Indymac Loan Modification Fillable Application PDF Form

What is the Indymac Loan Modification Fillable Application Pdf Form

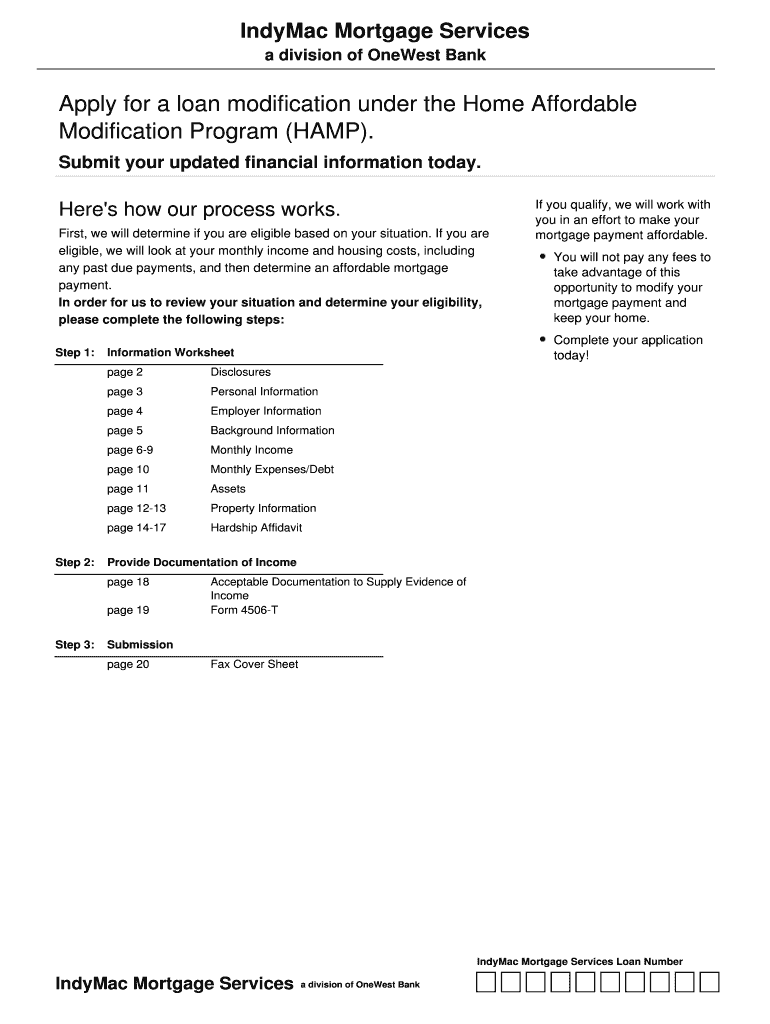

The Indymac loan modification fillable application PDF form is a crucial document for homeowners seeking to modify their mortgage terms with Indymac Mortgage Services. This form allows borrowers to request changes to their existing loan agreements, which may include adjustments to interest rates, monthly payments, or loan duration. By filling out this form, homeowners can initiate the process of obtaining a loan modification, potentially making their mortgage more manageable and affordable.

How to use the Indymac Loan Modification Fillable Application Pdf Form

Using the Indymac loan modification fillable application PDF form involves several steps. First, download the form from a reliable source. Once you have the form, fill it out electronically or by hand, ensuring that all required fields are completed accurately. After completing the form, review it for any errors or omissions. Once verified, you can submit the form to Indymac Mortgage Services as per the instructions provided on the form. It is essential to keep a copy for your records.

Steps to complete the Indymac Loan Modification Fillable Application Pdf Form

Completing the Indymac loan modification fillable application PDF form requires careful attention to detail. Follow these steps:

- Download the form from a trusted source.

- Provide your personal information, including your name, address, and contact details.

- Include details about your current mortgage, such as the loan number and property address.

- Specify the reason for requesting a loan modification.

- Attach any required documentation that supports your request, such as proof of income or hardship letters.

- Review the completed form for accuracy before submission.

Legal use of the Indymac Loan Modification Fillable Application Pdf Form

The legal use of the Indymac loan modification fillable application PDF form is governed by various regulations that ensure the document is valid and enforceable. To be legally binding, the form must be filled out completely and accurately, and any signatures must comply with electronic signature laws, such as the ESIGN Act and UETA. Utilizing a reliable eSignature platform can help ensure compliance and provide a secure method for submitting the form.

Eligibility Criteria

To qualify for a loan modification through the Indymac loan modification fillable application PDF form, borrowers must meet specific eligibility criteria. Generally, these criteria include:

- Demonstrating financial hardship, such as job loss, medical expenses, or other significant life changes.

- Being the owner-occupant of the property in question.

- Having a mortgage that is owned or serviced by Indymac Mortgage Services.

- Providing necessary documentation to support the modification request, including income verification and hardship letters.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Indymac loan modification fillable application PDF form can be done through various methods. Borrowers may choose to submit the form online through the Indymac Mortgage Services portal, ensuring a quick and efficient process. Alternatively, the completed form can be mailed to the appropriate address provided on the form. For those who prefer face-to-face interaction, submitting the form in person at a local Indymac branch may also be an option, allowing for immediate assistance and clarification.

Quick guide on how to complete indymac loan modification fillable application pdf form

Effortlessly Prepare Indymac Loan Modification Fillable Application Pdf Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can access the correct form and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle Indymac Loan Modification Fillable Application Pdf Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and Electronically Sign Indymac Loan Modification Fillable Application Pdf Form with Ease

- Locate Indymac Loan Modification Fillable Application Pdf Form and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools available through airSlate SignNow specifically for that purpose.

- Form your electronic signature using the Sign feature, which takes seconds and holds the same legal value as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose your preferred method of delivering your form via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced papers, tedious document searching, or mistakes that require reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you select. Modify and electronically sign Indymac Loan Modification Fillable Application Pdf Form to ensure top-notch communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

How do I fill out the application form for an educational loan online?

Depending on which country you are in and what kind of lender you are going for. There are bank loans and licensed money lenders. If you are taking a large amount, banks are recommended. If you are working, need a small amount for your tuition and in need of it fast, you can try a licensed moneylender.

-

How do I create a fillable HTML form online that can be downloaded as a PDF? I have made a framework for problem solving and would like to give people access to an online unfilled form that can be filled out and downloaded filled out.

Create PDF Form that will be used for download and convert it to HTML Form for viewing on your website.However there’s a lot of PDF to HTML converters not many can properly convert PDF Form including form fields. If you plan to use some calculations or validations it’s even harder to find one. Try PDFix Form Converter which works fine to me.

-

When I fill out a loan application form at a bank, how does the bank know if I am lying about my total assets and liabilities?

Your credit report has more than the score, because part of what makes up you score is the amount of liabilities and how they are handled. Liabilities that will show areCar payments and balanceCredit cardsDepartment store cardsStudent loansChild support/alimony Judgements And many more.For assetsBank statementsBrokerage accounts401k statements etc.If an applicant is sufficiently strong (20% down-payment and a few months mortgage payments reserved) then all assets are usually not verified.But as a mortgage broker I've even used a car and boat title to boost an otherwise shaky application.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How many application forms does a person need to fill out in his/her lifetime?

As many as you want to !

Create this form in 5 minutes!

How to create an eSignature for the indymac loan modification fillable application pdf form

How to create an eSignature for the Indymac Loan Modification Fillable Application Pdf Form online

How to generate an eSignature for the Indymac Loan Modification Fillable Application Pdf Form in Chrome

How to make an electronic signature for signing the Indymac Loan Modification Fillable Application Pdf Form in Gmail

How to make an eSignature for the Indymac Loan Modification Fillable Application Pdf Form right from your smart phone

How to create an eSignature for the Indymac Loan Modification Fillable Application Pdf Form on iOS

How to make an electronic signature for the Indymac Loan Modification Fillable Application Pdf Form on Android

People also ask

-

What is the Indymac Loan Modification Fillable Application Pdf Form?

The Indymac Loan Modification Fillable Application Pdf Form is a document designed to simplify the process of applying for loan modifications with Indymac. This fillable PDF form allows users to easily input their information, making it more efficient to submit applications for loan adjustments. By using this form, borrowers can ensure they provide all necessary details to improve their chances of approval.

-

How can I fill out the Indymac Loan Modification Fillable Application Pdf Form?

Filling out the Indymac Loan Modification Fillable Application Pdf Form is straightforward. Simply download the PDF, open it in a compatible PDF reader, and enter your information in the designated fields. Once completed, you can save and submit the form electronically or print it out for submission.

-

Is there a cost associated with the Indymac Loan Modification Fillable Application Pdf Form?

The Indymac Loan Modification Fillable Application Pdf Form is typically available for free online. However, there may be costs associated with additional services or consultations regarding your loan modification application. It's advisable to check for any fees that may apply when seeking professional assistance.

-

What are the benefits of using the Indymac Loan Modification Fillable Application Pdf Form?

Using the Indymac Loan Modification Fillable Application Pdf Form streamlines the application process, ensuring you provide all required information in a clear and organized manner. This can lead to faster processing times and reduces the likelihood of errors in your application. Additionally, having a fillable form can make it easier to track changes and updates.

-

Can I eSign the Indymac Loan Modification Fillable Application Pdf Form?

Yes, you can easily eSign the Indymac Loan Modification Fillable Application Pdf Form using airSlate SignNow. Our platform allows you to sign documents digitally, ensuring a secure and legally binding signature. This feature saves time and simplifies the submission process, making it ideal for busy borrowers.

-

Are there any integrations available with the Indymac Loan Modification Fillable Application Pdf Form?

Absolutely! The Indymac Loan Modification Fillable Application Pdf Form can be seamlessly integrated with various document management and cloud storage solutions. This allows you to store, manage, and share your application conveniently, enhancing your workflow and document organization.

-

What features does airSlate SignNow offer for the Indymac Loan Modification Fillable Application Pdf Form?

airSlate SignNow provides several features for the Indymac Loan Modification Fillable Application Pdf Form, including easy document sharing, electronic signatures, and customizable templates. These tools make it simple to manage your loan modification documents efficiently while ensuring they are secure and compliant with legal standards.

Get more for Indymac Loan Modification Fillable Application Pdf Form

Find out other Indymac Loan Modification Fillable Application Pdf Form

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast