4797 Form Sales of Business Property OMB No Chegg Com

Understanding the 2021 Form 4797

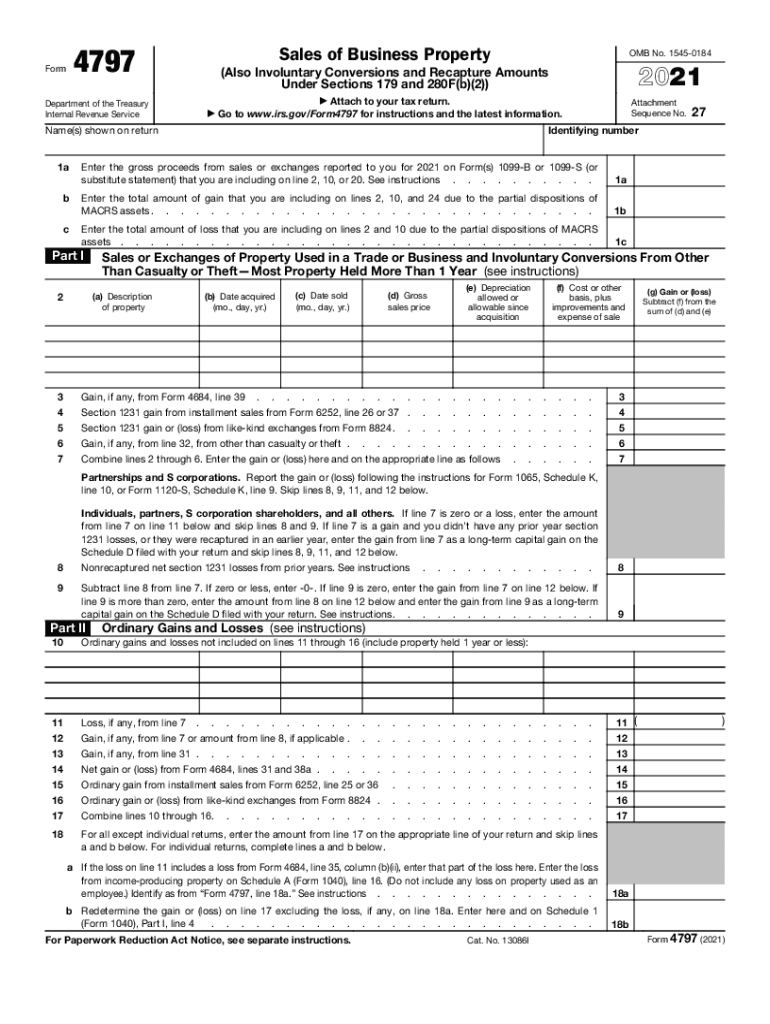

The 2021 Form 4797, officially known as the Sales of Business Property, is a crucial document for reporting the sale or exchange of business property. This form is primarily used by businesses and individuals who have disposed of assets used in a trade or business. It helps taxpayers report gains or losses from these transactions, ensuring accurate tax calculations. The form covers various types of property, including real estate, machinery, and equipment.

Steps to Complete the 2021 Form 4797

Completing the 2021 Form 4797 requires careful attention to detail. Here are the essential steps:

- Gather necessary information: Collect details about the property sold, including purchase date, sale date, and the amount received.

- Determine property classification: Identify whether the property is Section 1231, ordinary income, or other types of property.

- Calculate gain or loss: Use the appropriate calculations to determine the gain or loss on the sale of the property.

- Fill out the form: Enter the information accurately in the designated sections of the form.

- Review for accuracy: Double-check all entries to ensure compliance with IRS guidelines.

Legal Use of the 2021 Form 4797

The 2021 Form 4797 must be completed and submitted in compliance with IRS regulations. It serves as a legal document that reports the financial transactions related to business property sales. Proper use of this form helps in maintaining transparency and accuracy in tax reporting. Failing to file the form correctly can lead to penalties and interest on unpaid taxes.

Filing Deadlines for the 2021 Form 4797

Timely filing of the 2021 Form 4797 is essential to avoid penalties. Generally, the form is due on the same date as your tax return. For most taxpayers, this means April 15 of the following year. However, if you file for an extension, ensure that the form is submitted by the extended deadline. Keeping track of these dates is crucial for compliance.

Examples of Using the 2021 Form 4797

Several scenarios may require the use of the 2021 Form 4797. For instance:

- A business sells a commercial property that has appreciated in value.

- A sole proprietor disposes of old equipment used in their business.

- A partnership sells a piece of real estate owned by the business.

Each of these examples illustrates the form's application in reporting gains or losses associated with business property transactions.

IRS Guidelines for the 2021 Form 4797

The IRS provides specific guidelines for completing the 2021 Form 4797. Taxpayers must adhere to these instructions to ensure accurate reporting. The guidelines cover topics such as property classifications, how to report gains or losses, and the necessary documentation required to support the entries made on the form. Familiarizing oneself with these guidelines can help prevent errors and facilitate smoother tax filing.

Quick guide on how to complete 4797 form sales of business property omb nocheggcom

Complete 4797 Form Sales Of Business Property OMB No Chegg com effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the essential tools required to create, modify, and eSign your documents rapidly without any hindrances. Manage 4797 Form Sales Of Business Property OMB No Chegg com on any device using airSlate SignNow's Android or iOS applications and streamline any document-based process today.

The easiest way to modify and eSign 4797 Form Sales Of Business Property OMB No Chegg com without stress

- Find 4797 Form Sales Of Business Property OMB No Chegg com and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant parts of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and eSign 4797 Form Sales Of Business Property OMB No Chegg com while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 4797 form sales of business property omb nocheggcom

The way to create an electronic signature for your PDF document in the online mode

The way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What is the 2021 form 4797, and why is it important?

The 2021 form 4797 is used to report the sale or exchange of business property. It is crucial for taxpayers to accurately report these transactions to ensure proper tax calculations and compliance with IRS regulations.

-

How can airSlate SignNow help with the 2021 form 4797?

airSlate SignNow allows you to easily prepare, send, and eSign the 2021 form 4797. Our user-friendly platform streamlines the process, ensuring your documents are handled securely and efficiently.

-

What features does airSlate SignNow offer for submitting the 2021 form 4797?

airSlate SignNow offers features like document templates, electronic signatures, and secure cloud storage specifically for forms like the 2021 form 4797. You can customize the document and track its status in real-time.

-

Is there a cost associated with using airSlate SignNow for the 2021 form 4797?

Yes, airSlate SignNow has affordable pricing plans that cater to different business needs. These plans often include unlimited document signing and storage options, making it cost-effective for handling the 2021 form 4797 and other documents.

-

Can I integrate airSlate SignNow with other software for managing the 2021 form 4797?

Absolutely! airSlate SignNow integrates seamlessly with various software tools, allowing you to manage the 2021 form 4797 alongside your existing applications. This feature enhances productivity by streamlining workflows.

-

What are the benefits of using airSlate SignNow for the 2021 form 4797?

Using airSlate SignNow for the 2021 form 4797 provides signNow benefits such as increased efficiency, secure electronic signatures, and easy access from any device. This helps businesses save time and reduce paperwork.

-

How secure is airSlate SignNow when dealing with sensitive documents like the 2021 form 4797?

airSlate SignNow prioritizes your security, employing robust encryption and compliance with industry standards. This ensures that your sensitive data on the 2021 form 4797 remains protected throughout the signing process.

Get more for 4797 Form Sales Of Business Property OMB No Chegg com

- Letter from tenant to landlord about insufficient notice of rent increase georgia form

- Notice rent increase form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase georgia form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant georgia form

- Letter from tenant to landlord containing notice to landlord to withdraw retaliatory rent increase georgia form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory decrease in services georgia form

- Temporary lease agreement to prospective buyer of residence prior to closing georgia form

- Retaliatory eviction georgia form

Find out other 4797 Form Sales Of Business Property OMB No Chegg com

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy