Individual Income TaxResident and Nonresident Form

Understanding the Individual Income Tax for Residents and Nonresidents

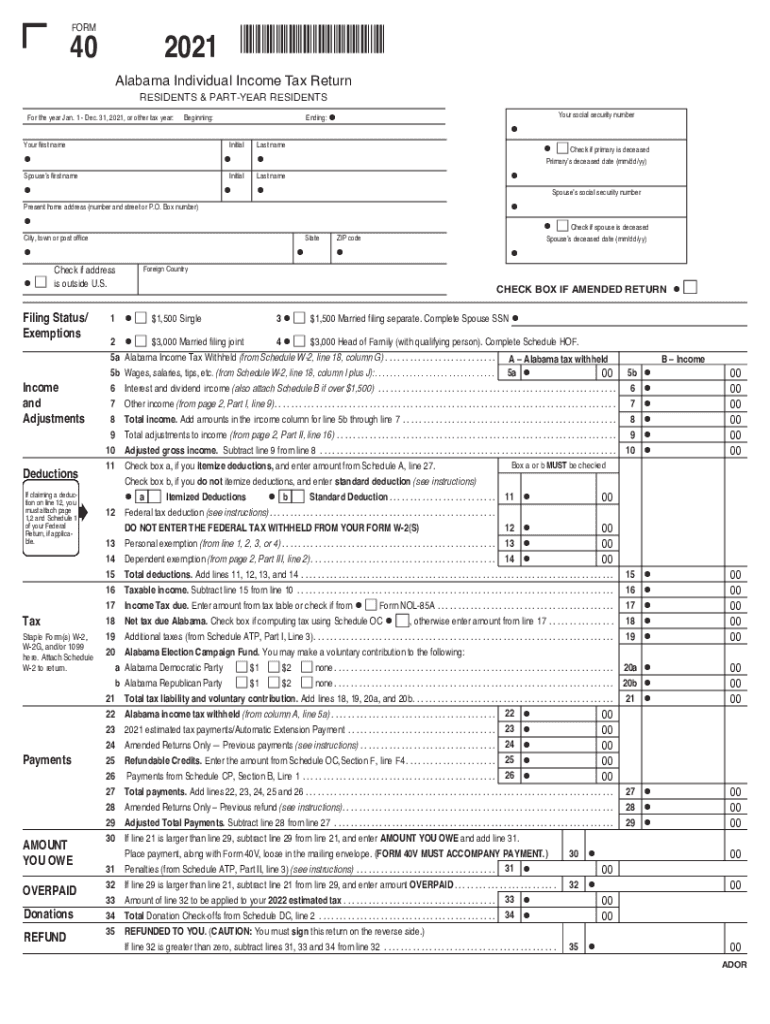

The Alabama state form 40 2021 is essential for both residents and nonresidents who need to file their individual income tax returns. Residents are individuals who have established their domicile in Alabama, while nonresidents are those who earn income in Alabama but reside elsewhere. Understanding the distinction is critical for accurately completing the form, as different rules may apply to income earned and deductions available. Residents typically report all income, while nonresidents only report income sourced from Alabama.

Steps to Complete the Individual Income Tax for Residents and Nonresidents

Completing the Alabama state form 40 2021 involves several steps to ensure accurate reporting of income and deductions. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, calculate your total income, considering any adjustments for deductions or credits applicable to your situation. Fill out the form carefully, ensuring that all information is accurate. Finally, review your completed form for any errors before submitting it to the Alabama Department of Revenue.

Required Documents for Filing

To successfully file the Alabama state form 40 2021, certain documents are necessary. These include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income, such as rental or investment income

- Documentation for any deductions or credits claimed, such as medical expenses or educational credits

Having these documents ready will streamline the filing process and help ensure compliance with state tax laws.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines for the Alabama state form 40 2021. Typically, the deadline for filing individual income tax returns is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers should be mindful of any extensions that may be available, which can provide additional time to file but not to pay any taxes owed.

Legal Use of the Individual Income Tax for Residents and Nonresidents

The Alabama state form 40 2021 is legally binding when completed and submitted according to state regulations. To ensure that the form is recognized by the Alabama Department of Revenue, it must be signed appropriately, either electronically or in print. Compliance with the legal requirements set forth by the state ensures that your submission is valid and can be processed without issues.

Digital vs. Paper Version of the Form

Filing the Alabama state form 40 2021 can be done through both digital and paper methods. The digital version allows for a more streamlined process, with the ability to eSign and submit online, which can expedite processing times. Conversely, the paper version requires mailing to the appropriate tax office, which may take longer for processing. Choosing the digital route can enhance security and provide immediate confirmation of submission.

Quick guide on how to complete individual income taxresident and nonresident

Prepare Individual Income TaxResident And Nonresident effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Individual Income TaxResident And Nonresident on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to alter and eSign Individual Income TaxResident And Nonresident with ease

- Find Individual Income TaxResident And Nonresident and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight relevant portions of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your needs in document management in just a few clicks from a device of your choice. Edit and eSign Individual Income TaxResident And Nonresident and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the individual income taxresident and nonresident

The best way to create an e-signature for a PDF online

The best way to create an e-signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

The way to generate an e-signature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the Alabama State Form 40 2021?

The Alabama State Form 40 2021 is the official state income tax return form that residents must file to report their income for the tax year. Completing this form accurately is essential for ensuring compliance with Alabama tax regulations and maximizing any potential refunds.

-

How can airSlate SignNow help with the Alabama State Form 40 2021?

airSlate SignNow offers a seamless solution for electronically signing and sending the Alabama State Form 40 2021. Our platform ensures that users can complete their tax documents efficiently, saving time and enhancing accuracy in the filing process.

-

Is there a cost associated with using airSlate SignNow for the Alabama State Form 40 2021?

Yes, while airSlate SignNow provides a cost-effective solution for managing your Alabama State Form 40 2021, pricing may vary based on the subscription plan you choose. We offer various plans that cater to individual and business needs, ensuring that you find an option that fits your budget.

-

What features does airSlate SignNow offer for the Alabama State Form 40 2021?

Our platform offers features such as eSignature capabilities, document tracking, and cloud storage specifically for the Alabama State Form 40 2021. These tools simplify the process of completing and submitting your forms, ensuring you can manage your tax documents from anywhere.

-

Can I integrate airSlate SignNow with other software while filing the Alabama State Form 40 2021?

Absolutely! airSlate SignNow integrates seamlessly with various software, allowing users to streamline their workflow when working on the Alabama State Form 40 2021. These integrations can enhance your productivity by connecting with tools you already use, such as accounting or document management systems.

-

What benefits does airSlate SignNow provide for filing the Alabama State Form 40 2021?

One of the key benefits is the ease of use and accessibility that airSlate SignNow provides while filing the Alabama State Form 40 2021. Users can quickly fill out, sign, and send their forms from any device, making tax season less stressful and more efficient.

-

Is airSlate SignNow secure for filing the Alabama State Form 40 2021?

Yes, security is a top priority for airSlate SignNow. When filing the Alabama State Form 40 2021, users can trust that their data is protected with bank-level encryption and robust security measures, ensuring your sensitive information remains confidential and secure.

Get more for Individual Income TaxResident And Nonresident

- Letter from tenant to landlord about landlords failure to make repairs maryland form

- Maryland notice rent form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession maryland form

- Letter from tenant to landlord about illegal entry by landlord maryland form

- Letter from landlord to tenant about time of intent to enter premises maryland form

- Maryland tenant landlord form

- Letter from tenant to landlord about sexual harassment maryland form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children maryland form

Find out other Individual Income TaxResident And Nonresident

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document