Revenue Nebraska Govtax Professionalstax PreparersTax PreparersNebraska Department of Revenue Form

Understanding the Nebraska Nonresident Tax

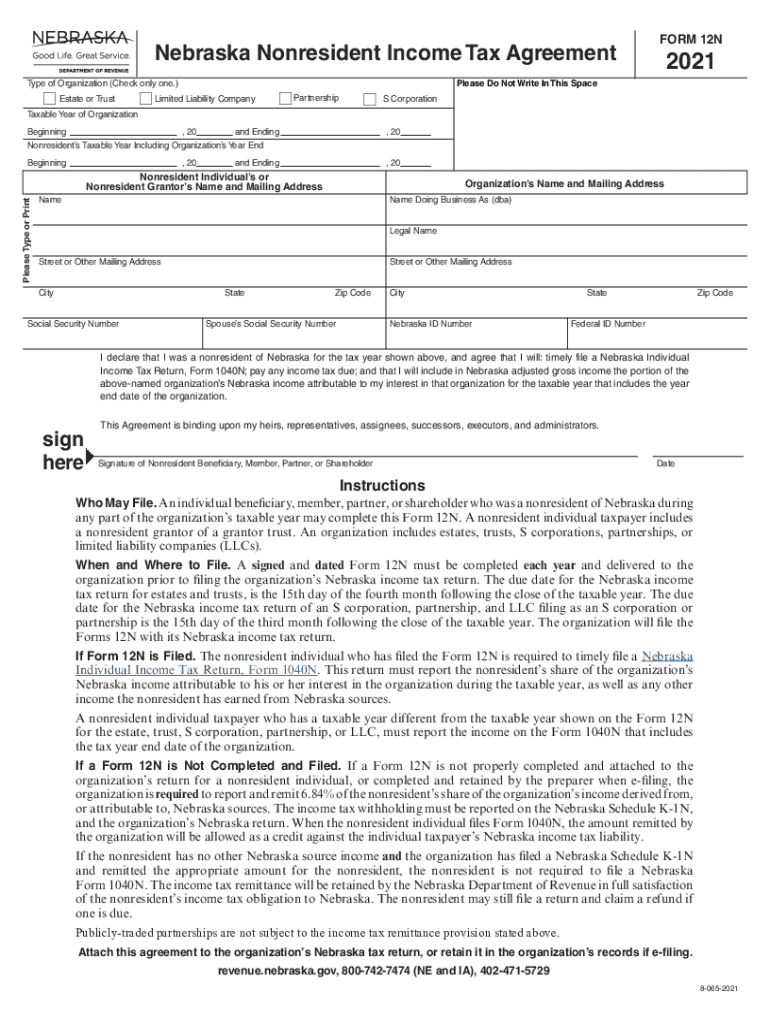

The Nebraska nonresident tax applies to individuals who earn income in Nebraska but do not reside in the state. This tax is calculated based on the income earned from Nebraska sources, and it is essential for nonresidents to understand their tax obligations. The Nebraska Department of Revenue provides guidelines for calculating this tax, which may differ from the tax obligations of residents. Nonresidents must file the appropriate forms, such as the Nebraska Form 12N, to report their income accurately.

Steps to Complete the Nebraska Nonresident Tax Form

Filling out the Nebraska nonresident tax form involves several steps to ensure compliance and accuracy. Begin by gathering all necessary documentation, including income statements and any relevant tax documents. Next, download the Nebraska Form 12N from the Nebraska Department of Revenue website. Carefully fill out the form, reporting all income earned in Nebraska. Once completed, review the form for accuracy before submitting it either online or via mail. It is crucial to keep a copy of the submitted form for your records.

Filing Deadlines for Nebraska Nonresident Tax

Timely filing of the Nebraska nonresident tax is vital to avoid penalties. The filing deadline for most taxpayers is typically April 15, aligning with federal tax deadlines. However, if you are unable to meet this deadline, you may apply for an extension. It is important to note that an extension to file does not extend the time to pay any taxes owed. Therefore, ensure that any estimated tax payments are made on time to avoid interest and penalties.

Required Documents for Nebraska Nonresident Tax Filing

When filing the Nebraska nonresident tax, certain documents are necessary to support your claims. These include:

- W-2 forms from employers for income earned in Nebraska

- 1099 forms for any additional income sources

- Documentation of any deductions or credits you plan to claim

- Previous year’s tax return for reference

Having these documents ready will streamline the filing process and help ensure accuracy in your tax return.

Penalties for Non-Compliance with Nebraska Nonresident Tax

Failing to comply with Nebraska nonresident tax regulations can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial to file your tax return accurately and on time to avoid these consequences. If you believe you may have missed a deadline or made an error, it is advisable to contact the Nebraska Department of Revenue for guidance on how to rectify the situation.

Digital vs. Paper Version of Nebraska Nonresident Tax Form

Filing the Nebraska nonresident tax can be done either digitally or through paper forms. The digital option offers convenience and typically faster processing times. Using e-filing systems can also help reduce errors, as many platforms provide built-in checks. Conversely, paper filing may be preferred by those who are more comfortable with traditional methods. Regardless of the method chosen, ensure that all information is accurate and submitted by the deadline.

Quick guide on how to complete revenuenebraskagovtax professionalstax preparerstax preparersnebraska department of revenue

Complete Revenue nebraska govtax professionalstax preparersTax PreparersNebraska Department Of Revenue effortlessly on any device

Web-based document administration has gained popularity among businesses and individuals. It offers an ideal environmentally friendly option to conventional printed and signed papers, enabling you to obtain the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, amend, and electronically sign your documents promptly without interruptions. Manage Revenue nebraska govtax professionalstax preparersTax PreparersNebraska Department Of Revenue on any device through airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The easiest way to amend and electronically sign Revenue nebraska govtax professionalstax preparersTax PreparersNebraska Department Of Revenue with ease

- Obtain Revenue nebraska govtax professionalstax preparersTax PreparersNebraska Department Of Revenue and click on Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would prefer to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow caters to all your document management needs with just a few clicks from any device you choose. Edit and electronically sign Revenue nebraska govtax professionalstax preparersTax PreparersNebraska Department Of Revenue while ensuring top-notch communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the revenuenebraskagovtax professionalstax preparerstax preparersnebraska department of revenue

The best way to create an e-signature for a PDF document online

The best way to create an e-signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

The way to generate an e-signature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is Nebraska nonresident tax?

Nebraska nonresident tax is a tax imposed on individuals who earn income from sources within Nebraska but do not reside in the state. Understanding this tax is crucial for anyone looking to manage their financial obligations effectively while working or doing business in Nebraska.

-

How does airSlate SignNow help with Nebraska nonresident tax documentation?

airSlate SignNow streamlines the process of signing and sending important documents related to Nebraska nonresident tax. With our eSignature solution, you can ensure that all tax-related forms are signed quickly and securely, simplifying your filing process.

-

What are the pricing options for using airSlate SignNow for Nebraska nonresident tax forms?

airSlate SignNow offers flexible pricing plans to suit various business needs when managing Nebraska nonresident tax forms. We provide cost-effective solutions that enable you to process tax documents without breaking your budget.

-

Can I integrate airSlate SignNow with my accounting software for Nebraska nonresident tax purposes?

Yes, airSlate SignNow can seamlessly integrate with leading accounting software to assist in managing your Nebraska nonresident tax documentation. This feature helps ensure all your tax information is accurately captured and easily accessible.

-

What features does airSlate SignNow offer for handling Nebraska nonresident tax documents?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking of document status, making it ideal for handling Nebraska nonresident tax documents. These capabilities make signing and sending forms more efficient.

-

How secure is airSlate SignNow for managing Nebraska nonresident tax documents?

Security is a top priority at airSlate SignNow. Our platform uses industry-standard encryption to protect your Nebraska nonresident tax documents and personal information, ensuring your data remains safe and confidential.

-

What benefits can I expect from using airSlate SignNow for my Nebraska nonresident tax needs?

By using airSlate SignNow for your Nebraska nonresident tax needs, you can expect improved efficiency, reduced processing time, and enhanced compliance. Our user-friendly platform allows you to focus on what matters most while we handle your document needs.

Get more for Revenue nebraska govtax professionalstax preparersTax PreparersNebraska Department Of Revenue

- Mutual wills package with last wills and testaments for married couple with no children connecticut form

- Mutual wills package with last wills and testaments for married couple with minor children connecticut form

- Legal last will and testament form for married person with adult and minor children from prior marriage connecticut

- Legal last will and testament form for civil union partner with adult and minor children from prior marriage connecticut

- Legal last will and testament form for married person with adult and minor children connecticut

- Legal last will and testament form for civil union partner with adult and minor children connecticut

- Mutual wills package with last wills and testaments for married couple with adult and minor children connecticut form

- Ct widow form

Find out other Revenue nebraska govtax professionalstax preparersTax PreparersNebraska Department Of Revenue

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online