1040 Tax Table Form

What is the 1040 Tax Table

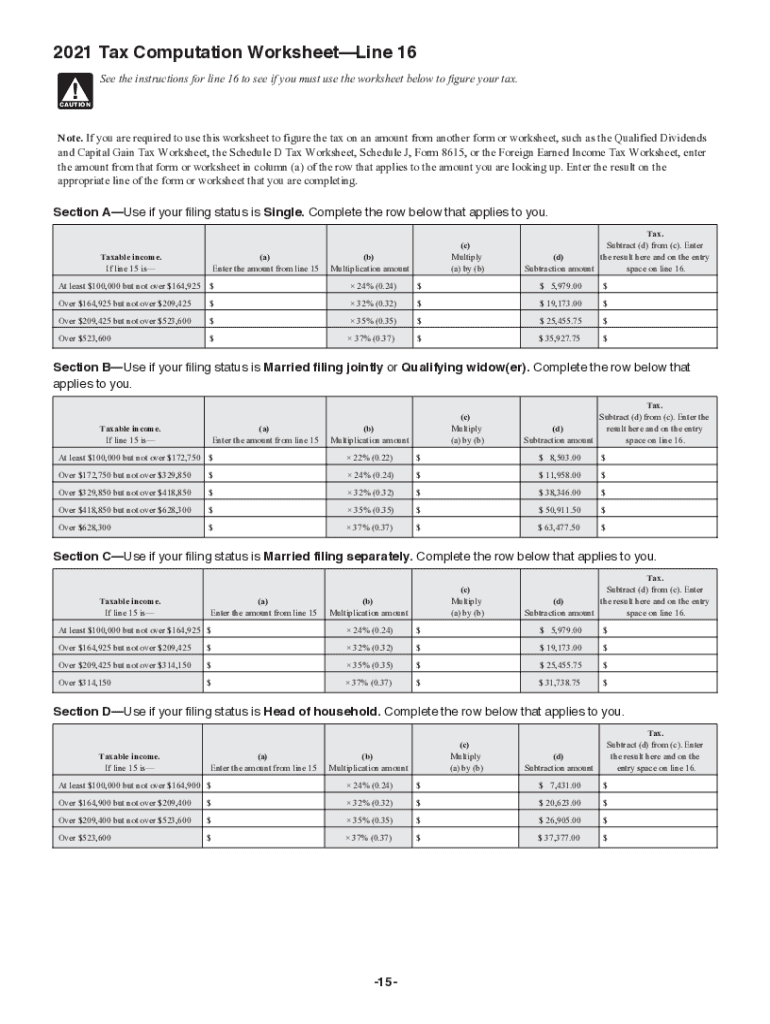

The 1040 Tax Table is a crucial resource for taxpayers in the United States, providing a structured format to determine the amount of federal income tax owed based on taxable income. This table is part of the IRS Form 1040, which is the standard individual income tax return form. The tax table simplifies the process by allowing individuals to find their tax liability without complex calculations. By locating their income level within the table, taxpayers can quickly ascertain the corresponding tax amount, making it easier to complete their tax returns accurately.

How to use the 1040 Tax Table

Using the 1040 Tax Table involves a few straightforward steps. First, taxpayers should determine their taxable income, which is their total income minus any deductions and exemptions. Next, they locate the appropriate row in the tax table that corresponds to their filing status, such as single, married filing jointly, or head of household. Once they find their income range, they can read across to find the exact tax amount owed. This method eliminates the need for complicated calculations, streamlining the tax preparation process.

Steps to complete the 1040 Tax Table

Completing the 1040 Tax Table requires careful attention to detail. Here are the essential steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Calculate your total income for the year.

- Subtract any applicable deductions, such as the standard deduction or itemized deductions, to determine your taxable income.

- Refer to the 1040 Tax Table and find the row that matches your taxable income and filing status.

- Record the corresponding tax amount on your Form 1040.

IRS Guidelines

The IRS provides specific guidelines for using the 1040 Tax Table effectively. Taxpayers must ensure that they are using the correct version of the table for the tax year they are filing. Additionally, the IRS emphasizes the importance of accurate reporting of income and deductions to avoid discrepancies. Following these guidelines helps ensure compliance with tax laws and reduces the risk of audits or penalties.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for taxpayers. The standard deadline for filing Form 1040 is typically April 15 of the following year, unless it falls on a weekend or holiday. In such cases, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may be available, as well as the importance of timely payment to avoid interest and penalties on any owed taxes.

Required Documents

To accurately complete the 1040 Tax Table, taxpayers need several key documents. These include:

- W-2 forms from employers, detailing annual earnings and withheld taxes.

- 1099 forms for any freelance or contract work.

- Documentation of any other income sources, such as rental income or investment earnings.

- Receipts or records for deductions, including medical expenses, mortgage interest, and charitable contributions.

Eligibility Criteria

Eligibility to use the 1040 Tax Table typically depends on the taxpayer's filing status and income level. Most individuals and families can use the table, but those with more complex tax situations, such as self-employed individuals or those with significant investment income, may need to use additional forms or schedules. Understanding these criteria ensures that taxpayers select the appropriate filing method and accurately report their income.

Quick guide on how to complete 1040 tax table 2022

Complete 1040 Tax Table effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage 1040 Tax Table on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to update and eSign 1040 Tax Table with ease

- Locate 1040 Tax Table and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Edit and eSign 1040 Tax Table to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1040 tax table 2022

How to make an electronic signature for your PDF file online

How to make an electronic signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

The best way to create an e-signature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

The best way to create an e-signature for a PDF on Android devices

People also ask

-

What is the 2021 standard deduction and how does it affect my taxes?

The 2021 standard deduction is a specific dollar amount that reduces the income you are taxed on. For most taxpayers, it simplifies the filing process, allowing them to lower their taxable income without itemizing deductions. It's a crucial factor to consider when preparing your tax documents.

-

How can I determine if I should itemize deductions or take the 2021 standard deduction?

Deciding whether to itemize or take the 2021 standard deduction depends on your eligible expenses. If your total deductions exceed the 2021 standard deduction amount, itemizing may benefit you more. However, if your deductions are lower, the standard deduction simplifies your tax filing.

-

Does airSlate SignNow help with understanding the 2021 standard deduction on tax documents?

Yes, airSlate SignNow offers an intuitive platform for managing your tax documents, including forms related to the 2021 standard deduction. You can easily eSign and send necessary tax forms, making it hassle-free to understand your deductions and obligations each year.

-

Is airSlate SignNow cost-effective for managing documents related to the 2021 standard deduction?

Absolutely! airSlate SignNow provides a cost-effective solution for businesses that need to manage and eSign documents, including those related to the 2021 standard deduction. With competitive pricing plans, you can optimize your operational costs while ensuring compliance and accuracy in tax document handling.

-

What features does airSlate SignNow offer that are beneficial for tax filing purposes, especially concerning the 2021 standard deduction?

airSlate SignNow offers a variety of features such as customizable templates and secure eSigning, which streamline the tax filing process. These features ensure that you can efficiently gather necessary information related to the 2021 standard deduction and store all your documents securely.

-

Can I integrate airSlate SignNow with other financial software for tax purposes?

Yes, airSlate SignNow easily integrates with various financial software tools, enhancing your ability to manage documents related to the 2021 standard deduction. This seamless integration allows for effective document flow, making tax preparation simpler and more efficient.

-

How does using airSlate SignNow improve the process of submitting forms related to the 2021 standard deduction?

Using airSlate SignNow simplifies the submission of tax forms by providing a structured, electronic solution for eSigning and sending documents. This not only saves time but also reduces the likelihood of errors, ensuring your 2021 standard deduction paperwork is handled efficiently.

Get more for 1040 Tax Table

Find out other 1040 Tax Table

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online