if you aren’t an employee (like you get paid without taxes being withheld for you) and are issued a 1099-MISC form instead of a W-2, you’re STILL responsible for paying your taxes as you earn that money - in no greater than quarterly installments. If you go over three months without paying taxes when you’re making money - whether your employer is withholding it and paying it on your behalf or you just made the money and no one took any taxes out for you - you’ll be fined and charged interest on your late tax payments.Talk with a licensed tax preparer and they can help you better understand what it all means. Good luck and happy tax season!

-

How much do accountants charge for helping you fill out a W-4 form?

A W-4 is a very simple form to instruct your employer to withhold the proper tax. It's written in very plain English and is fairly easy to follow. I honestly do not know of a CPA that will do one of these. If you're having trouble and cannot find a tutorial you like on line see if you can schedule a probing meeting. It should take an accounting student about 10 minutes to walk you through. There is even a worksheet on the back.If you have mitigating factors such as complex investments, partnership income, lies or garnishments, talk to your CPA about those, and then ask their advice regarding the W4 in the context of those issues.

-

How do essay writing services work?

Although every essay writing service provider has a unique way of doing things, I can summarize their operations in four simple steps.You register with the company by filling a form that needs your personal information.Place your order detailing all the requirements of the paper.Sit back and let the writers do the work.Receive the paper and review it, then pay.However, most will let you request a revision if you are not satisfied even though some will charge you.Though that sounds quite easy, I would also suggest working with a writer or consultant directly to help you interact one on one.The advantage of working with clients directly is that;You can follow the progress by interacting with the writer at intervals.You can bargain the cost of the work unlike with companies where the prices are fixed.Also, you get instant feedback and clarifications whenever there are issues.You build trust with a single writer, which creates consistent quality and writing style.Although you may recommend the same writer with the writing companies, you might not get them every time you need their service.Having been in this industry for the last five years, I understand the nitty gritty of the essay writing services. If you need high quality, unique, and timely essays, get to me through the following firstgradeessays@gmail.comThank you

-

Is it normal nowadays for U.S. physicians to charge $100+ to fill out a 2-page form for a patient?

Medicaid patients would never be expected to pay their own bills. That defeats the purpose of providing this program as a resource to the aid of those who are below the poverty level. Legally, if you signed paperwork to the effect that you agree to pay whatever your insurance won't, there may be an issue.The larger question aside, technically, the professionally can set his fees at whatever level the market will allow. His time spent to complete your form would have been otherwise spent productively. The fact that he is the gatekeeper to your disability benefits should amount to some value with which you are able to accept rewarding him (or her).The doctor’s office needs to find a billable reason to submit (or re-submit) the claim as part of your medical treatment to Medicaid. It is absolutely a normal responsibility of their billing office to find a way to get insurance to reimburse. The failure is theirs, and turning the bill over to you would be ridiculous.If they accept Medicaid to begin with, they have to deal with the government’s complex processes to get paid. Generally, when a claim is denied a new reason to justify the doctor patient interaction will be necessary. I would guess “encounter for administrative reason” was sent. It is often too vague to justify payment. They may need to include the diagnosis behind your medical disability. If they have seen you before, and medical claims have bern accepted on those visits, then a resubmission for timely follow-up on those conditions could be justifued as reason for payment. The fact is, Medicaid is in a huge free-fall and payments are coming much more slowly since the new year. $800 billion is planned to be cut and possibly $600 billion on top of that. When we call their phone line for assistance, wait times are over two hours, if any one even answers. Expect less offices to accept new Medicaid, and many will be dismissing their Medicaid clients. If the office closes due to poor financial decisions, they can be of no service to anyone.Sister, things are rough all over.

-

Electric car charging station: why can't you simply get a fully charged battery instead of waiting for the battery to charge?

Tesla already tried it and closed it down due to lack of demand.The swap station allowed a driver to swap for a fresh battery for about the same price as a tank of premium gasoline. The swap on the return trip would be for the owner’s original battery, fully charged, and at no cost. That meant going back to the same swap station on the return trip. It meant owners had to swap back at a given time, or at least during station hours. But the biggest issue for me was that it wouldn’t have saved any time. On a long trip, I need to eat. The swap station was at Harris Ranch. There’s a Supercharger station there where I can charge for free. There’s also a restaurant. By the time I get seated, order, get my meal, eat, pay and get back to my car, I have a 100% charge anyway. Instead of paying for a swap, I pay for a meal that I would have eaten anyway and a swap wouldn’t save me a minute.Swap stations make sense if they save time. They also make sense if they save money, and at about half the cost of gasoline, they saved money. But a driver could save more time and more money by using a supercharger since it didn’t even require a five minute wait for a battery swap.If I travel from Silicon Valley to Los Angeles, the trip is about 400 miles. The closed swap station is on the way, and so are many supercharger stations. It’s also about as much as I’d want to drive on a given day without stopping for the night. With a Model 3 and a long range battery, I can make the trip with a single 17 minute charge to stop. I can’t finish a meal in 17 minutes and would need a second stop to use the restroom. A swap station would simply offer me no advantage.One of the big advantages of owning an EV is never having to stop for gasoline because on 98% of days, I charge at home when I’d be parked anyway, while I’m asleep. I have two EVs, and adding solar to my home, with enough capacity to charge both cars and power my home, cost less than the tax incentives on the cars. I am essentially charging for free for more than the life of the car, and not spending a minute doing so except for road trips.The problem is that there’s a perceived disadvantage since many people think that an EV delays trips. In real life, it doesn’t delay them for me. Granted I might be able to make that trip 18 minutes faster if I didn’t have to stop to charge, and might have needed a five minute stop for gasoline instead. But when I arrived at my destination tired and hungry, I’d end up going to a restaurant, and by the time I got out of the restaurant it would be later than the time I would have arrived had I charged and eaten en route.This doesn’t address the issue of people who have no place to charge at home. For them, infrastructure improvements are needed. Even though they may not have a regular place to charge, their cars still spend most of the time parked, so improving infrastructure is a better solution than swapping stations.When there are millions of EVs on the road, and some are 20 years old with diminished capacity, it might make sense to have swap stations. A person could swap for a battery with no range loss, use it for a trip, and then swap back at the end of the trip. A 300 mile battery that had degraded down to 180 miles might still be perfectly good for daily commuting, but on a road trip, could delay the trip by over an hour. Somebody who drives a 20 year old car might not want to pay thousands of dollars to get a new battery to save a few hours a year at most, but might be willing to pay for a battery swap.

-

Is it legal for a doctor to charge fifty dollars to fill out the one page ca20 form workers comp requires?

Almost certainly. This is not covered under the costs of medical care. If it takes him only 10 minutes to do so that physician is being underpaid. If it is 5 minutes it might be close. Doctor’s time is expensive because of high overhead. The front desk person, the nurse, the building, the utilities, the malpractice insurance. Most physicians have overhead of over $200 an hour.

-

Is it legal for companies to charge a previous employee a fee for filling out an employment verification form?

I’m not a lawyer, but I’d say you don’t have to pay. The law, as I know it, requires former employers to confirm your dates of employment and title. If your former employer demands you pay a fee for this, ask for the demand in writing (say you need it for financial records), then send a copy of that demand to the company you applied to, and your state’s Office of the Attorney General or Labor Department. The demand on email would also work, as would a voicemail you can attach to an email.

Create this form in 5 minutes!

How to create an eSignature for the form charged

How to generate an electronic signature for your Form Charged in the online mode

How to generate an eSignature for your Form Charged in Google Chrome

How to make an eSignature for signing the Form Charged in Gmail

How to make an eSignature for the Form Charged right from your smartphone

How to create an eSignature for the Form Charged on iOS

How to generate an electronic signature for the Form Charged on Android

People also ask

-

What is a Cca Form and how is it used in airSlate SignNow?

A Cca Form is a document used for various purposes, including customer consent and authorization. With airSlate SignNow, users can easily create, send, and eSign Cca Forms, streamlining the process and ensuring compliance. Our platform allows for quick customization and secure storage of these forms.

-

How much does it cost to use airSlate SignNow for Cca Forms?

airSlate SignNow offers flexible pricing plans to suit different business needs, including those looking to manage Cca Forms. You can choose from monthly or annual subscriptions, which provide access to all features related to creating and signing Cca Forms. Check our pricing page for detailed information on the plans available.

-

What features does airSlate SignNow offer for managing Cca Forms?

airSlate SignNow includes a variety of features for efficiently handling Cca Forms, such as customizable templates, automated workflows, and real-time tracking of document statuses. Additionally, the platform supports various signing methods, ensuring that your Cca Form can be completed securely and quickly.

-

Can I integrate airSlate SignNow with other applications to manage Cca Forms?

Yes, airSlate SignNow offers integration with numerous applications, enabling seamless management of Cca Forms. You can connect with tools like Google Workspace, Salesforce, and more to enhance your document workflows. This integration allows for automatic data entry and improved efficiency.

-

Is airSlate SignNow compliant with legal standards for Cca Forms?

Absolutely! airSlate SignNow ensures that all Cca Forms signed through our platform comply with legal standards, including eIDAS and ESIGN Act regulations. This compliance guarantees that your documents are legally binding and secure, providing peace of mind for your business.

-

How does airSlate SignNow enhance the signing experience for Cca Forms?

airSlate SignNow enhances the signing experience for Cca Forms by offering a user-friendly interface and multiple signing options. Signers can easily access, review, and complete Cca Forms from any device, ensuring a smooth and efficient process. Our platform also provides notifications and reminders to keep everyone informed.

-

Can I track the status of my Cca Forms in airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your Cca Forms in real-time. You will receive updates on when the document is viewed, signed, or completed, giving you complete visibility throughout the signing process. This feature helps you manage your documents effectively.

Get more for Cca Form

Find out other Cca Form

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer