Instructions for Form it 213 "Claim for Empire State Child

Understanding the IT 213 Instructions for Claiming Empire State Child Credit

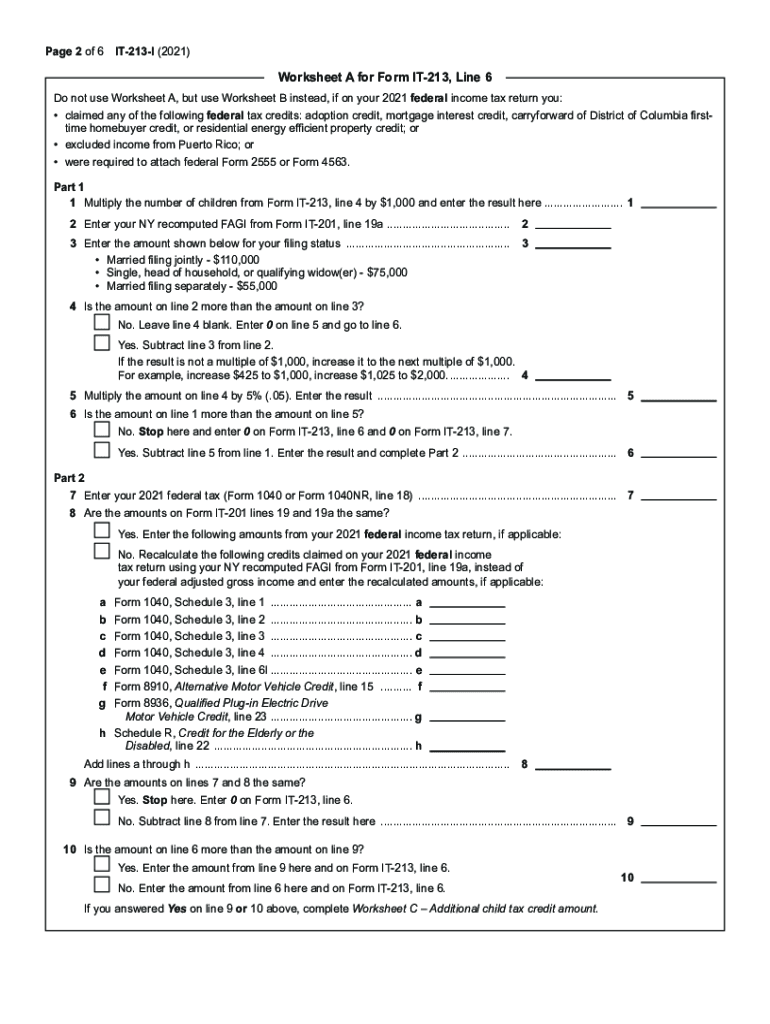

The IT 213 form, known as the Claim for Empire State Child Credit, is designed for residents of New York who wish to claim this tax credit for eligible children. The instructions for this form outline the eligibility criteria, necessary documentation, and the process for submission. It is essential for applicants to carefully review these instructions to ensure compliance with state regulations and to maximize their potential benefits.

Steps to Complete the IT 213 Claim Form

Completing the IT 213 form involves several key steps:

- Gather Required Information: Collect details such as your child's Social Security number, date of birth, and your income information.

- Fill Out the Form: Input the required information accurately in the designated fields of the IT 213 form.

- Review for Accuracy: Double-check all entries to avoid mistakes that could delay processing.

- Submit the Form: Choose your preferred submission method, whether online or by mail, and ensure it is sent before the deadline.

Eligibility Criteria for the IT 213 Credit

To qualify for the Empire State Child Credit through the IT 213 form, applicants must meet specific eligibility requirements:

- The child must be a qualifying child under the age of 17 at the end of the tax year.

- The applicant must have a valid New York State tax return filed for the year in question.

- Income limits may apply, so it's important to check the latest guidelines to ensure compliance.

Form Submission Methods for IT 213

There are multiple ways to submit the IT 213 form:

- Online Submission: Many taxpayers prefer to file electronically through the New York State Department of Taxation and Finance website.

- Mail Submission: Completed forms can be mailed to the designated address provided in the instructions.

- In-Person Submission: Some applicants may choose to deliver their forms in person at local tax offices.

Required Documents for IT 213 Submission

When filling out the IT 213 form, applicants must include certain documents to support their claim:

- Proof of Relationship: This may include birth certificates or adoption papers for the qualifying child.

- Income Documentation: W-2 forms or tax returns may be necessary to verify income eligibility.

- Identification: A valid driver's license or state ID may be required for verification purposes.

Filing Deadlines for IT 213

It is crucial to be aware of the filing deadlines associated with the IT 213 form:

- The form must typically be submitted by the tax filing deadline, which is usually April 15 of the following year.

- Extensions may be available, but it is advisable to check with the New York State Department of Taxation and Finance for specific details.

Quick guide on how to complete instructions for form it 213 ampquotclaim for empire state child

Manage Instructions For Form IT 213 "Claim For Empire State Child effortlessly on any device

Digital document organization has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without delays. Handle Instructions For Form IT 213 "Claim For Empire State Child on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Instructions For Form IT 213 "Claim For Empire State Child effortlessly

- Find Instructions For Form IT 213 "Claim For Empire State Child and click Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Identify key sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Instructions For Form IT 213 "Claim For Empire State Child to ensure excellent communication throughout every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 213 ampquotclaim for empire state child

The way to create an electronic signature for your PDF online

The way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to make an e-signature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The best way to make an e-signature for a PDF document on Android

People also ask

-

What is the 'new york it 213 state' and how does it relate to eSignature solutions?

The 'new york it 213 state' refers to specific regulations in New York that guide the use of electronic signatures. Understanding these regulations is crucial for businesses looking to comply with state laws while utilizing eSignature solutions like airSlate SignNow.

-

How does airSlate SignNow ensure compliance with the 'new york it 213 state' regulations?

airSlate SignNow is designed to comply with the 'new york it 213 state' regulations by providing features like secure audit trails and identity verification. This ensures that all electronic signatures collected through our platform are legally binding and meet state requirements.

-

What are the pricing options available for airSlate SignNow in relation to the 'new york it 213 state'?

Pricing for airSlate SignNow varies based on the features and number of users needed, but it is designed to be cost-effective for businesses in the 'new york it 213 state.' You can choose from several pricing tiers that align with your organization's needs.

-

What key features does airSlate SignNow offer that are beneficial for businesses in the 'new york it 213 state'?

Key features of airSlate SignNow include easy document editing, template creation, and advanced reporting tools. These features help streamline document workflow and ensure compliance with 'new york it 213 state' requirements, making it easier for businesses to manage their documents.

-

Can airSlate SignNow integrate with other software to support operations in the 'new york it 213 state'?

Yes, airSlate SignNow can integrate with various software applications, including CRM systems and cloud storage platforms. This flexibility allows businesses operating in the 'new york it 213 state' to create seamless workflows across their existing applications.

-

What benefits can businesses in the 'new york it 213 state' expect from using airSlate SignNow?

By using airSlate SignNow, businesses in the 'new york it 213 state' can enhance their document signing process, reduce turnaround times, and save on costs associated with paper-based workflows. The platform simplifies the entire signing experience for both businesses and their clients.

-

Is airSlate SignNow user-friendly for teams in the 'new york it 213 state'?

Absolutely, airSlate SignNow is designed for ease of use, ensuring that teams in the 'new york it 213 state' can adopt it quickly with minimal training. Its intuitive interface allows users to navigate the platform easily, making document management efficient.

Get more for Instructions For Form IT 213 "Claim For Empire State Child

- Louisiana expungement form

- Pretrial memorandum requesting change of custody and amendment of visitation louisiana form

- Pretrial memorandum regarding child support louisiana form

- Memorandum defendant form

- Letter to client advising of pretrial conference and trial schedules louisiana form

- Louisiana memorandum 497309002 form

- Motion to appoint form

- Motion and order for psychological evaluation louisiana 497309004 form

Find out other Instructions For Form IT 213 "Claim For Empire State Child

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later