Download ILovePDF for Web Apps Latest Version Form

IRS Guidelines

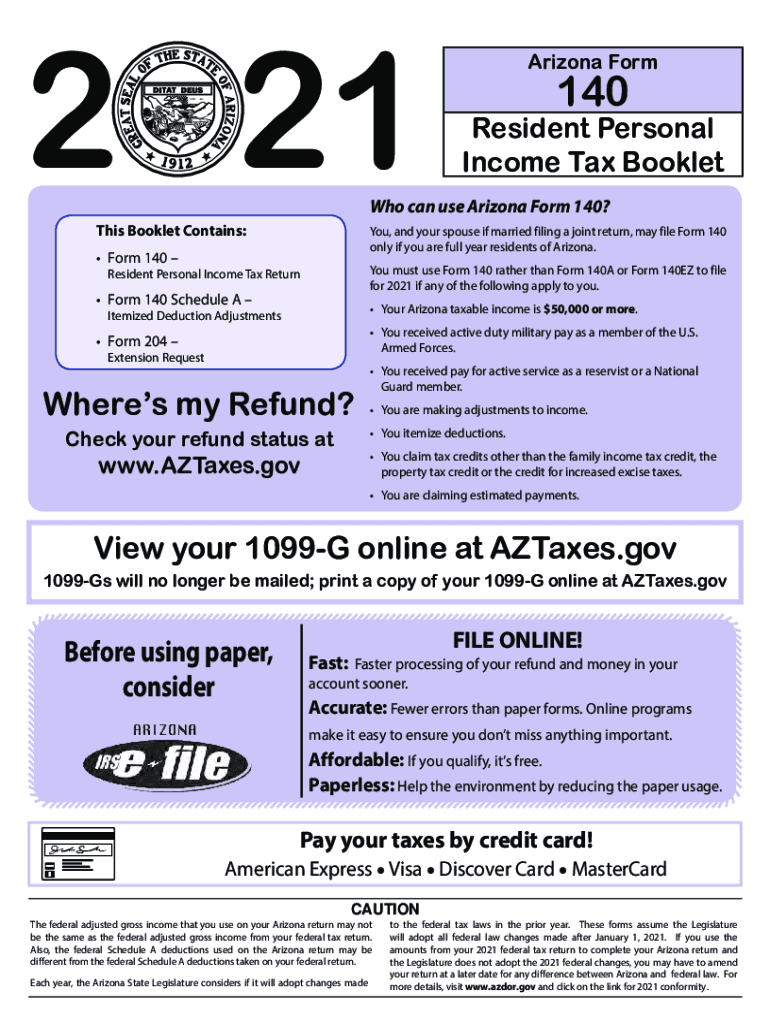

The IRS provides comprehensive guidelines for filing state income taxes, including specific instructions for Arizona. Understanding these guidelines is crucial for accurate tax filing. The Arizona Department of Revenue aligns its instructions with IRS regulations, ensuring that taxpayers are informed about allowable deductions, credits, and forms required for submission. For the 2021 tax year, taxpayers should refer to the IRS's official website for updates on federal tax laws that may impact their Arizona income tax obligations.

Filing Deadlines / Important Dates

For the 2021 tax year, the deadline for filing Arizona state income tax returns is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of estimated tax payment deadlines, which are generally due quarterly. Keeping track of these important dates helps ensure timely filing and avoids penalties.

Required Documents

When preparing to file Arizona income tax for 2021, taxpayers should gather essential documents. This includes W-2 forms from employers, 1099 forms for any additional income, and records of any deductions or credits claimed. Additionally, documentation for any tax payments made throughout the year should be collected. Having these documents organized will streamline the filing process and ensure accuracy.

Form Submission Methods (Online / Mail / In-Person)

Arizona offers several methods for submitting income tax returns. Taxpayers can file online using the state’s e-filing system, which is often the fastest method for processing returns. Alternatively, returns can be mailed to the appropriate address provided in the Arizona income tax instructions. In-person submissions are also accepted at designated state revenue offices, though this may require an appointment. Each method has its own processing times and requirements, so taxpayers should choose the one that best suits their needs.

Penalties for Non-Compliance

Failure to comply with Arizona income tax regulations can result in various penalties. This may include late filing fees, interest on unpaid taxes, and potential legal action for severe non-compliance. Understanding these penalties emphasizes the importance of timely and accurate filing. Taxpayers are encouraged to stay informed about their obligations to avoid these consequences.

Taxpayer Scenarios (e.g., self-employed, retired, students)

Different taxpayer scenarios may affect how individuals file their Arizona income tax. For instance, self-employed individuals must report their business income and expenses, while retirees may have specific deductions available related to pensions or social security. Students may qualify for educational credits or deductions. Each scenario has unique requirements and benefits that taxpayers should consider when preparing their returns.

Quick guide on how to complete download ilovepdf for web apps free latest version

Accomplish Download ILovePDF For Web Apps Latest Version effortlessly on any gadget

Digital document management has gained traction among companies and individuals alike. It serves as a superb environmentally-friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and safely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Download ILovePDF For Web Apps Latest Version on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign Download ILovePDF For Web Apps Latest Version with ease

- Obtain Download ILovePDF For Web Apps Latest Version and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Download ILovePDF For Web Apps Latest Version and guarantee excellent communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the download ilovepdf for web apps free latest version

The best way to make an electronic signature for a PDF online

The best way to make an electronic signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

How to generate an e-signature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

What are the key features of the airSlate SignNow solution for managing Arizona income tax instructions 2021?

airSlate SignNow offers features like customizable templates, secure eSigning, and document management, which are essential when handling Arizona income tax instructions 2021. This ensures you can efficiently prepare and sign necessary documents without the hassle of printing or mailing. It simplifies compliance with state regulations, making tax season stress-free.

-

How does airSlate SignNow help with tracking Arizona income tax instructions 2021?

With airSlate SignNow, users can track the entire signing process of documents related to Arizona income tax instructions 2021. Our platform provides real-time notifications and the ability to monitor who has viewed or signed the documents. This transparency helps ensure compliance and keeps all parties informed during the tax preparation process.

-

What is the pricing structure for using airSlate SignNow for Arizona income tax instructions 2021?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, especially for tasks like managing Arizona income tax instructions 2021. Whether you're a small business or a large enterprise, we have a plan that fits your budget and provides all the necessary features for effective document management. Visit our pricing page for more details.

-

Are there any integrations available with airSlate SignNow for Arizona income tax instructions 2021?

Yes, airSlate SignNow seamlessly integrates with various platforms and software, ensuring that you can manage Arizona income tax instructions 2021 alongside your existing tools. Whether it’s CRM systems or cloud storage solutions, our integrations make it easy to streamline your document workflows. This enhances productivity and keeps everything organized in one place.

-

Is airSlate SignNow suitable for individuals preparing Arizona income tax instructions 2021?

Absolutely! airSlate SignNow is not just for businesses; individuals can also benefit from our solution when preparing Arizona income tax instructions 2021. Our user-friendly interface allows anyone to manage their tax documents efficiently, ensuring that signing and submission are quick and legal. It's a perfect tool for personal tax management.

-

Can airSlate SignNow ensure the security of my documents related to Arizona income tax instructions 2021?

Security is a top priority at airSlate SignNow. We implement robust encryption and secure servers to protect your documents related to Arizona income tax instructions 2021. You can rest assured knowing that your sensitive data is safe from unauthorized access during the eSigning process.

-

What benefits does airSlate SignNow offer for businesses managing Arizona income tax instructions 2021?

Businesses using airSlate SignNow for Arizona income tax instructions 2021 enjoy signNow benefits, including time savings, easier collaboration, and improved compliance. The ability to sign documents electronically eliminates delays and ensures faster processing. This efficiency not only speeds up tax preparation but also enhances overall productivity.

Get more for Download ILovePDF For Web Apps Latest Version

- Al bankruptcy forms

- Al bankruptcy 7 form

- Bill of sale with warranty by individual seller alabama form

- Bill of sale with warranty for corporate seller alabama form

- Bill of sale without warranty by individual seller alabama form

- Bill of sale without warranty by corporate seller alabama form

- Chapter 13 plan alabama form

- Chapter 13 plan alabama 497295908 form

Find out other Download ILovePDF For Web Apps Latest Version

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form