221 UNDERPAYMENT of ESTIMATED UNINCORPORATED BUSINESS TAX Form

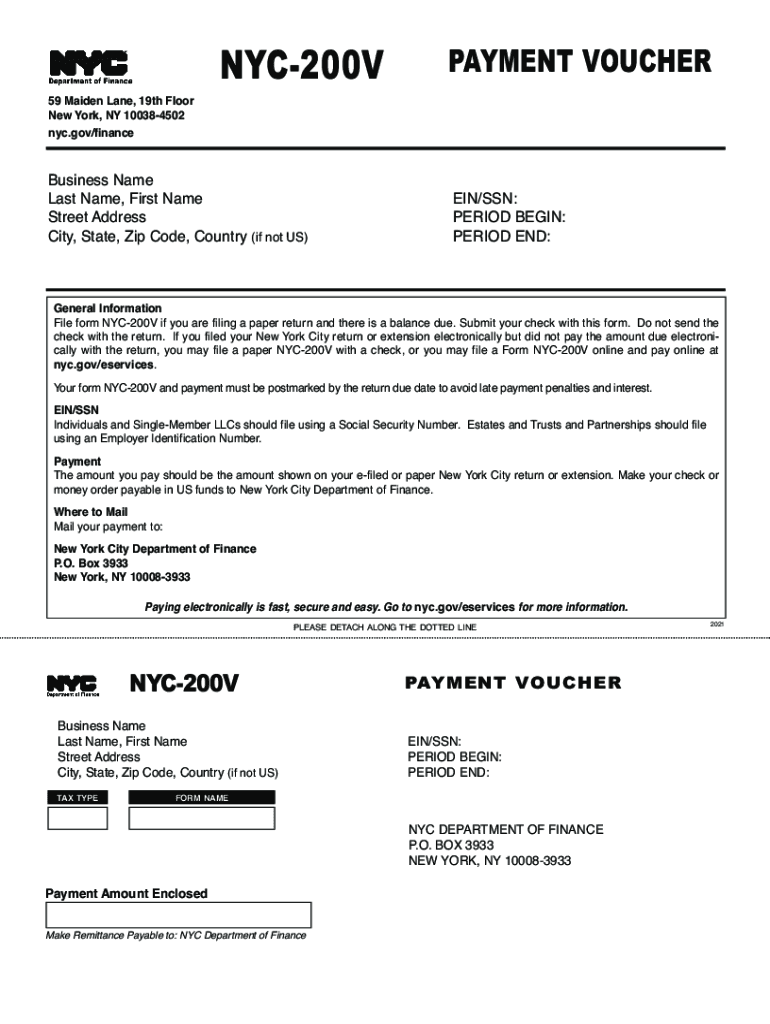

Understanding the NYC 200V Form

The NYC 200V form is a crucial document for individuals and businesses in New York City who need to report underpayment of estimated unincorporated business tax. This form is specifically designed for those who have not met their estimated tax payment obligations. Understanding its purpose and requirements is essential to ensure compliance with local tax laws.

Steps to Complete the NYC 200V Form

Completing the NYC 200V form involves several key steps:

- Gather necessary financial documents, including previous tax returns and income statements.

- Calculate your estimated tax liability based on your income and applicable tax rates.

- Fill out the form accurately, ensuring all required information is provided.

- Double-check your calculations to avoid errors that could lead to penalties.

- Submit the completed form by the specified deadline to avoid late fees.

Legal Use of the NYC 200V Form

The NYC 200V form is legally binding and must be filled out in accordance with New York City tax regulations. It is important to ensure that all information provided is truthful and complete. Failure to comply with the legal requirements surrounding this form can result in penalties or legal action from tax authorities.

Filing Deadlines for the NYC 200V Form

Timely submission of the NYC 200V form is critical. The filing deadlines are typically aligned with the estimated tax payment schedule. It is advisable to check the official NYC Department of Finance website for the most current deadlines to ensure compliance and avoid any penalties for late submission.

Required Documents for the NYC 200V Form

When preparing to complete the NYC 200V form, gather the following documents:

- Previous year’s tax returns.

- Income statements and receipts.

- Documentation of any deductions or credits you plan to claim.

Having these documents ready will streamline the completion process and help ensure accuracy.

Penalties for Non-Compliance with the NYC 200V Form

Failing to file the NYC 200V form or submitting it late can lead to significant penalties. These may include fines based on the amount of tax owed, interest on unpaid taxes, and potential legal action. It is important to adhere to all filing requirements to avoid these consequences.

Quick guide on how to complete 221 underpayment of estimated unincorporated business tax

Effortlessly Prepare 221 UNDERPAYMENT OF ESTIMATED UNINCORPORATED BUSINESS TAX on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to obtain the right format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage 221 UNDERPAYMENT OF ESTIMATED UNINCORPORATED BUSINESS TAX across any platform with the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The Easiest Method to Alter and eSign 221 UNDERPAYMENT OF ESTIMATED UNINCORPORATED BUSINESS TAX with Ease

- Find 221 UNDERPAYMENT OF ESTIMATED UNINCORPORATED BUSINESS TAX and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you would like to share your document, either via email, text (SMS), or via an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or errors requiring the printing of new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Modify and eSign 221 UNDERPAYMENT OF ESTIMATED UNINCORPORATED BUSINESS TAX to ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 221 underpayment of estimated unincorporated business tax

The best way to generate an e-signature for a PDF document online

The best way to generate an e-signature for a PDF document in Google Chrome

How to generate an e-signature for signing PDFs in Gmail

The best way to create an e-signature from your smart phone

How to create an e-signature for a PDF document on iOS

The best way to create an e-signature for a PDF file on Android OS

People also ask

-

What is the pricing structure for the NYC 200V plan?

The NYC 200V plan offers competitive pricing tailored for businesses looking to streamline their document management. Pricing varies based on user count and features, but it generally provides excellent value given its robust capabilities. For detailed pricing, visit our website or contact our sales team.

-

What features does the NYC 200V plan include?

The NYC 200V plan includes features such as customizable e-signature workflows, document templates, and real-time tracking. It also supports multiple file formats and integration with various productivity tools, making it an ideal choice for businesses. These features are designed to enhance productivity and ensure compliance with regulatory standards.

-

How does the NYC 200V improve my business processes?

With NYC 200V, businesses can automate their document signing processes, reducing the time spent on paperwork. This leads to faster turnaround times, allowing your team to focus on more strategic tasks. Overall, adopting this solution can enhance efficiency and improve customer satisfaction.

-

Can I integrate NYC 200V with other software tools?

Yes, the NYC 200V plan offers seamless integrations with various software applications such as CRM systems, cloud storage, and project management tools. This flexibility allows you to maintain your existing workflows while enhancing your document management capabilities. Integrating with your favorite tools is straightforward and requires minimal setup.

-

Is the NYC 200V plan suitable for small businesses?

Absolutely! The NYC 200V plan is designed to cater to businesses of all sizes, including small businesses. Its cost-effectiveness and scalability make it an attractive option for growing companies looking to streamline their document processes without breaking the bank.

-

What security features does the NYC 200V plan offer?

The NYC 200V plan prioritizes security with features like encryption, secure access, and audit trails. These measures ensure that your documents are protected from unauthorized access and compliance is maintained. Our platform is designed to safeguard sensitive information, providing peace of mind to users.

-

How do I get started with the NYC 200V plan?

Getting started with the NYC 200V plan is easy! You can sign up directly through our website or contact our sales team for assistance. Once registered, you'll gain access to all the features and resources you need to start streamlining your document management right away.

Get more for 221 UNDERPAYMENT OF ESTIMATED UNINCORPORATED BUSINESS TAX

- Settlement of community property louisiana form

- Judicial partition property form

- Petition for partition of community property with list of commercial property louisiana form

- Property partition form

- Louisiana motion compel form

- Motion to compel answers to interrogatories and plaintiffs request for production louisiana form

- Compilation of child support and alimony pendente lite due louisiana form

- Non marital cohabitation living together agreement louisiana form

Find out other 221 UNDERPAYMENT OF ESTIMATED UNINCORPORATED BUSINESS TAX

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free