Form 1065 Schedule K 1

What is the Form 1065 Schedule K-1

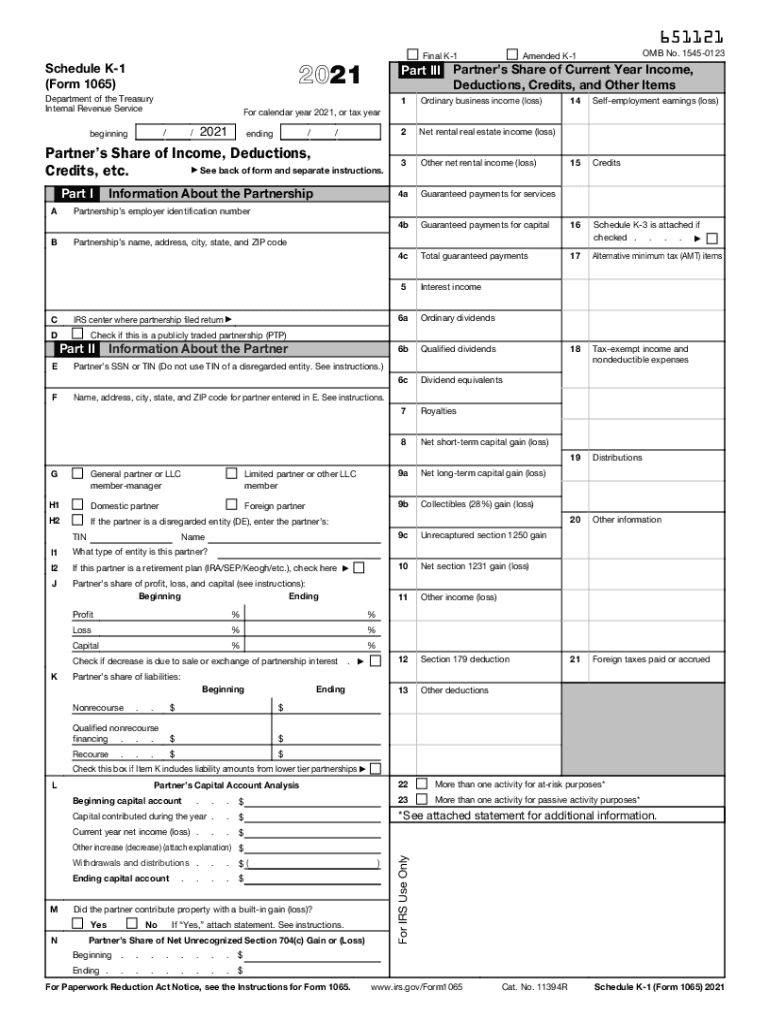

The Form 1065 Schedule K-1 is a tax document used by partnerships to report income, deductions, and credits to the Internal Revenue Service (IRS). Each partner receives a K-1, which details their share of the partnership's income, losses, and other tax-related items. This form is essential for partners to accurately report their income on their individual tax returns. The information provided on the K-1 is derived from the partnership's Form 1065, which is filed by the partnership itself.

Steps to Complete the Form 1065 Schedule K-1

Completing the Form 1065 Schedule K-1 involves several key steps:

- Gather necessary information about the partnership, including its name, address, and Employer Identification Number (EIN).

- Identify each partner's share of profits, losses, and capital, which should be based on the partnership agreement.

- Fill out the K-1 form, ensuring that all fields are accurately completed, including the partner's name, address, and tax identification number.

- Report any special allocations or distributions that may apply to specific partners.

- Review the completed form for accuracy before submitting it to the IRS and providing copies to each partner.

How to Obtain the Form 1065 Schedule K-1

Partners can obtain the Form 1065 Schedule K-1 from the partnership itself. The partnership is responsible for preparing and distributing the K-1s to its partners after filing the Form 1065 with the IRS. If a partner does not receive their K-1, they should contact the partnership directly to request a copy. Additionally, the form can be accessed on the IRS website for reference, although it is typically filled out by the partnership rather than individual partners.

Legal Use of the Form 1065 Schedule K-1

The legal use of the Form 1065 Schedule K-1 is crucial for compliance with IRS regulations. Each partner must include the information from their K-1 when filing their personal tax returns. Failure to report income or discrepancies between the K-1 and the partner's tax return can lead to penalties or audits. It is important for partners to retain a copy of their K-1 for their records and to ensure that they understand the tax implications of the income reported.

Filing Deadlines / Important Dates

The filing deadline for Form 1065, which includes the issuance of Schedule K-1 to partners, is typically March 15 of each year. However, if the partnership files for an extension, this deadline can be extended to September 15. Partners should be aware of these dates to ensure timely filing of their individual tax returns, as the information on the K-1 is necessary for accurate reporting.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the Form 1065 Schedule K-1. Partnerships must ensure that they follow these guidelines to avoid issues with their tax filings. This includes accurate reporting of income, deductions, and credits, as well as proper distribution of K-1s to partners. The IRS also outlines the requirements for electronic filing and record-keeping, which partnerships must adhere to in order to maintain compliance.

Quick guide on how to complete form 1065 schedule k 1

Effortlessly Prepare Form 1065 Schedule K 1 on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers a perfect environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely save it online. airSlate SignNow provides you with all the necessary tools to quickly create, modify, and electronically sign your documents without any delays. Handle Form 1065 Schedule K 1 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Form 1065 Schedule K 1 effortlessly

- Obtain Form 1065 Schedule K 1 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form navigation, or errors that require printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your preference. Modify and eSign Form 1065 Schedule K 1 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1065 schedule k 1

The best way to make an e-signature for a PDF document online

The best way to make an e-signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

How to make an e-signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the 2021 form K1 and why is it important?

The 2021 form K1 is a tax document used to report income, deductions, and credits from partnerships, S corporations, and estates. Understanding this form is crucial for accurate tax filing as it impacts your personal tax return. Having the right tools, like airSlate SignNow, can simplify the eSigning process for these crucial documents.

-

How can airSlate SignNow help me with my 2021 form K1?

airSlate SignNow simplifies the process of sending and eSigning your 2021 form K1. With our user-friendly platform, you can securely send your K1 forms for signatures, track their status, and receive completed documents in minutes, saving you valuable time during tax season.

-

What are the pricing options for using airSlate SignNow for the 2021 form K1?

airSlate SignNow offers flexible pricing plans suitable for individuals and businesses needing to manage their 2021 form K1 and other documents. You can choose from monthly or annual subscriptions that provide various features, ensuring you find the right fit according to your document management needs.

-

Does airSlate SignNow provide templates for the 2021 form K1?

Yes, airSlate SignNow provides customizable templates for the 2021 form K1, allowing you to streamline your document preparation process. These templates ensure you have the correct format and fields pre-filled, making it easier to collect signatures and complete your forms accurately.

-

Is airSlate SignNow secure for handling the 2021 form K1?

Absolutely, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling your 2021 form K1. Our platform utilizes advanced encryption methods and secure cloud storage to protect your sensitive tax documents and personal information throughout the eSigning process.

-

What integrations does airSlate SignNow offer for managing the 2021 form K1?

airSlate SignNow integrates with various apps and services that streamline the management of your 2021 form K1. Whether it's cloud storage platforms, CRMs, or accounting software, these integrations enhance your workflow and make accessing documents easier and more efficient.

-

Can multiple signers access the 2021 form K1 through airSlate SignNow?

Yes, airSlate SignNow allows multiple signers to access and eSign the 2021 form K1 simultaneously. This collaborative feature speeds up the signing process, ensuring that everyone involved can contribute quickly, making it an ideal solution for partnerships and groups.

Get more for Form 1065 Schedule K 1

Find out other Form 1065 Schedule K 1

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now