Form 13614 NR Rev 10 Nonresident Alien Intake and Interview Sheet

What is the Form 13614 NR Rev 10 Nonresident Alien Intake and Interview Sheet

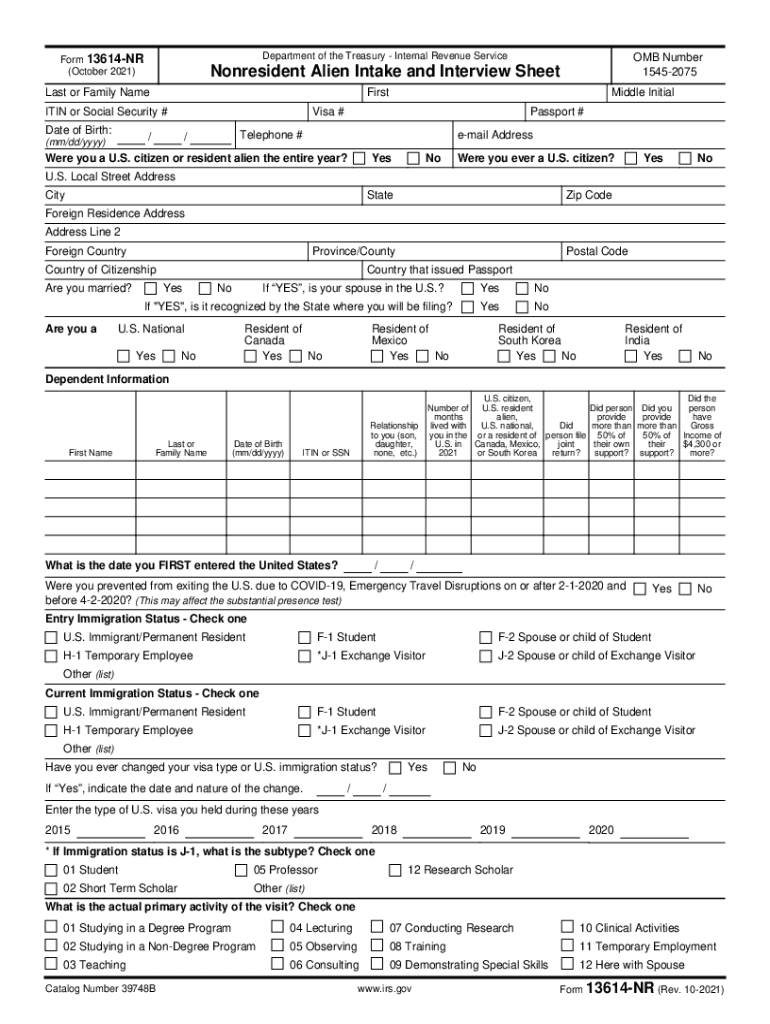

The Form 13614 NR Rev 10 is a crucial document used by the IRS to gather information from nonresident aliens during the tax preparation process. This intake and interview sheet is designed to help tax preparers collect essential details about the taxpayer's residency status, income sources, and applicable deductions. Understanding this form is vital for ensuring compliance with U.S. tax laws and for accurately filing tax returns for individuals who do not meet the criteria for resident alien status.

How to use the Form 13614 NR Rev 10 Nonresident Alien Intake and Interview Sheet

Using the Form 13614 NR involves several steps to ensure that all necessary information is accurately captured. First, the taxpayer should complete the form by providing personal details such as name, address, and Social Security number or Individual Taxpayer Identification Number. Next, it is important to disclose income sources, including wages, interest, and dividends. Tax preparers should review the completed form with the taxpayer to clarify any uncertainties and ensure all relevant information is included. This collaborative approach helps in preparing a comprehensive tax return.

Steps to complete the Form 13614 NR Rev 10 Nonresident Alien Intake and Interview Sheet

Completing the Form 13614 NR requires careful attention to detail. Follow these steps:

- Begin with personal identification information, including name and contact details.

- Provide your residency status and the type of visa, if applicable.

- List all sources of income earned in the U.S. and abroad.

- Identify any deductions or credits you may qualify for.

- Review the form with a tax preparer to ensure accuracy before submission.

Legal use of the Form 13614 NR Rev 10 Nonresident Alien Intake and Interview Sheet

The legal use of the Form 13614 NR is governed by IRS regulations, which require accurate reporting of income and tax obligations for nonresident aliens. This form serves as a foundational document that supports compliance with U.S. tax laws. When completed correctly, it aids in determining the taxpayer's filing requirements and eligibility for various deductions. It is essential to understand that any inaccuracies may lead to penalties or delays in processing tax returns.

Required Documents

To complete the Form 13614 NR, certain documents are necessary. These include:

- Passport or visa to verify residency status.

- Social Security number or Individual Taxpayer Identification Number.

- Documentation of income sources, such as W-2 forms or 1099s.

- Records of any deductions or credits claimed.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the Form 13614 NR. Taxpayers should refer to the IRS website or consult a tax professional to ensure compliance with current tax laws. These guidelines include instructions on how to report income accurately and what documentation is required to support claims made on the form. Adhering to these guidelines is crucial for a smooth tax filing experience.

Quick guide on how to complete form 13614 nr rev 10 2021 nonresident alien intake and interview sheet

Handle Form 13614 NR Rev 10 Nonresident Alien Intake And Interview Sheet seamlessly on any gadget

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-conscious alternative to conventional printed and physically signed paperwork, as you can obtain the correct version and securely keep it online. airSlate SignNow equips you with all the necessary resources to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage Form 13614 NR Rev 10 Nonresident Alien Intake And Interview Sheet on any gadget using airSlate SignNow’s Android or iOS applications and enhance any document-focused workflow today.

How to modify and electronically sign Form 13614 NR Rev 10 Nonresident Alien Intake And Interview Sheet effortlessly

- Locate Form 13614 NR Rev 10 Nonresident Alien Intake And Interview Sheet and click on Get Form to begin.

- Utilize the resources we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as an ink signature.

- Review all details and click on the Done button to preserve your changes.

- Choose how you want to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced papers, tiring form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Form 13614 NR Rev 10 Nonresident Alien Intake And Interview Sheet and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 13614 nr rev 10 2021 nonresident alien intake and interview sheet

The way to create an e-signature for a PDF document in the online mode

The way to create an e-signature for a PDF document in Chrome

The best way to generate an e-signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The best way to generate an e-signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the 13614 template used for?

The 13614 template is designed for organizations to streamline the process of document signing and management. It provides a structured format to gather necessary information efficiently, ensuring that all required fields are completed accurately. By using the 13614 template, businesses can minimize errors and enhance the overall signing experience.

-

How can I access the 13614 template?

You can access the 13614 template directly through the airSlate SignNow platform. Once you log in, navigate to the template library where you'll find the 13614 template among other pre-built templates. This makes it easy for users to quickly utilize and customize the document to meet their specific needs.

-

Is the 13614 template customizable?

Yes, the 13614 template is fully customizable within airSlate SignNow. Users can edit fields, add their branding, and adjust settings to align with their specific business requirements. This flexibility ensures that the 13614 template can serve a wide range of industries and use cases.

-

What are the pricing options for using the 13614 template?

Pricing for utilizing the 13614 template is included in the airSlate SignNow subscription plans. These plans vary based on features and the number of users, ensuring that businesses can choose the option that best fits their budget. Consider the potential time and cost savings that using the 13614 template can provide as part of your decision.

-

Does the 13614 template integrate with other software?

Absolutely, the 13614 template can seamlessly integrate with various business applications and systems. airSlate SignNow supports integrations with popular CRMs, document management systems, and more. This functionality enhances the utility of the 13614 template, allowing for a more connected workflow.

-

What are the main benefits of using the 13614 template?

Using the 13614 template offers numerous benefits, including faster document turnaround times and reduced paperwork. The template simplifies the signing process, enabling teams to focus on core tasks rather than getting bogged down in manual processes. Furthermore, it helps maintain compliance by ensuring that all essential information is included.

-

Is the 13614 template suitable for all business sizes?

Yes, the 13614 template is designed to be suitable for businesses of all sizes. Whether you're a small startup or a large corporation, the template can be adapted to fit your diverse needs. Its simplicity and effectiveness make it a valuable tool for any organization looking to improve their document signing process.

Get more for Form 13614 NR Rev 10 Nonresident Alien Intake And Interview Sheet

- Commercial rental lease application questionnaire idaho form

- Apartment lease rental application questionnaire idaho form

- Residential rental lease application idaho form

- Salary verification form for potential lease idaho

- Landlord agreement to allow tenant alterations to premises idaho form

- Notice of default on residential lease idaho form

- Landlord tenant lease co signer agreement idaho form

- Application for sublease idaho form

Find out other Form 13614 NR Rev 10 Nonresident Alien Intake And Interview Sheet

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed