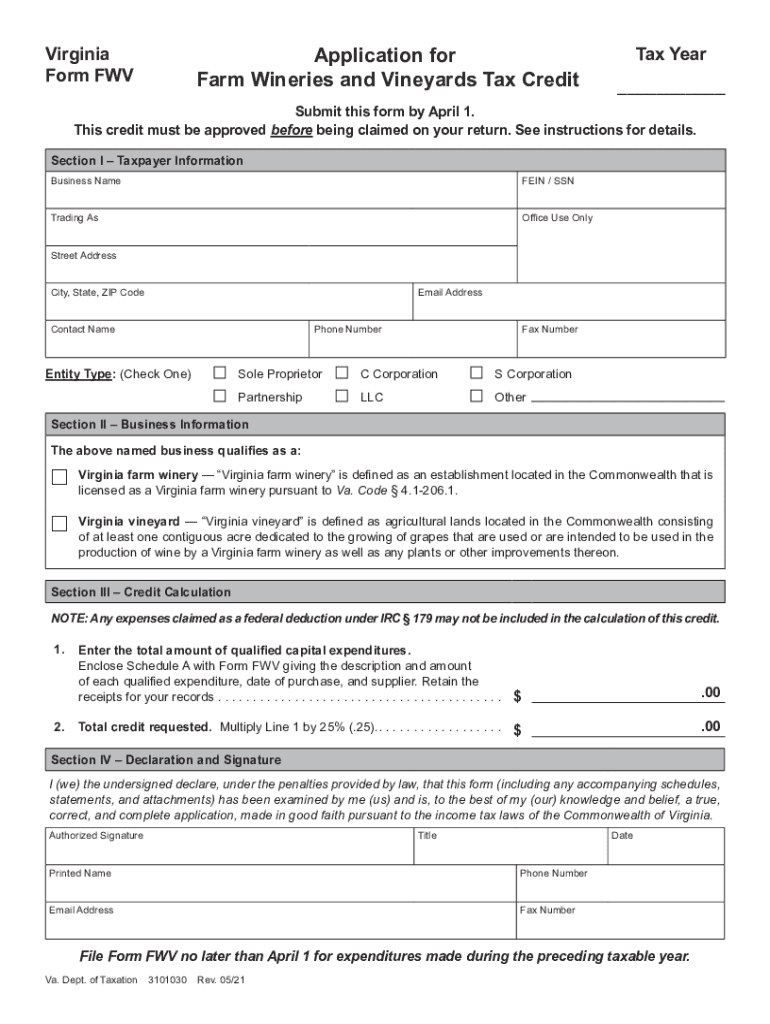

Fillable Online Tax Virginia Form FWV Application for Farm

What is the Virginia Form ST 13A?

The Virginia Form ST 13A, also known as the Virginia tax exempt form ST 13A, is a critical document used by qualifying businesses and organizations to claim exemption from sales tax on purchases related to specific activities. This form is essential for entities such as farmers, certain non-profits, and educational institutions that meet the criteria set by the state. By submitting this form, eligible applicants can ensure that they do not incur sales tax on eligible purchases, thereby supporting their operational costs.

Eligibility Criteria for the Virginia Form ST 13A

To qualify for the Virginia Form ST 13A, applicants must meet specific criteria established by the state. Generally, the following entities may be eligible:

- Farmers engaged in agricultural production.

- Non-profit organizations that operate for charitable purposes.

- Educational institutions that provide instruction.

Applicants must provide documentation proving their eligibility, which may include tax identification numbers, proof of agricultural production, or non-profit status. Ensuring that all criteria are met is crucial for the successful approval of the form.

Steps to Complete the Virginia Form ST 13A

Completing the Virginia Form ST 13A involves several key steps to ensure accuracy and compliance:

- Gather necessary documentation, including proof of eligibility.

- Fill out the form with accurate information, including your business name, address, and tax identification number.

- Specify the type of exemption you are claiming and provide details about the purchases.

- Review the form for completeness and accuracy.

- Submit the completed form to the appropriate state agency.

Following these steps carefully will help facilitate a smooth application process and ensure that your exemption claim is processed efficiently.

Legal Use of the Virginia Form ST 13A

The Virginia Form ST 13A is legally binding when completed and submitted correctly. It serves as a formal request for sales tax exemption and must be filled out in accordance with Virginia state laws. To maintain compliance, it is essential to understand the specific legal requirements associated with the form, including the types of purchases that qualify for exemption. Misuse of the form or failure to adhere to regulations can result in penalties or denial of the exemption.

Form Submission Methods for Virginia Form ST 13A

Applicants can submit the Virginia Form ST 13A through various methods, ensuring flexibility and convenience. The available submission methods include:

- Online submission via the Virginia Department of Taxation website.

- Mailing the completed form to the designated state agency address.

- In-person submission at local tax offices or designated locations.

Choosing the appropriate submission method can help expedite the processing of your exemption claim.

Key Elements of the Virginia Form ST 13A

Understanding the key elements of the Virginia Form ST 13A is vital for accurate completion. The form typically includes:

- Applicant's name and contact information.

- Tax identification number.

- Details about the nature of the exemption being claimed.

- Signature of the authorized representative.

Each section must be filled out clearly to prevent delays in processing and to ensure that all necessary information is provided for the exemption claim.

Quick guide on how to complete fillable online tax virginia form fwv application for farm

Effortlessly prepare Fillable Online Tax Virginia Form FWV Application For Farm on any device

Online document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features needed to create, alter, and eSign your documents quickly without wait times. Manage Fillable Online Tax Virginia Form FWV Application For Farm on any device with airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

How to modify and eSign Fillable Online Tax Virginia Form FWV Application For Farm with ease

- Find Fillable Online Tax Virginia Form FWV Application For Farm and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you favor. Alter and eSign Fillable Online Tax Virginia Form FWV Application For Farm to ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable online tax virginia form fwv application for farm

How to generate an electronic signature for a PDF document online

How to generate an electronic signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

How to make an e-signature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the form st 13a and how can it be used with airSlate SignNow?

The form st 13a is a specific tax form used for certain filing purposes. With airSlate SignNow, you can easily create, send, and eSign the form st 13a, ensuring that your submissions are efficient and secure.

-

How does airSlate SignNow streamline the completion of form st 13a?

airSlate SignNow simplifies the completion of the form st 13a with its user-friendly interface and robust features. You can fill out the form digitally, add electronic signatures, and securely send it to relevant parties without any hassle.

-

Is there a free trial available for using form st 13a with airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows users to explore its features, including the functionality for form st 13a. You can experience the full capabilities of the platform before committing to a subscription.

-

What are the pricing options for using airSlate SignNow with form st 13a?

airSlate SignNow offers flexible pricing plans based on your needs. You can choose from monthly or annual subscriptions that include complete features for managing documents like the form st 13a, making it a cost-effective solution.

-

Can airSlate SignNow integrate with other tools for managing form st 13a?

Absolutely, airSlate SignNow integrates seamlessly with various applications and tools, enhancing the management of the form st 13a. This connectivity allows you to streamline your workflow and keep all your processes organized.

-

What features does airSlate SignNow offer for managing form st 13a?

airSlate SignNow provides a range of features for managing the form st 13a, including document templates, customizable workflows, and secure eSigning options. These features enhance efficiency and reduce the likelihood of errors in your submissions.

-

How secure is the process of signing form st 13a using airSlate SignNow?

The process of signing the form st 13a using airSlate SignNow is highly secure. The platform employs advanced encryption and security measures to protect your data and ensure that your electronic signatures are legally binding.

Get more for Fillable Online Tax Virginia Form FWV Application For Farm

- Florida discovery 497302704 form

- Small claims 497302705 form

- Deed parents form

- Warranty deed individual to individual with reserved life estate florida form

- Florida deed trust form

- Discovery interrogatories from plaintiff to defendant with production requests florida form

- Florida pretrial conference form

- Florida notice abandoned property form

Find out other Fillable Online Tax Virginia Form FWV Application For Farm

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney