IRS Schedule D 1065 FormpdfFiller

What is the IRS Schedule D 1065 Form?

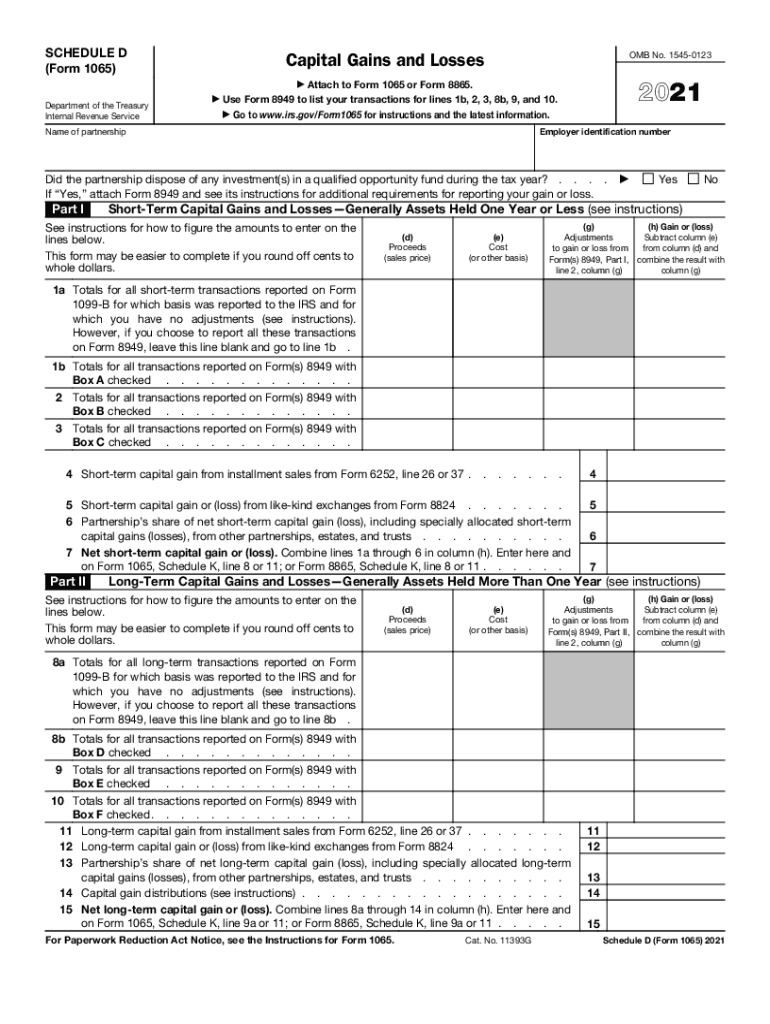

The IRS Schedule D 1065 form is used by partnerships to report capital gains and losses from the sale of assets. This form is essential for accurately calculating the capital gains tax that partners may owe on their individual tax returns. It provides a detailed account of the transactions that occurred during the tax year, including the sale of stocks, bonds, and other capital assets. Understanding this form is crucial for compliance with IRS regulations and for ensuring that all partners report their income correctly.

Steps to Complete the IRS Schedule D 1065 Form

Completing the IRS Schedule D 1065 form involves several key steps:

- Gather necessary information: Collect all transaction details, including dates of acquisition and sale, purchase prices, and sale proceeds.

- Fill out the form: Begin by entering the partnership's information at the top of the form. Then, list each transaction in the appropriate sections, ensuring accuracy in reporting gains and losses.

- Calculate totals: After entering all transactions, calculate the total capital gains and losses. This will determine the net gain or loss for the partnership.

- Review for accuracy: Double-check all entries for errors or omissions. Accurate reporting is essential to avoid penalties.

- Submit the form: File the completed Schedule D 1065 form along with the partnership's tax return by the designated deadline.

Legal Use of the IRS Schedule D 1065 Form

The legal use of the IRS Schedule D 1065 form is critical for partnerships to maintain compliance with federal tax laws. This form must be completed accurately to reflect all capital transactions. Failure to do so can result in penalties, including fines and interest on unpaid taxes. It is important for partnerships to ensure that all partners understand their responsibilities regarding the reporting of capital gains and losses on their individual tax returns.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Schedule D 1065 form align with the partnership's tax return deadlines. Typically, partnerships must file their returns by March 15 for calendar year filers. If an extension is filed, the deadline may be extended to September 15. It is crucial to adhere to these deadlines to avoid late filing penalties and interest charges on any taxes owed.

Required Documents

To complete the IRS Schedule D 1065 form, several documents are necessary:

- Records of all capital transactions, including purchase and sale documents.

- Previous tax returns that may affect current reporting.

- Partnership agreement detailing the distribution of gains and losses among partners.

- Any supporting documentation for deductions or credits claimed.

Form Submission Methods

The IRS Schedule D 1065 form can be submitted through several methods:

- Online: Many tax preparation software programs allow for electronic filing of the form.

- Mail: Partnerships can print the completed form and mail it to the appropriate IRS address based on their location.

- In-Person: Some partnerships may choose to deliver their forms directly to a local IRS office, although this method is less common.

Quick guide on how to complete irs schedule d 1065 formpdffiller

Prepare IRS Schedule D 1065 FormpdfFiller effortlessly on any device

Web-based document management has become increasingly popular among companies and individuals. It offers a remarkable eco-friendly option to traditional printed and signed documents, enabling you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, alter, and eSign your documents swiftly without delays. Handle IRS Schedule D 1065 FormpdfFiller on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign IRS Schedule D 1065 FormpdfFiller with ease

- Locate IRS Schedule D 1065 FormpdfFiller and select Get Form to begin.

- Use the tools provided to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form: via email, text message (SMS), invitation link, or download it to your computer.

No more lost or misfiled documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign IRS Schedule D 1065 FormpdfFiller and ensure superior communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs schedule d 1065 formpdffiller

How to make an electronic signature for your PDF in the online mode

How to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to create an e-signature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

How to create an e-signature for a PDF on Android OS

People also ask

-

What is IRS Form D and how does airSlate SignNow assist with it?

IRS Form D refers to a specific tax form used by certain businesses and individuals. airSlate SignNow simplifies the process by allowing users to securely send, sign, and manage IRS Form D online, ensuring a smooth and efficient workflow.

-

Is airSlate SignNow a cost-effective solution for handling IRS Form D?

Yes, airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. With its cost-effective solution, users can manage their IRS Form D and other documents without breaking the bank.

-

What features does airSlate SignNow offer for completing IRS Form D?

airSlate SignNow provides various features including templates, electronic signatures, and document tracking. These tools make it easy to fill out and finalize IRS Form D efficiently while maintaining compliance.

-

Can I integrate airSlate SignNow with other software for managing IRS Form D?

Absolutely! airSlate SignNow supports integration with popular applications like CRMs and cloud storage services. This capability enhances workflow efficiency for users handling IRS Form D alongside their other business processes.

-

What are the benefits of using airSlate SignNow for IRS Form D?

Using airSlate SignNow streamlines the signing and submission process for IRS Form D, saving time and reducing errors. It also provides a secure platform, ensuring your sensitive data is protected while managing your tax forms.

-

How does airSlate SignNow ensure compliance when dealing with IRS Form D?

airSlate SignNow is designed with compliance in mind, utilizing advanced security measures and encryption protocols. This ensures that all electronic transactions, including those involving IRS Form D, meet legal and regulatory requirements.

-

Can I access IRS Form D on mobile devices through airSlate SignNow?

Yes, airSlate SignNow has a mobile-friendly platform that allows users to access and manage IRS Form D from their smartphones and tablets. This flexibility lets you complete your documents anytime and anywhere.

Get more for IRS Schedule D 1065 FormpdfFiller

- Notice of default for past due payments in connection with contract for deed florida form

- Final notice of default for past due payments in connection with contract for deed florida form

- Assignment of contract for deed by seller florida form

- Notice of assignment of contract for deed florida form

- Fl purchase form

- Buyers home inspection checklist florida form

- Sellers information for appraiser provided to buyer florida

- Legallife multistate guide and handbook for selling or buying real estate florida form

Find out other IRS Schedule D 1065 FormpdfFiller

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself