Incapacitated Child Tax Credit Claim Form 2

What is the Incapacitated Child Tax Credit Claim Form 2

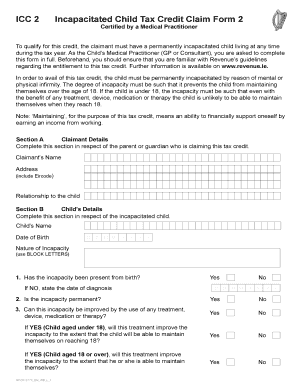

The Incapacitated Child Tax Credit Claim Form 2 is a specific tax form used by caregivers or parents of children who are incapacitated. This form allows eligible individuals to claim tax credits that can significantly reduce their tax liability. The credit is designed to assist families who provide care for children with disabilities or other conditions that limit their ability to care for themselves. Understanding the purpose and details of this form is essential for maximizing potential tax benefits.

How to use the Incapacitated Child Tax Credit Claim Form 2

Using the Incapacitated Child Tax Credit Claim Form 2 involves several steps to ensure accurate completion and submission. First, gather all necessary information regarding the child’s condition and your relationship to them. Next, fill out the form with precise details, including personal information, the nature of the incapacity, and any relevant medical documentation. Finally, review the completed form for accuracy before submitting it to the appropriate tax authority, either electronically or by mail.

Steps to complete the Incapacitated Child Tax Credit Claim Form 2

Completing the Incapacitated Child Tax Credit Claim Form 2 requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, such as proof of the child's incapacity and your identification.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about the incapacitated child, including their name, date of birth, and nature of the incapacity.

- Include any relevant medical or legal documentation that supports the claim.

- Review the form for completeness and accuracy.

- Submit the form according to the guidelines provided, either online or by mail.

Required Documents

When filling out the Incapacitated Child Tax Credit Claim Form 2, certain documents are essential to support your claim. Required documents typically include:

- Proof of the child's incapacity, such as medical records or a doctor’s statement.

- Your identification, such as a driver's license or Social Security card.

- Any relevant tax documents from previous years, if applicable.

Having these documents ready can streamline the process and enhance the credibility of your claim.

Eligibility Criteria

To qualify for the tax credit associated with the Incapacitated Child Tax Credit Claim Form 2, specific eligibility criteria must be met. Generally, the following conditions apply:

- The child must be under the age of 17 at the end of the tax year.

- The child must be permanently and totally disabled, as defined by the IRS.

- The caregiver must have provided more than half of the child's support during the tax year.

Reviewing these criteria carefully is crucial to ensure that you meet all requirements before submitting your claim.

Form Submission Methods

The Incapacitated Child Tax Credit Claim Form 2 can be submitted through various methods, depending on your preference and the guidelines set by the IRS. Common submission methods include:

- Online submission through approved e-filing platforms, which often provide a streamlined process.

- Mailing a printed version of the form to the appropriate IRS address.

- In-person submission at designated IRS offices, if necessary.

Choosing the right submission method can help ensure that your claim is processed efficiently.

Quick guide on how to complete incapacitated child tax credit claim form 2

Effortlessly prepare Incapacitated Child Tax Credit Claim Form 2 on any device

Managing documents online has gained popularity among both companies and individuals. It serves as a suitable eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents quickly and without delay. Manage Incapacitated Child Tax Credit Claim Form 2 on any device using the airSlate SignNow applications for Android or iOS and enhance any document-based process today.

How to edit and electronically sign Incapacitated Child Tax Credit Claim Form 2 with ease

- Locate Incapacitated Child Tax Credit Claim Form 2 and click Access Form to begin.

- Use the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Finish button to save your updates.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searches, or errors that necessitate reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device. Edit and electronically sign Incapacitated Child Tax Credit Claim Form 2 and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the incapacitated child tax credit claim form 2

The best way to make an e-signature for a PDF file online

The best way to make an e-signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to generate an e-signature straight from your mobile device

How to make an e-signature for a PDF file on iOS

How to generate an e-signature for a PDF document on Android devices

People also ask

-

What is the incapacitated child tax credit form?

The incapacitated child tax credit form is a specific tax document that allows parents or guardians of a child with disabilities to claim certain tax benefits. This form helps ensure that you receive the financial support you need to care for your incapacitated child, maximizing your tax deductions. It's essential to understand this form to benefit fully from the available child tax credits.

-

How do I obtain the incapacitated child tax credit form?

You can obtain the incapacitated child tax credit form directly from the IRS website or through tax preparation software. Additionally, airSlate SignNow streamlines the process of signing and submitting this form electronically, ensuring your application is efficiently handled. Make sure to review the guidelines provided to fill it out correctly.

-

Can I use airSlate SignNow for the incapacitated child tax credit form?

Yes, airSlate SignNow offers a robust platform for electronically signing and sending the incapacitated child tax credit form. Our user-friendly interface makes it easy to manage your documents securely and conveniently. This feature enhances your filing experience, making tax time less stressful.

-

What features does airSlate SignNow offer for handling forms like the incapacitated child tax credit form?

airSlate SignNow provides features such as easy eSigning, document templates, and secure cloud storage, which are ideal for managing forms like the incapacitated child tax credit form. Additionally, our platform allows you to track the status of your documents and ensures compliance with legal standards. These features make our solution perfect for both individuals and businesses.

-

Is there a cost associated with airSlate SignNow for using the incapacitated child tax credit form?

Yes, there is a cost associated with using airSlate SignNow, which offers flexible pricing plans tailored to different needs. The investment provides signNow value through features that simplify the process of managing the incapacitated child tax credit form. You can choose a plan that best suits your budget and requirements.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like the incapacitated child tax credit form streamlines your documentation process, saving you time and effort. Our platform ensures that you can securely sign and send documents from anywhere, reducing the need for physical paperwork. This promotes efficiency and enhances your overall tax filing experience.

-

Are there integrations available with airSlate SignNow for tax software?

Yes, airSlate SignNow offers integrations with various tax software and accounting tools to facilitate a seamless process when handling the incapacitated child tax credit form. This functionality makes it easier to manage all your financial forms and ensures accurate data flow between systems. You can select from supported integrations to enhance your productivity.

Get more for Incapacitated Child Tax Credit Claim Form 2

- Roofing contractor package district of columbia form

- Electrical contractor package district of columbia form

- Sheetrock drywall contractor package district of columbia form

- Flooring contractor package district of columbia form

- Trim carpentry contractor package district of columbia form

- Fencing contractor package district of columbia form

- Hvac contractor package district of columbia form

- Landscaping contractor package district of columbia form

Find out other Incapacitated Child Tax Credit Claim Form 2

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe