Www Irs Govpubirs Pdf2021 Instructions for Form 2441 Internal Revenue Service

Understanding the 2021 Instructions for Form 2441

The 2021 Instructions for Form 2441 provide essential guidance for taxpayers claiming the Child and Dependent Care Expenses Credit. This form is primarily used to report expenses incurred for the care of qualifying individuals, allowing for potential tax credits that can significantly reduce tax liability. Understanding the form's requirements and instructions is crucial for accurate filing and maximizing potential benefits.

Steps to Complete the 2021 Instructions for Form 2441

Completing the 2021 Instructions for Form 2441 involves several key steps:

- Gather necessary documentation, including receipts for care expenses and Social Security numbers for qualifying individuals.

- Review the eligibility criteria to ensure that the care expenses qualify for the credit.

- Fill out the form accurately, ensuring all required fields are completed, including the total amount of qualifying expenses.

- Double-check calculations and ensure that all information is consistent with supporting documents.

- Submit the completed form along with your federal tax return, either electronically or via mail.

Key Elements of the 2021 Instructions for Form 2441

Several key elements are outlined in the 2021 Instructions for Form 2441 that taxpayers should pay close attention to:

- Qualifying Individuals: This includes children under the age of thirteen and other dependents who are unable to care for themselves.

- Eligible Expenses: The instructions specify what types of care expenses qualify, such as daycare, babysitting, and certain educational expenses.

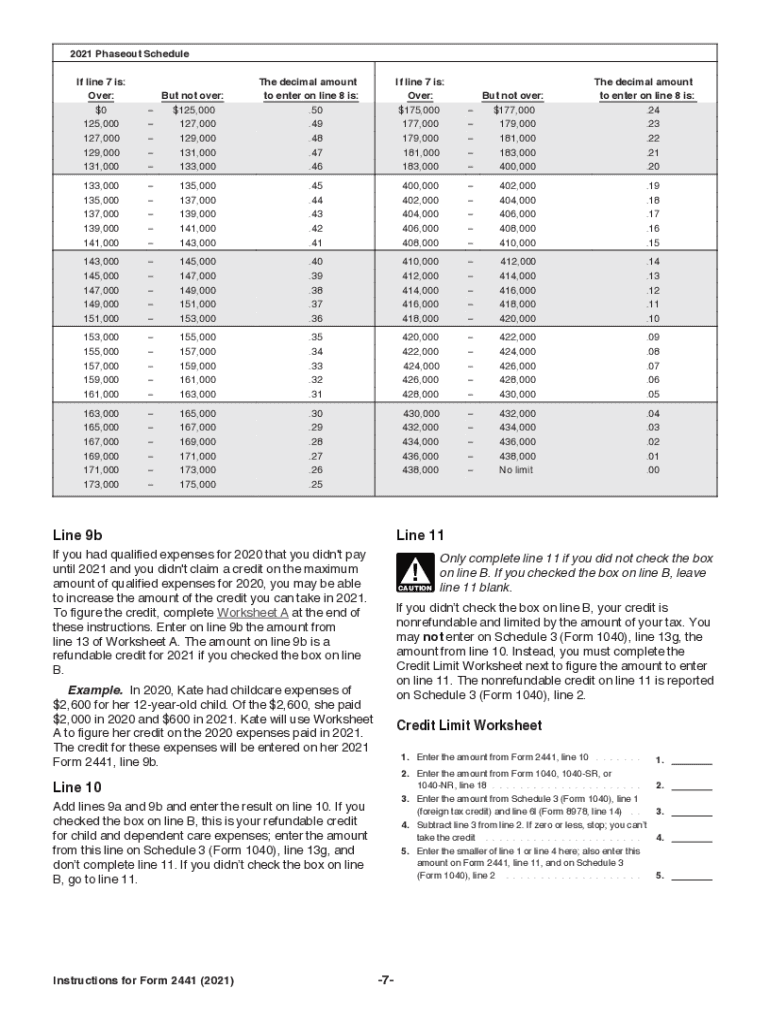

- Income Limits: There are income thresholds that may affect the amount of credit you can claim.

- Filing Requirements: Understanding whether you need to file Form 2441 based on your tax situation is crucial.

Legal Use of the 2021 Instructions for Form 2441

The legal use of the 2021 Instructions for Form 2441 ensures compliance with IRS regulations. Taxpayers must accurately report their expenses and adhere to the guidelines set forth in the instructions to avoid penalties. Misreporting or failing to meet eligibility criteria can lead to disallowance of the credit and potential audits. Therefore, using the instructions as a roadmap for compliance is essential.

Filing Deadlines for Form 2441

Filing deadlines for Form 2441 align with the general tax filing deadlines. Typically, the deadline for submitting your federal tax return, including Form 2441, is April fifteenth of the year following the tax year. However, if you file for an extension, you may have additional time. It is important to remain aware of these deadlines to avoid late fees and penalties.

Eligibility Criteria for Claiming the Child and Dependent Care Credit

To claim the Child and Dependent Care Credit using the 2021 Instructions for Form 2441, taxpayers must meet specific eligibility criteria:

- The taxpayer must have earned income during the year.

- Care expenses must be incurred for a qualifying individual.

- The care must enable the taxpayer to work or look for work.

- Taxpayers must provide the care provider's information, including their name and Tax Identification Number.

Quick guide on how to complete wwwirsgovpubirs pdf2021 instructions for form 2441 internal revenue service

Prepare Www irs govpubirs pdf2021 Instructions For Form 2441 Internal Revenue Service effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as a superb eco-friendly alternative to traditional printed and signed papers, allowing you to locate the proper template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Www irs govpubirs pdf2021 Instructions For Form 2441 Internal Revenue Service on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Www irs govpubirs pdf2021 Instructions For Form 2441 Internal Revenue Service effortlessly

- Obtain Www irs govpubirs pdf2021 Instructions For Form 2441 Internal Revenue Service and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of your files or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your amendments.

- Select how you wish to deliver your document, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Www irs govpubirs pdf2021 Instructions For Form 2441 Internal Revenue Service and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovpubirs pdf2021 instructions for form 2441 internal revenue service

The way to create an electronic signature for your PDF file in the online mode

The way to create an electronic signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What are the 2441 2021 instructions for using airSlate SignNow?

The 2441 2021 instructions provide guidance on how to effectively use airSlate SignNow for eSigning and document management. These instructions detail the essential steps for uploading documents, adding signatures, and sending them to recipients. Following the 2441 2021 instructions ensures you utilize all features efficiently, enhancing your signing experience.

-

How much does airSlate SignNow cost in relation to the 2441 2021 instructions?

Pricing for airSlate SignNow varies based on the plan you choose, but it's designed to be cost-effective. While specific costs are not detailed in the 2441 2021 instructions, you can find a breakdown of Pricing options on our website. This transparency helps you select the best plan suitable for your business needs.

-

What features are highlighted in the 2441 2021 instructions for airSlate SignNow?

The 2441 2021 instructions highlight key features such as document templates, real-time tracking, and customizable workflows. These features help streamline the signing process, making it faster and more efficient. With airSlate SignNow, you'll find these features outlined clearly to maximize your document management.

-

What benefits can I expect following the 2441 2021 instructions?

By adhering to the 2441 2021 instructions, you can expect enhanced productivity and a smoother eSigning experience. The instructions emphasize best practices, which help minimize errors and ensure document compliance. Ultimately, implementing these instructions can lead to faster contract turnarounds and improved client satisfaction.

-

Are there integrations available as mentioned in the 2441 2021 instructions?

Yes, the 2441 2021 instructions detail various integrations that airSlate SignNow supports, including popular software platforms like Salesforce and Google Drive. These integrations allow you to streamline your workflow further and connect your signing processes with existing tools. This ensures you can work more efficiently by keeping everything in one ecosystem.

-

How do I navigate the interface using the 2441 2021 instructions?

The 2441 2021 instructions include a user-friendly guide to navigating the airSlate SignNow interface. This section includes step-by-step illustrations, making it easier for you to familiarize yourself with the dashboard and tools. Quick tips within these instructions help you find what you need without hassle.

-

Can I find support for queries related to the 2441 2021 instructions?

Absolutely! If you have further questions about the 2441 2021 instructions, our support team is readily available to assist you. You can signNow out through multiple channels, and our dedicated experts will help clarify any doubts you may have regarding airSlate SignNow. Customer satisfaction is a top priority for us.

Get more for Www irs govpubirs pdf2021 Instructions For Form 2441 Internal Revenue Service

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant idaho form

- Idaho tenant landlord 497305532 form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory decrease in services idaho form

- Temporary lease agreement to prospective buyer of residence prior to closing idaho form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction idaho form

- Letter from landlord to tenant returning security deposit less deductions idaho form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return idaho form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return idaho form

Find out other Www irs govpubirs pdf2021 Instructions For Form 2441 Internal Revenue Service

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed