Ia 1120 Form

What is the IA 1120?

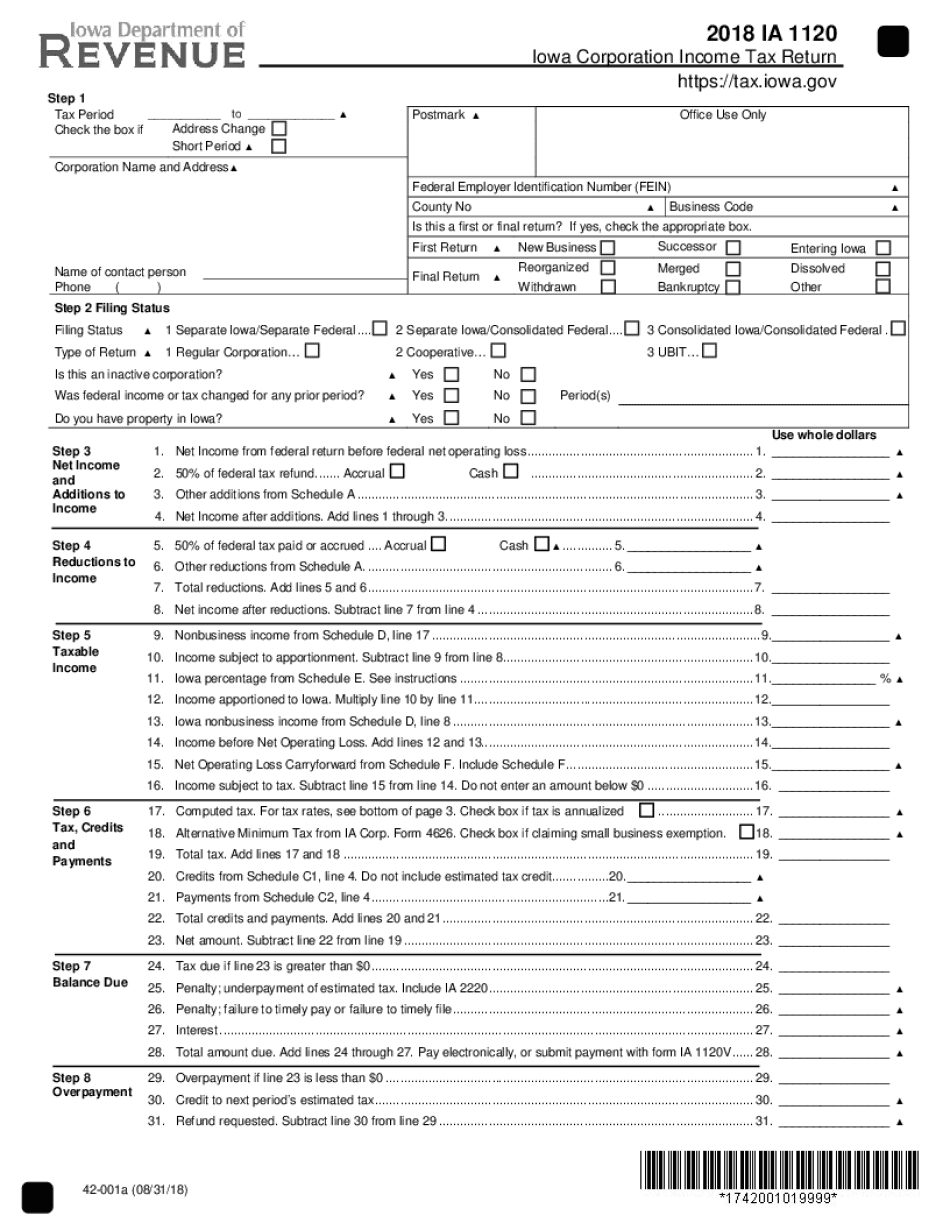

The IA 1120 is the Iowa Corporation Income Tax Return form, designed for corporations operating within the state of Iowa. This form is essential for reporting income, calculating tax liabilities, and ensuring compliance with state tax regulations. Corporations must accurately complete the IA 1120 to reflect their financial activities for the tax year, including revenue, deductions, and credits. Proper filing is crucial to avoid penalties and ensure the corporation meets its tax obligations.

Steps to Complete the IA 1120

Completing the IA 1120 involves several key steps:

- Gather necessary financial documents, including income statements, balance sheets, and any relevant tax documents.

- Fill out the IA 1120 form, ensuring all sections are completed accurately, including income, deductions, and tax credits.

- Calculate the total tax liability based on the information provided.

- Review the completed form for accuracy and completeness before submission.

Following these steps helps ensure that the IA 1120 is filed correctly, minimizing the risk of errors or omissions.

Legal Use of the IA 1120

The IA 1120 serves as a legally binding document when filed with the Iowa Department of Revenue. To ensure its legal standing, corporations must comply with all relevant state tax laws and regulations. The form must be signed by an authorized representative of the corporation, affirming that the information provided is true and accurate to the best of their knowledge. Failure to comply with legal requirements can result in penalties or audits.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the IA 1120. The standard due date for the IA 1120 is typically the first day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due on April 1. Extensions may be available, but it is crucial to file for an extension before the original deadline to avoid late fees.

Required Documents

To complete the IA 1120, corporations need to gather several key documents:

- Financial statements, including income statements and balance sheets.

- Documentation of any deductions or credits claimed.

- Previous year’s tax return, if applicable, for reference.

- Any supporting schedules or forms required by the Iowa Department of Revenue.

Having these documents ready will streamline the filing process and help ensure accuracy.

Form Submission Methods

Corporations can submit the IA 1120 through various methods:

- Online submission via the Iowa Department of Revenue's e-filing system.

- Mailing a paper copy of the completed form to the appropriate address.

- In-person submission at designated Iowa Department of Revenue offices.

Each method has its own processing times and requirements, so corporations should choose the option that best suits their needs.

Quick guide on how to complete ia 1120

Easily Create Ia 1120 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents quickly and without delays. Manage Ia 1120 on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

Edit and Electronically Sign Ia 1120 Effortlessly

- Obtain Ia 1120 and click on Get Form to begin.

- Use the tools available to fill out your form.

- Emphasize important parts of your documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, monotonous form searches, or errors that necessitate printing additional document copies. airSlate SignNow caters to your document management needs with just a few clicks from any device you choose. Modify and electronically sign Ia 1120 and ensure excellent communication throughout any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ia 1120

The way to create an electronic signature for a PDF document online

The way to create an electronic signature for a PDF document in Google Chrome

How to generate an e-signature for signing PDFs in Gmail

The best way to make an e-signature from your smart phone

The best way to create an e-signature for a PDF document on iOS

The best way to make an e-signature for a PDF file on Android OS

People also ask

-

What is the IA 1120 form and why is it important?

The IA 1120 form is used for corporate income tax filings in Iowa. It's essential for ensuring compliance with state tax laws, and accurately completing this form can prevent costly penalties. Businesses must understand how to effectively use the IA 1120 to report their income and tax obligations.

-

How can airSlate SignNow help with the IA 1120 process?

airSlate SignNow streamlines the process of completing and submitting your IA 1120 form by providing an easy-to-use platform for eSigning and document management. By digitizing your paperwork, airSlate SignNow reduces the chances of errors and speeds up submission. This enhances efficiency for businesses when handling tax documentation.

-

What are the pricing options for using airSlate SignNow for my IA 1120 forms?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose from basic to premium options depending on your needs, making it a cost-effective solution for managing your IA 1120 forms. Each plan provides access to a range of features that simplify the signing and submission process.

-

Are there any features specifically designed for handling tax documents like the IA 1120?

Yes, airSlate SignNow includes features such as customizable templates and automated workflows tailored for tax documents, including the IA 1120. These tools help ensure that all necessary information is accurately captured and that the forms are completed efficiently. Additionally, secure storage options help you maintain compliance with record-keeping requirements.

-

Is it easy to integrate airSlate SignNow with other financial software for my IA 1120 needs?

Absolutely! airSlate SignNow can be integrated with various accounting and financial software, making it easier to manage your IA 1120 forms alongside other financial documents. This integration allows for seamless data transfer, reducing administrative burdens and enhancing the overall efficiency of your tax preparation process.

-

Can I use airSlate SignNow to collaborate with my team on the IA 1120 form?

Yes, airSlate SignNow supports team collaboration, allowing multiple users to work on the IA 1120 form simultaneously. This feature helps streamline communication and ensures that all input is captured in real-time, making it easier to finalize your tax filings efficiently. Effective collaboration is crucial for accurate submissions.

-

What benefits do I get by using airSlate SignNow for my IA 1120 filings?

Using airSlate SignNow for your IA 1120 filings offers several benefits, including improved accuracy, faster turnaround times, and a more efficient signing process. By reducing the need for physical documents, you save time and resources, allowing your team to focus on other essential business operations. Plus, the user-friendly interface ensures a smooth experience.

Get more for Ia 1120

- Warranty deed husband and wife to two individuals alabama form

- Alabama ucc1 financing statement alabama form

- Alabama ucc1 financing statement addendum alabama form

- Alabama ucc3 financing statement amendment alabama form

- Alabama ucc3 financing statement amendment addendum alabama form

- Legal last will and testament form for single person with no children alabama

- Legal last will and testament form for a single person with minor children alabama

- Legal last will and testament form for single person with adult and minor children alabama

Find out other Ia 1120

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed

- Electronic signature Washington Toll Manufacturing Agreement Simple

- Can I Electronic signature Delaware Quitclaim Deed

- Electronic signature Iowa Quitclaim Deed Easy

- Electronic signature Kentucky Quitclaim Deed Safe

- Electronic signature Maine Quitclaim Deed Easy

- How Can I Electronic signature Montana Quitclaim Deed