N 15 Rev NonResident and Part Year Resident Income Tax Return Forms Fillable

Understanding the HI N-15 Tax Form

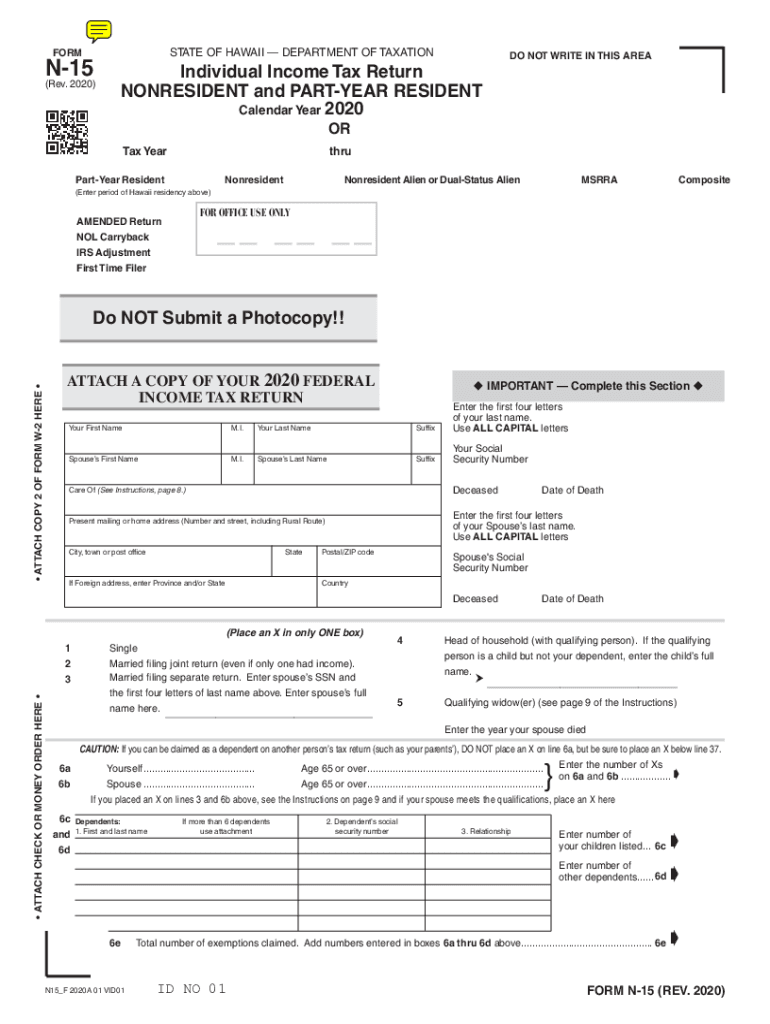

The HI N-15 tax form is specifically designed for non-residents and part-year residents of Hawaii to report their income earned within the state. This form is essential for individuals who do not meet the criteria for full residency but still have tax obligations due to income sourced from Hawaii. The HI N-15 allows taxpayers to accurately calculate their tax liabilities based on the income they earned while residing or working in Hawaii.

Steps to Complete the HI N-15 Tax Form

Completing the HI N-15 tax form involves several key steps:

- Gather all necessary documentation, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all income earned in Hawaii, ensuring to include only the income that is taxable under state law.

- Calculate your deductions and credits, if applicable, which can help reduce your overall tax liability.

- Review your completed form for accuracy before submitting it to ensure compliance with state regulations.

Legal Use of the HI N-15 Tax Form

The HI N-15 tax form is legally recognized for filing tax returns by non-residents and part-year residents. To ensure its legal standing, the form must be filled out accurately and submitted by the designated deadlines. Compliance with the guidelines set forth by the Hawaii Department of Taxation is crucial for the form to be considered valid. This includes providing truthful information and maintaining proper documentation to support claims made on the form.

Filing Deadlines for the HI N-15 Tax Form

It is important to be aware of the filing deadlines for the HI N-15 tax form. Generally, the form must be submitted by the same deadline as federal tax returns, which is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any extensions that may apply and ensure they file on time to avoid penalties.

Required Documents for the HI N-15 Tax Form

When preparing to file the HI N-15 tax form, it is essential to gather all required documents. These typically include:

- W-2 forms from employers for income earned in Hawaii.

- 1099 forms for any freelance or contract work.

- Documentation of any deductions or credits you plan to claim.

- Proof of residency status, if applicable.

Examples of Using the HI N-15 Tax Form

The HI N-15 tax form is utilized in various scenarios, including:

- A non-resident who worked in Hawaii for a few months during the year.

- A part-year resident who moved to Hawaii mid-year and earned income both in and out of the state.

- Individuals who receive income from Hawaii sources while residing in another state.

Quick guide on how to complete n 15 rev 2020 nonresident and part year resident income tax return forms 2020 fillable

Complete N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents swiftly without delays. Manage N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable without stress

- Obtain N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable and click Get Form to begin.

- Utilize the tools we provide to finish your form.

- Emphasize important sections of your documents or conceal sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any chosen device. Edit and eSign N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the n 15 rev 2020 nonresident and part year resident income tax return forms 2020 fillable

The best way to generate an electronic signature for a PDF file in the online mode

The best way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The way to make an e-signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is the hi n15 tax, and how does it relate to document signing?

The hi n15 tax refers to a specific taxation guideline that companies must adhere to when signing legal documents. Understanding how to manage the hi n15 tax is essential for businesses to ensure compliance while using electronic signatures. airSlate SignNow simplifies this process by providing templates and features that help businesses stay informed about their tax obligations.

-

How does airSlate SignNow help with managing hi n15 tax documentation?

airSlate SignNow offers features that streamline the management of documentation associated with the hi n15 tax. Users can easily create, edit, and store documents, ensuring they meet tax requirements. This efficiency not only saves time but also minimizes the risk of errors related to tax documentation.

-

What are the pricing plans for using airSlate SignNow for managing hi n15 tax documents?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Each plan includes features tailored to help users manage hi n15 tax documents effectively. Businesses can choose the plan that best fits their needs while benefiting from a cost-effective solution for document handling.

-

What are the key features of airSlate SignNow related to hi n15 tax compliance?

Key features of airSlate SignNow that support hi n15 tax compliance include secure electronic signatures, document storage, and automated workflows. These tools help ensure that all necessary documentation is compliant with tax regulations. By utilizing these features, businesses can manage their tax documents more efficiently.

-

Can airSlate SignNow integrate with other software to assist with hi n15 tax processes?

Yes, airSlate SignNow offers seamless integrations with various software platforms that help streamline hi n15 tax processes. By connecting with accounting and tax software, users can ensure their documents and signatures align with tax regulations. This integration enhances productivity and simplifies tax-related workflows.

-

What benefits does airSlate SignNow provide for businesses dealing with hi n15 tax?

Using airSlate SignNow provides several benefits for businesses managing hi n15 tax, including increased efficiency, improved compliance, and cost savings. With easy-to-use templates and electronic signatures, businesses can expedite their tax documentation process. This ultimately leads to faster transactions and fewer compliance issues.

-

Is airSlate SignNow secure for handling hi n15 tax documents?

Absolutely, airSlate SignNow prioritizes security, making it safe for handling hi n15 tax documents. The platform employs advanced encryption and adherence to regulations to protect sensitive information. Users can confidently sign and manage their tax-related documents, knowing that their data is secure.

Get more for N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable

- Revocation of postnuptial property agreement district of columbia district of columbia form

- Postnuptial property agreement district of columbia district of columbia form

- Amendment to postnuptial property agreement district of columbia district of columbia form

- Dc civil form

- District columbia corporation form

- District of columbia renunciation and disclaimer of property from will by testate district of columbia form

- Dc notice form

- Dc personal representative form

Find out other N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document