Schedule D 540 California Capital Gain or Loss Adjustment Schedule D 540 California Capital Gain or Loss Adjustment Form

Understanding the California Schedule D 540 Capital Gain or Loss Adjustment

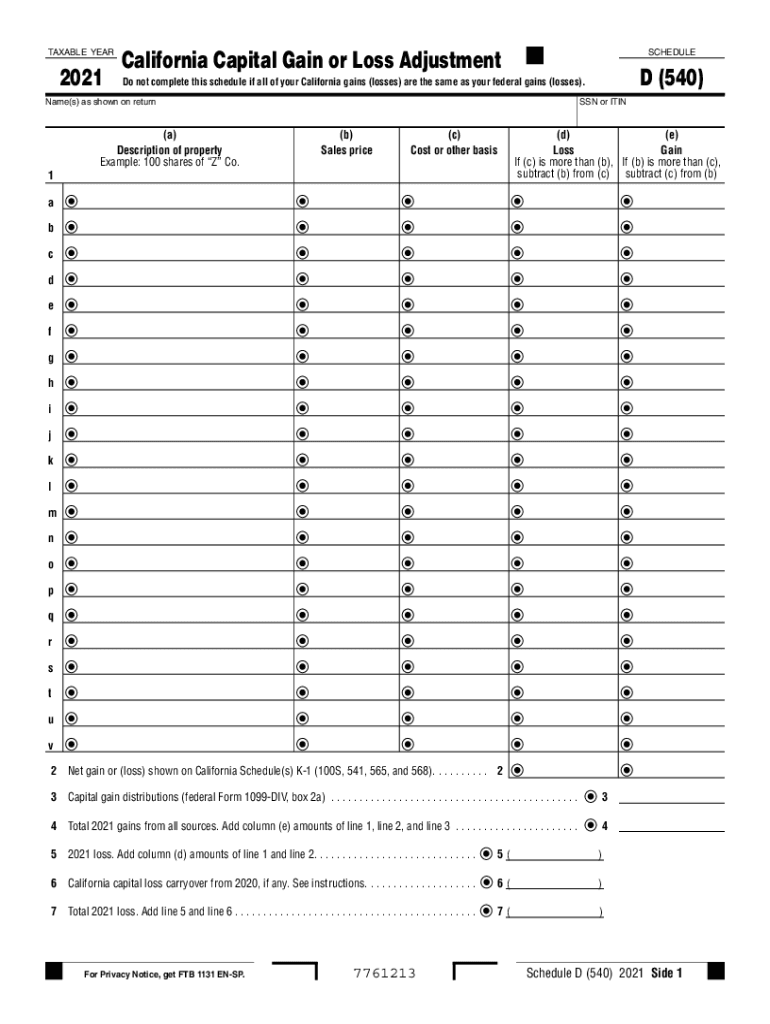

The California Schedule D 540 is a crucial form for taxpayers who need to report capital gains and losses. This form helps individuals calculate their overall capital gain or loss for the tax year, which is essential for determining tax liability. The adjustments made on this form can significantly impact the amount of tax owed or refunded. It is important to understand the specifics of this form to ensure accurate reporting and compliance with state tax regulations.

Steps to Complete the California Schedule D 540 Capital Gain or Loss Adjustment

Completing the Schedule D 540 involves several key steps:

- Gather all necessary documentation, including records of capital asset transactions.

- Determine your total capital gains and losses for the year.

- Complete the required sections of the Schedule D 540, ensuring all calculations are accurate.

- Double-check your entries for any errors before finalizing the form.

- Submit the completed form along with your California tax return.

Key Elements of the California Schedule D 540 Capital Gain or Loss Adjustment

Several key elements must be included when filling out the Schedule D 540:

- Identification of the taxpayer, including name and Social Security number.

- A detailed list of all capital assets sold during the tax year.

- Calculations of both short-term and long-term capital gains and losses.

- Any applicable adjustments, such as carryovers from previous years.

Legal Use of the California Schedule D 540 Capital Gain or Loss Adjustment

The Schedule D 540 is legally required for reporting capital gains and losses in California. Proper completion of this form ensures compliance with state tax laws. Failure to accurately report capital gains can lead to penalties and interest on unpaid taxes. It is essential to maintain records and documentation to support the figures reported on the form, as this can be requested by the California Franchise Tax Board during audits.

Filing Deadlines for the California Schedule D 540 Capital Gain or Loss Adjustment

Taxpayers should be aware of the filing deadlines associated with the Schedule D 540. Generally, the form must be submitted by the tax return deadline, which is typically April 15 for most individuals. If additional time is needed, taxpayers may file for an extension, but it is crucial to ensure that any taxes owed are paid by the original deadline to avoid penalties.

Examples of Using the California Schedule D 540 Capital Gain or Loss Adjustment

Consider a taxpayer who sold stocks and real estate during the year. The Schedule D 540 would be used to report the gains from these sales. For instance, if the taxpayer sold stocks for a profit of $5,000 and incurred a loss of $2,000 from the sale of real estate, the net capital gain would be $3,000. This example illustrates how the form is utilized to calculate overall capital gains and losses accurately.

Quick guide on how to complete 2021 schedule d 540 california capital gain or loss adjustment 2021 schedule d 540 california capital gain or loss adjustment

Easily prepare Schedule D 540 California Capital Gain Or Loss Adjustment Schedule D 540 California Capital Gain Or Loss Adjustment on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the right form and securely save it online. airSlate SignNow provides you with all the tools required to swiftly create, modify, and eSign your documents without delays. Handle Schedule D 540 California Capital Gain Or Loss Adjustment Schedule D 540 California Capital Gain Or Loss Adjustment on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign Schedule D 540 California Capital Gain Or Loss Adjustment Schedule D 540 California Capital Gain Or Loss Adjustment effortlessly

- Locate Schedule D 540 California Capital Gain Or Loss Adjustment Schedule D 540 California Capital Gain Or Loss Adjustment and click Get Form to begin.

- Use the available tools to fill out your form.

- Emphasize pertinent parts of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the information and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Schedule D 540 California Capital Gain Or Loss Adjustment Schedule D 540 California Capital Gain Or Loss Adjustment and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2021 schedule d 540 california capital gain or loss adjustment 2021 schedule d 540 california capital gain or loss adjustment

How to make an electronic signature for a PDF file online

How to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your mobile device

The best way to generate an e-signature for a PDF file on iOS

How to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the California Gain Form, and why do I need it?

The California Gain Form is a crucial document used for reporting capital gains and determining tax liabilities in California. Understanding this form allows individuals to ensure compliance with state tax regulations, potentially avoiding penalties or overpayment. airSlate SignNow streamlines the process of filling out and eSigning this form, making it easier for users to manage their tax responsibilities.

-

How does airSlate SignNow help with the California Gain Form?

airSlate SignNow simplifies the entire process of completing the California Gain Form by providing an intuitive platform for document creation and eSignature. Users can easily fill out the necessary fields, collaborate with others, and securely sign the form online. This reduces the time spent on paperwork and enhances efficiency.

-

Is there a cost associated with using airSlate SignNow for the California Gain Form?

Yes, airSlate SignNow operates on a subscription basis, offering various pricing plans to suit different needs. Users can choose from flexible options, ensuring they pay only for what they need when managing forms like the California Gain Form. The affordability combined with advanced features makes it a cost-effective choice for businesses and individuals alike.

-

Can I integrate airSlate SignNow with other applications when working on my California Gain Form?

Absolutely! airSlate SignNow seamlessly integrates with numerous applications, enabling users to streamline their workflows while handling the California Gain Form. This integration enhances productivity and allows users to manage all necessary documents and data efficiently from a single platform.

-

What features does airSlate SignNow offer for managing the California Gain Form?

airSlate SignNow offers a variety of features that enhance the management of the California Gain Form, including customizable templates, cloud storage, and real-time collaboration tools. Users can also track the status of their documents and receive notifications, ensuring that they never miss an important deadline. These features signNowly simplify the eSigning process.

-

Is the California Gain Form legally binding when signed with airSlate SignNow?

Yes, documents signed using airSlate SignNow, including the California Gain Form, are legally binding. The platform adheres to legal standards and regulations for electronic signatures, ensuring that your signed forms hold the same legal weight as traditional handwritten signatures. This provides peace of mind for users handling important financial documents.

-

How secure is my information when using airSlate SignNow to handle the California Gain Form?

Security is a top priority for airSlate SignNow. The platform utilizes advanced encryption and security protocols to protect your personal and financial information while working on the California Gain Form. This ensures that your data remains confidential and secure throughout the entire process.

Get more for Schedule D 540 California Capital Gain Or Loss Adjustment Schedule D 540 California Capital Gain Or Loss Adjustment

- Massachusetts bill sale form

- Living wills and health care package massachusetts form

- Last will and testament package massachusetts form

- Subcontractors package massachusetts form

- Ma minors form

- Massachusetts identity form

- Massachusetts identity 497309962 form

- Identity theft by known imposter package massachusetts form

Find out other Schedule D 540 California Capital Gain Or Loss Adjustment Schedule D 540 California Capital Gain Or Loss Adjustment

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation