HI Schedule K 1 Form N 35 Fill Online, Printable

What is the HI Schedule K 1 Form N 35?

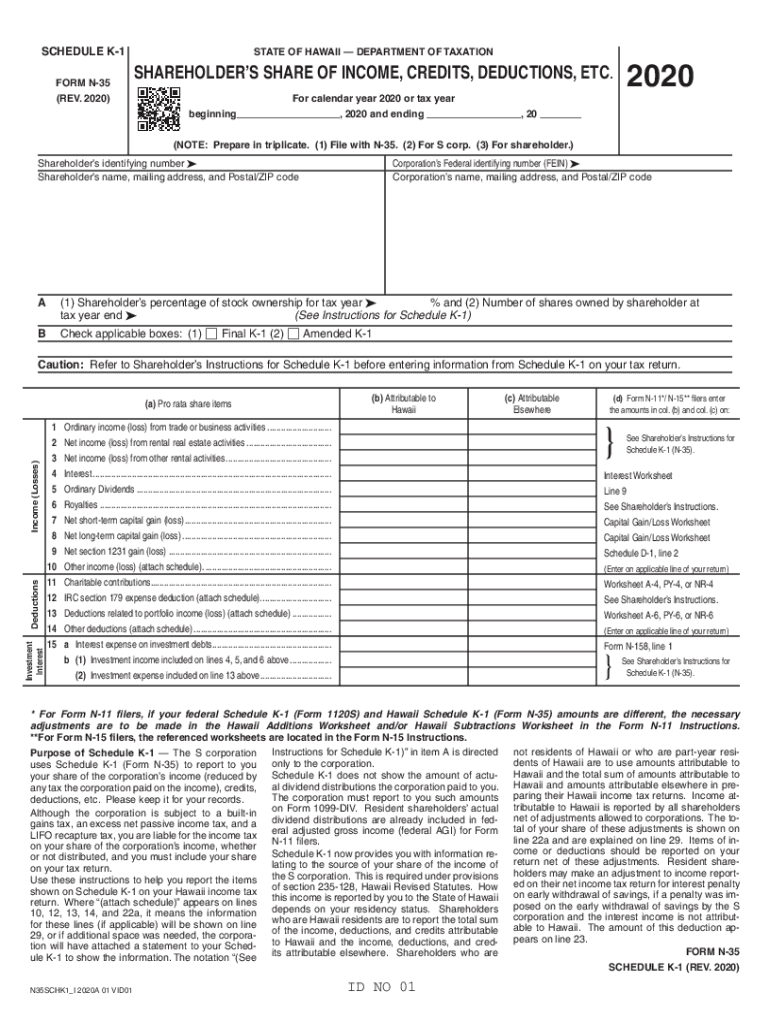

The HI Schedule K 1 Form N 35 is a tax document used in Hawaii to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. This form provides detailed information about each partner's or shareholder's share of income, which is essential for accurate tax reporting. It is crucial for individuals involved in these entities to understand the information contained in this form, as it directly impacts their personal tax returns.

Steps to Complete the HI Schedule K 1 Form N 35

Completing the HI Schedule K 1 Form N 35 involves several key steps:

- Gather Necessary Information: Collect all relevant financial information from the partnership or S corporation, including income, deductions, and credits.

- Fill Out the Form: Input the gathered data into the appropriate sections of the form. Ensure accuracy to avoid issues during filing.

- Review for Errors: Double-check all entries for accuracy. Mistakes can lead to delays or penalties.

- Submit the Form: File the completed form with the Hawaii Department of Taxation by the specified deadline.

Legal Use of the HI Schedule K 1 Form N 35

The HI Schedule K 1 Form N 35 is legally recognized for reporting income and deductions associated with partnerships and S corporations in Hawaii. To ensure its legal validity, it must be filled out correctly and submitted to the appropriate tax authorities. The form must also comply with state and federal tax regulations, which include providing accurate information regarding income distribution and deductions.

Key Elements of the HI Schedule K 1 Form N 35

Understanding the key elements of the HI Schedule K 1 Form N 35 is essential for accurate completion:

- Entity Information: Details about the partnership or S corporation, including name, address, and tax identification number.

- Partner or Shareholder Information: Information about the individual receiving the K 1, including their name, address, and taxpayer identification number.

- Income and Deductions: Specific sections for reporting various types of income, such as ordinary business income, rental income, and capital gains, as well as deductions and credits.

How to Obtain the HI Schedule K 1 Form N 35

The HI Schedule K 1 Form N 35 can be obtained through the Hawaii Department of Taxation's website. It is available for download in a printable format. Additionally, tax professionals and accounting software may provide access to the form as part of their services. Ensuring you have the correct version of the form is important for compliance with current tax laws.

Filing Deadlines for the HI Schedule K 1 Form N 35

Filing deadlines for the HI Schedule K 1 Form N 35 are typically aligned with the tax return deadlines for partnerships and S corporations. Generally, the form must be filed by the fifteenth day of the third month following the end of the entity's tax year. It is important to be aware of these deadlines to avoid penalties and ensure timely processing of your tax return.

Quick guide on how to complete 2018 2020 hi schedule k 1 form n 35 fill online printable

Complete HI Schedule K 1 Form N 35 Fill Online, Printable effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can access the correct form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage HI Schedule K 1 Form N 35 Fill Online, Printable on any device with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to alter and eSign HI Schedule K 1 Form N 35 Fill Online, Printable with ease

- Locate HI Schedule K 1 Form N 35 Fill Online, Printable and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal standing as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and eSign HI Schedule K 1 Form N 35 Fill Online, Printable while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2018 2020 hi schedule k 1 form n 35 fill online printable

The best way to generate an electronic signature for a PDF online

The best way to generate an electronic signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

The way to make an e-signature straight from your smartphone

The way to make an e-signature for a PDF on iOS

The way to make an e-signature for a PDF document on Android

People also ask

-

What is the Hawaii Schedule Form N-35 and why is it important?

The Hawaii Schedule Form N-35 is a crucial document for businesses operating in Hawaii for tax purposes. It helps ensure compliance with state regulations and streamlines the reporting process. Completing this form accurately can save time and reduce the risk of penalties.

-

How can airSlate SignNow help with the Hawaii Schedule Form N-35?

airSlate SignNow offers a user-friendly platform for businesses to complete and eSign the Hawaii Schedule Form N-35 quickly and securely. Our solution simplifies document management, making it easier to store and retrieve important tax forms. This efficiency helps businesses stay organized and compliant.

-

What are the pricing plans for using airSlate SignNow for the Hawaii Schedule Form N-35?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. You can choose from various subscription options that provide different features tailored to your needs, including eSigning and document management for the Hawaii Schedule Form N-35. Visit our pricing page for detailed information on costs.

-

Is airSlate SignNow compliant with Hawaii's legal requirements for the Schedule Form N-35?

Yes, airSlate SignNow complies with all legal standards required for electronic signatures and document management in Hawaii. Our platform is designed to meet specific compliance regulations, ensuring that your Hawaii Schedule Form N-35 is legally valid and accepted by authorities.

-

What features does airSlate SignNow offer for completing the Hawaii Schedule Form N-35?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time collaboration tools. These capabilities allow businesses to efficiently create, edit, and sign the Hawaii Schedule Form N-35. Our platform also provides tracking and reminders to help you stay on top of deadlines.

-

Can I integrate airSlate SignNow with other software for managing the Hawaii Schedule Form N-35?

Absolutely! airSlate SignNow offers integrations with various productivity and accounting tools. This allows for seamless data transfer and management of your Hawaii Schedule Form N-35 alongside your existing systems, enhancing overall efficiency.

-

What benefits does electronic signing offer for the Hawaii Schedule Form N-35?

Electronic signing with airSlate SignNow allows for faster processing of the Hawaii Schedule Form N-35, as it eliminates the need for physical paperwork. This method is not only quicker but also more secure, reducing the risk of document loss or tampering. Additionally, it enhances convenience for all parties involved.

Get more for HI Schedule K 1 Form N 35 Fill Online, Printable

- Contract for sale and purchase of real estate with no broker for residential home sale agreement district of columbia form

- Buyers home inspection checklist district of columbia form

- Sellers information for appraiser provided to buyer district of columbia

- Legallife multistate guide and handbook for selling or buying real estate district of columbia form

- Subcontractors agreement district of columbia form

- Option to purchase addendum to residential lease lease or rent to own district of columbia form

- Dc prenuptial premarital agreement with financial statements district of columbia form

- District of columbia prenuptial premarital agreement without financial statements district of columbia form

Find out other HI Schedule K 1 Form N 35 Fill Online, Printable

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe