F1041sd PDF SCHEDULE DForm 1041 Department of the

What is the 2021 Form 1041 Schedule D?

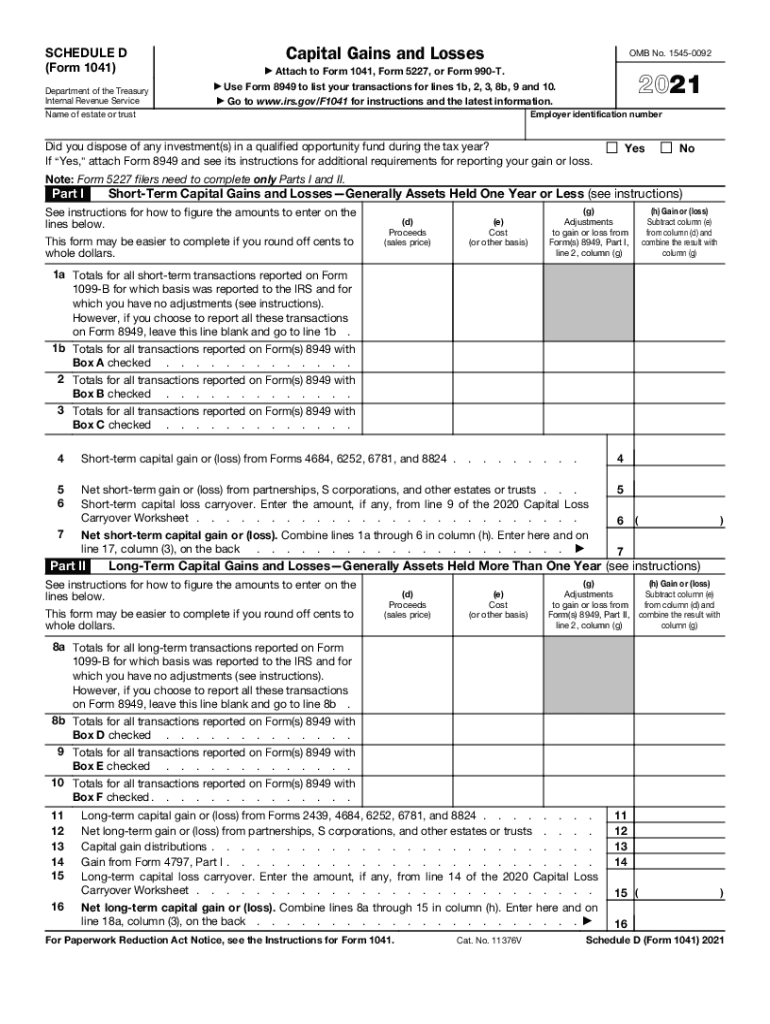

The 2021 Form 1041 Schedule D is a tax form used by estates and trusts to report capital gains and losses. This form is essential for calculating the overall tax liability of the estate or trust. It allows the fiduciary to report the sale or exchange of capital assets, ensuring that any gains or losses are accurately reflected in the overall tax return. Understanding how to properly fill out this form is crucial for compliance with IRS regulations.

Steps to Complete the 2021 Form 1041 Schedule D

Completing the 2021 Form 1041 Schedule D involves several key steps:

- Gather all relevant financial documents, including records of asset sales and purchases.

- Calculate the total capital gains and losses for the tax year, ensuring to include both short-term and long-term transactions.

- Fill out the form by entering the necessary information in the appropriate sections, including details about each asset sold.

- Transfer the totals to the main Form 1041, ensuring that all calculations are accurate.

- Review the completed form for any errors before submission.

IRS Guidelines for the 2021 Form 1041 Schedule D

The IRS provides specific guidelines for completing the 2021 Form 1041 Schedule D. These guidelines include instructions on how to report various types of capital gains and losses, as well as the importance of maintaining accurate records. Taxpayers must adhere to these guidelines to avoid penalties and ensure compliance with federal tax laws. It is advisable to consult the IRS instructions for detailed information on eligibility and reporting requirements.

Filing Deadlines for the 2021 Form 1041 Schedule D

The filing deadline for the 2021 Form 1041 Schedule D coincides with the due date for Form 1041, which is typically the 15th day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year, this means the form is due by April 15, 2022. If additional time is needed, a six-month extension can be requested, but it is important to ensure that any taxes owed are paid by the original deadline to avoid interest and penalties.

Legal Use of the 2021 Form 1041 Schedule D

The legal use of the 2021 Form 1041 Schedule D is governed by IRS regulations. This form must be completed accurately to ensure that all capital gains and losses are reported correctly. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes. It is essential for fiduciaries to understand their legal responsibilities when filing this form to protect against potential legal issues.

Examples of Using the 2021 Form 1041 Schedule D

Examples of using the 2021 Form 1041 Schedule D include reporting gains from the sale of stocks, bonds, or real estate held by the estate or trust. For instance, if an estate sells a property for a profit, the fiduciary must report the gain on Schedule D, detailing the purchase price, sale price, and any associated costs. Additionally, if there are losses from other asset sales, these can be reported to offset gains, potentially reducing the overall tax liability.

Quick guide on how to complete f1041sdpdf schedule dform 1041 department of the

Effortlessly Prepare F1041sd pdf SCHEDULE DForm 1041 Department Of The on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage F1041sd pdf SCHEDULE DForm 1041 Department Of The on any device with airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

Effortlessly Edit and Electronically Sign F1041sd pdf SCHEDULE DForm 1041 Department Of The

- Locate F1041sd pdf SCHEDULE DForm 1041 Department Of The and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign F1041sd pdf SCHEDULE DForm 1041 Department Of The to ensure excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f1041sdpdf schedule dform 1041 department of the

The way to create an electronic signature for your PDF document online

The way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the 2021 Schedule D and why is it important?

The 2021 Schedule D is a crucial tax form used to report capital gains and losses to the IRS. It helps taxpayers calculate their tax liabilities based on various asset transactions. Proper completion of the 2021 Schedule D is essential for accurate tax filing and avoiding penalties.

-

How can airSlate SignNow help with the 2021 Schedule D filing?

airSlate SignNow allows users to easily eSign and send documents related to their 2021 Schedule D filings. With our user-friendly interface, you can quickly prepare and manage your tax documents, ensuring compliance and accuracy. Our platform streamlines the process, saving you time and effort.

-

What are the pricing options for using airSlate SignNow for the 2021 Schedule D?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs, ensuring easy access to eSigning for your 2021 Schedule D. Our pricing is scalable, allowing you to choose a plan that fits your budget and frequency of use. You'll also benefit from transparent costs with no hidden fees.

-

Are there any specific features of airSlate SignNow that support the 2021 Schedule D?

Yes, airSlate SignNow provides robust features to facilitate the completion of the 2021 Schedule D. Our document templates, real-time collaboration tools, and secure eSigning capabilities streamline your filing process. You can also track document status and receive notifications to stay updated on your forms.

-

Is airSlate SignNow compliant with regulations for submitting the 2021 Schedule D?

Absolutely! airSlate SignNow complies with all necessary regulations for electronic signatures, ensuring that your 2021 Schedule D submissions meet IRS requirements. Our platform uses advanced security measures to protect your sensitive information while ensuring legal conformity.

-

What integrations does airSlate SignNow offer for managing the 2021 Schedule D?

airSlate SignNow integrates seamlessly with popular accounting and tax software, streamlining the management of your 2021 Schedule D. This integration allows you to import data directly into your documents, reducing the risk of errors. With our extensive API, you can also customize workflows to suit your business needs.

-

Can airSlate SignNow assist businesses with bulk signing for the 2021 Schedule D?

Yes, airSlate SignNow offers bulk signing features that are particularly useful for businesses managing multiple 2021 Schedule D forms. This functionality allows multiple users to eSign documents at once, enhancing efficiency and productivity. It's an ideal solution for organizations needing to process numerous tax documents quickly.

Get more for F1041sd pdf SCHEDULE DForm 1041 Department Of The

- Letter from tenant to landlord containing request for permission to sublease idaho form

- Idaho landlord form

- Letter from landlord to tenant that sublease granted rent paid by subtenant old tenant released from liability for rent idaho form

- Idaho letter landlord form

- Letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration idaho form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497305544 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement idaho form

- Letter from tenant to landlord about insufficient notice of change in rental agreement for other than rent increase idaho form

Find out other F1041sd pdf SCHEDULE DForm 1041 Department Of The

- How To eSign New Hampshire Church Donation Giving Form

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later