Get the Form 4835 Department of the Treasury Internal

What is the 4835 Form from the IRS?

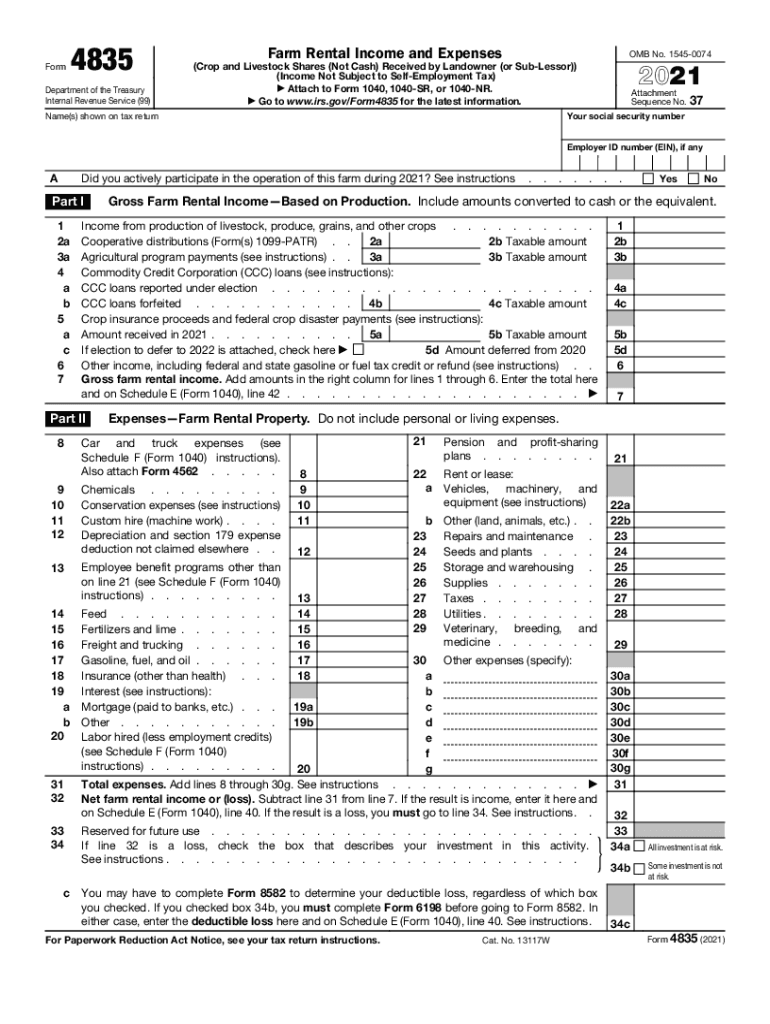

The 4835 form, officially known as the "Farm Rental Income and Expenses," is utilized by individuals who receive rental income from a farm. This form is essential for reporting income and expenses related to farming activities, particularly for those who do not materially participate in the farming operation. It helps taxpayers calculate their net income or loss from rental activities and is crucial for accurate tax reporting.

How to Complete the 4835 Form

Completing the 4835 form involves several steps to ensure accuracy and compliance with IRS guidelines. First, gather all necessary documentation, including records of rental income and expenses. Next, fill out the form with your personal information, including your name and Social Security number. Report your total rental income in the designated section, followed by detailed expenses such as repairs, maintenance, and other operational costs. Finally, calculate your net income or loss by subtracting total expenses from total income, and ensure all entries are accurate before submission.

Filing Deadlines for the 4835 Form

Timely filing of the 4835 form is crucial to avoid penalties. The deadline for submitting the form is typically the same as the individual income tax return, which is April 15 of the following year. If you require additional time, you may file for an extension, which grants an additional six months to submit your return. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties.

IRS Guidelines for the 4835 Form

The IRS provides specific guidelines for completing and filing the 4835 form. It is important to adhere to these guidelines to ensure compliance and avoid potential audits. The form must be filled out accurately, reflecting all income and expenses related to farm rental activities. Keep thorough records and documentation to support your entries, as the IRS may request this information during an audit. Additionally, familiarize yourself with any updates or changes to the form or related tax laws to ensure compliance.

Digital vs. Paper Version of the 4835 Form

Both digital and paper versions of the 4835 form are available for taxpayers. The digital version allows for easier completion and submission, often through tax software that can guide users through the process. In contrast, the paper version requires manual completion and mailing to the IRS. While both versions are legally valid, the digital format may offer benefits such as automatic calculations and error-checking features, making the process more efficient.

Key Elements of the 4835 Form

Understanding the key elements of the 4835 form is essential for accurate completion. The form includes sections for reporting rental income, various expenses, and calculating net income or loss. Key elements to focus on include:

- Rental Income: Total income received from renting out farm property.

- Expenses: Detailed breakdown of costs associated with the rental, including repairs, utilities, and depreciation.

- Net Income Calculation: The difference between total income and total expenses, which determines tax liability.

Penalties for Non-Compliance with the 4835 Form

Failing to comply with the requirements of the 4835 form can result in significant penalties. The IRS may impose fines for late filing or inaccuracies in reporting income and expenses. Additionally, underreporting income can lead to further scrutiny and potential audits. It is essential to accurately complete the form and file it on time to avoid these penalties and ensure compliance with tax obligations.

Quick guide on how to complete get the free form 4835 department of the treasury internal

Effortlessly Handle Get The Form 4835 Department Of The Treasury Internal on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Get The Form 4835 Department Of The Treasury Internal on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign Get The Form 4835 Department Of The Treasury Internal with Ease

- Obtain Get The Form 4835 Department Of The Treasury Internal and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or censor sensitive information with tools that airSlate SignNow specifically supplies for this purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Alter and electronically sign Get The Form 4835 Department Of The Treasury Internal and guarantee effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the get the free form 4835 department of the treasury internal

How to make an electronic signature for a PDF in the online mode

How to make an electronic signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The best way to generate an e-signature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the 4835 2021 IRS form and who needs to file it?

The 4835 2021 IRS form is used by farmers and fishermen to report income and expenses from farming or fishing operations. Individuals who earn income from these activities and are not considered self-employed need to file this form. Understanding the 4835 2021 IRS requirements can help ensure proper reporting of income and avoid penalties.

-

How can airSlate SignNow help with submitting the 4835 2021 IRS form?

airSlate SignNow provides an efficient solution for eSigning and managing documents, including the 4835 2021 IRS form. With our platform, you can easily upload, edit, and send this essential form for electronic signature. This streamlines the process, ensuring your filings are accurate and submitted on time.

-

What are the benefits of using airSlate SignNow for the 4835 2021 IRS form?

Using airSlate SignNow for the 4835 2021 IRS form simplifies the filing process. It allows you to sign documents securely, track the status of your forms, and store them in one place. Additionally, our platform reduces paper consumption, aligning with eco-friendly practices.

-

Is airSlate SignNow compliant with IRS regulations for the 4835 2021 form?

Yes, airSlate SignNow complies with IRS regulations when it comes to electronic signatures for the 4835 2021 IRS form. Our solutions adhere to industry standards for security and authenticity, ensuring your submissions meet necessary legal requirements. This gives users peace of mind when handling sensitive tax documents.

-

What pricing options does airSlate SignNow offer for businesses needing to file the 4835 2021 IRS form?

airSlate SignNow offers various pricing plans suitable for businesses of all sizes, including those needing to file the 4835 2021 IRS form. Plans are designed to be cost-effective, providing access to essential features like unlimited templates and secure eSignature capabilities. Choose a plan that meets your business needs without overspending.

-

Can airSlate SignNow integrate with accounting software for filing the 4835 2021 IRS form?

Yes, airSlate SignNow seamlessly integrates with popular accounting software to facilitate the filing of the 4835 2021 IRS form. This integration helps in importing financial data directly into the form, making it easier to complete your filings. Streamlining this process ensures accuracy and saves valuable time.

-

What features of airSlate SignNow are particularly beneficial for filing tax forms like the 4835 2021 IRS?

airSlate SignNow offers features like customizable templates, document tracking, and secure eSignatures that are particularly beneficial for filing tax forms like the 4835 2021 IRS. These features help in organizing your documents, ensuring timely submissions, and maintaining compliance with tax regulations. The user-friendly interface makes document management a breeze.

Get more for Get The Form 4835 Department Of The Treasury Internal

- Warranty deed form florida

- Fl wife 497302871 form

- Warranty deed from a limited liability company to a limited liability company florida form

- Fl limited company form

- Warranty deed from husband and wife to four individuals florida form

- Florida quitclaim deed form

- Warranty deed husband form

- Quitclaim deed grantor form

Find out other Get The Form 4835 Department Of The Treasury Internal

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy