CA Form 3885A Fill and Sign Printable Template

What is the California Form 3885A?

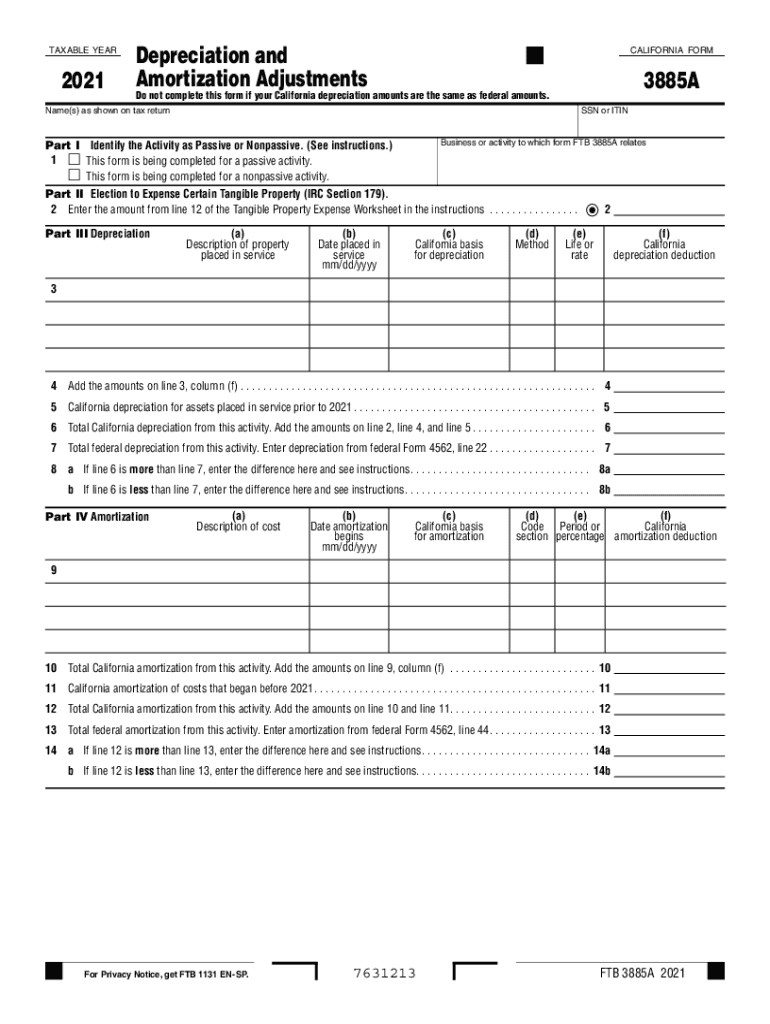

The California Form 3885A is a crucial document used for reporting depreciation adjustments for assets owned by businesses in California. This form is specifically designed for taxpayers to claim depreciation deductions on their state tax returns. It is essential for ensuring that businesses accurately reflect their asset values and related deductions, which ultimately impacts their overall tax liability. Understanding the purpose and requirements of the California 3885A is vital for compliance and effective tax planning.

Key Elements of the California Form 3885A

The California Form 3885A includes several important sections that taxpayers must complete to accurately report their depreciation adjustments. Key elements of the form consist of:

- Asset Information: Details about the assets being depreciated, including acquisition dates and costs.

- Depreciation Method: The method used for calculating depreciation, such as straight-line or declining balance.

- Adjustment Calculations: Any necessary adjustments to prior depreciation claims, including recapture amounts.

- Signature and Certification: A section for the taxpayer's signature, certifying that the information provided is accurate.

Steps to Complete the California Form 3885A

Completing the California Form 3885A involves several steps to ensure accuracy and compliance. Follow these steps:

- Gather necessary documentation, including purchase receipts and previous tax returns.

- Fill in the asset information, ensuring all details are correct and complete.

- Select the appropriate depreciation method based on your asset type and business needs.

- Calculate any adjustments needed for prior depreciation claims.

- Review the completed form for accuracy before signing and dating it.

Legal Use of the California Form 3885A

The California Form 3885A is legally binding when completed and submitted in compliance with state tax laws. To ensure its legal validity:

- Use a reliable eSignature solution, which provides a digital certificate to verify the signer's identity.

- Maintain compliance with relevant regulations such as the ESIGN Act and UETA.

- Keep a record of the completed form, including submission confirmation and any correspondence with tax authorities.

Filing Deadlines for the California Form 3885A

Timely submission of the California Form 3885A is essential to avoid penalties. The filing deadlines typically align with the state tax return due dates. For most businesses, this means:

- Filing by April 15 for calendar year taxpayers.

- For fiscal year taxpayers, the deadline is the 15th day of the fourth month following the end of the fiscal year.

Extensions may be available, but it is crucial to check with the California Franchise Tax Board for specific guidelines.

How to Obtain the California Form 3885A

The California Form 3885A can be easily obtained through various means:

- Visit the California Franchise Tax Board's official website to download the form in PDF format.

- Request a physical copy by contacting the Franchise Tax Board directly.

- Utilize eSignature platforms that offer the form for digital completion and submission.

Quick guide on how to complete ca form 3885a 2020 2022 fill and sign printable template

Complete CA Form 3885A Fill And Sign Printable Template seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It presents an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily locate the appropriate form and securely store it in the cloud. airSlate SignNow provides all the resources you need to generate, modify, and eSign your documents quickly and efficiently. Manage CA Form 3885A Fill And Sign Printable Template on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The most efficient way to modify and eSign CA Form 3885A Fill And Sign Printable Template with ease

- Locate CA Form 3885A Fill And Sign Printable Template and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Select relevant sections of the documents or obscure sensitive details with features that airSlate SignNow provides expressly for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, either by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printouts of new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign CA Form 3885A Fill And Sign Printable Template and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca form 3885a 2020 2022 fill and sign printable template

How to generate an e-signature for your PDF in the online mode

How to generate an e-signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to make an e-signature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

How to make an e-signature for a PDF document on Android OS

People also ask

-

What is the california 3885a form used for?

The california 3885a form is primarily used for documenting and ensuring compliance with various legal and business processes in California. By utilizing airSlate SignNow, businesses can easily send and eSign this form, streamlining their documentation efforts and maintaining compliance.

-

How can airSlate SignNow help with california 3885a documentation?

airSlate SignNow offers a user-friendly platform that simplifies the process of sending and eSigning the california 3885a form. With its intuitive interface, users can prepare, send, and track their documents seamlessly, reducing the time spent on paperwork.

-

What are the benefits of using airSlate SignNow for california 3885a?

Using airSlate SignNow for california 3885a provides several benefits, including increased efficiency, reduced paper usage, and enhanced security. Users can quickly manage their documents online, ensuring that their california 3885a forms are completed and stored safely.

-

Is there a cost associated with using airSlate SignNow for california 3885a?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective. Users can choose from various pricing plans tailored to their needs, ensuring that managing california 3885a forms remains affordable for businesses of all sizes.

-

Can I integrate airSlate SignNow with other applications for california 3885a?

Absolutely! airSlate SignNow supports a wide range of integrations with popular applications, making it easy to manage your california 3885a forms within your existing workflow. This ensures that you can streamline processes across different platforms while maintaining efficient document handling.

-

What features are available in airSlate SignNow for managing california 3885a forms?

airSlate SignNow provides several useful features for managing california 3885a forms, including customizable templates, automated workflows, and secure signing options. These features help simplify the process, ensuring that your documents are completed accurately and promptly.

-

How secure is my information when using airSlate SignNow for california 3885a?

Security is a top priority for airSlate SignNow. When using the platform for california 3885a forms, your information is encrypted and stored securely, adhering to high compliance standards to protect your sensitive data during the eSigning process.

Get more for CA Form 3885A Fill And Sign Printable Template

- Wedding planning or consultant package massachusetts form

- Hunting forms package massachusetts

- Identity theft recovery package massachusetts form

- Aging parent package massachusetts form

- Sale of a business package massachusetts form

- Legal documents for the guardian of a minor package massachusetts form

- Massachusetts health care proxy printable form

- New state resident package massachusetts form

Find out other CA Form 3885A Fill And Sign Printable Template

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF