Fillable Online MARYLAND FORM 510E FILE PASS through

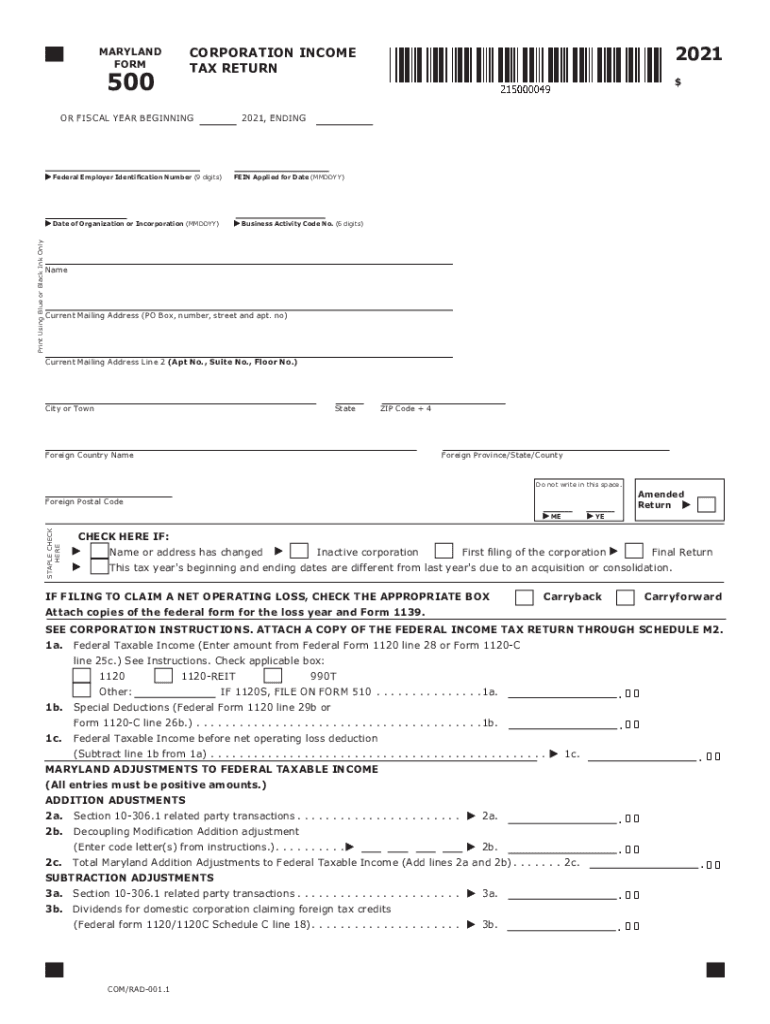

Understanding the Maryland Corporation Tax Return

The 2020 MD Form 500, also known as the Maryland Corporation Income Tax Return, is a crucial document for corporations operating within Maryland. This form is used to report the income, deductions, and credits of corporations for the tax year. It is essential for ensuring compliance with state tax laws and for determining the corporation's tax liability. Understanding the structure and requirements of this form can help businesses navigate their tax obligations efficiently.

Steps to Complete the 2020 MD Form 500

Completing the MD 500 return involves several key steps:

- Gather Financial Information: Collect all necessary financial documents, including income statements, balance sheets, and records of deductions.

- Fill Out the Form: Accurately enter your corporation's financial data into the form, ensuring that all sections are completed as required.

- Review for Accuracy: Double-check all entries for accuracy to avoid potential penalties or delays in processing.

- Submit the Form: Choose your submission method — online, by mail, or in person — and ensure it is sent by the due date.

Filing Deadlines for the MD Form 500

It is important to be aware of the filing deadlines associated with the Maryland 500 tax form. Generally, the return is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form must be filed by April 15. Failure to meet this deadline can result in penalties and interest on unpaid taxes.

Required Documents for Filing

Before filing the Maryland corporation tax return, ensure you have the following documents ready:

- Income Statements: Detailed reports of your corporation's revenues.

- Expense Records: Documentation of all business-related expenses.

- Previous Year’s Tax Returns: Reference your past filings for consistency and accuracy.

- Supporting Schedules: Any additional forms or schedules that apply to your corporation's specific tax situation.

Penalties for Non-Compliance

Failure to file the MD 500 tax on time or inaccuracies in the return can lead to significant penalties. These may include:

- Late Filing Penalties: A percentage of the unpaid tax may be charged for each month the return is late.

- Accuracy-Related Penalties: Additional charges may apply if the IRS determines that the return contains substantial errors.

- Interest on Unpaid Taxes: Interest accrues on any unpaid tax amounts until they are settled.

Digital vs. Paper Version of the Form

Filing the Maryland 500 form can be done either digitally or via paper. The digital version offers several advantages, including faster processing times and the ability to track submission status. Conversely, paper submissions may take longer to process and can be prone to delays. Choosing the digital route can enhance efficiency and reduce the risk of errors during submission.

Quick guide on how to complete fillable online maryland form 510e file pass through

Accomplish Fillable Online MARYLAND FORM 510E FILE PASS THROUGH smoothly on any device

Online document management has gained signNow traction among organizations and individuals alike. It serves as a sustainable alternative to conventional printed and signed documents, as it allows for secure online storage of the correct form. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without interruptions. Manage Fillable Online MARYLAND FORM 510E FILE PASS THROUGH on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and electronically sign Fillable Online MARYLAND FORM 510E FILE PASS THROUGH without any hassle

- Locate Fillable Online MARYLAND FORM 510E FILE PASS THROUGH and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to missing or lost documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Fillable Online MARYLAND FORM 510E FILE PASS THROUGH and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable online maryland form 510e file pass through

The best way to create an e-signature for your PDF document in the online mode

The best way to create an e-signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an e-signature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

The best way to make an e-signature for a PDF file on Android devices

People also ask

-

What is the 2020 MD Form 500?

The 2020 MD Form 500 is Maryland's state income tax return form that residents must file to report their income for the tax year. This form includes various sections for income, deductions, and credits applicable to taxpayers. By using airSlate SignNow, you can easily manage and sign the 2020 MD Form 500 electronically, streamlining the filing process.

-

How does airSlate SignNow help with the 2020 MD Form 500?

airSlate SignNow simplifies the completion and submission of the 2020 MD Form 500 by providing an intuitive platform for eSigning documents. It allows users to easily upload, edit, and send their forms without the hassle of traditional paper methods. This digital solution ensures that your filed documents are both secure and efficient.

-

Is there a cost associated with using airSlate SignNow for the 2020 MD Form 500?

Yes, there is a cost associated with using airSlate SignNow, but it remains a cost-effective solution for managing documents like the 2020 MD Form 500. Pricing plans vary based on the features and number of users you need. By investing in airSlate SignNow, you can save both time and money on your document management process.

-

Can I integrate airSlate SignNow with other software to manage the 2020 MD Form 500?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easier to manage your 2020 MD Form 500 and other documents. Integrations with tools like Google Drive, Dropbox, and CRM systems enhance your workflow and provide seamless access to your important files.

-

What are the key benefits of using airSlate SignNow for the 2020 MD Form 500?

Using airSlate SignNow for the 2020 MD Form 500 provides numerous benefits, including enhanced efficiency, reduced paperwork, and secure document management. The platform ensures that you can eSign documents quickly and accurately, minimizing the risk of errors. Additionally, it offers tracking features to keep you informed about the status of your filings.

-

Is the 2020 MD Form 500 eSigning process secure with airSlate SignNow?

Yes, the eSigning process for the 2020 MD Form 500 is highly secure with airSlate SignNow. The platform utilizes advanced security protocols, including encryption and secure access controls, to protect your personal information and documents. You can confidently sign and share your forms without worrying about data bsignNowes.

-

Can I access airSlate SignNow on mobile devices for the 2020 MD Form 500?

Yes, you can access airSlate SignNow on mobile devices, making it convenient to manage your 2020 MD Form 500 on the go. The mobile-friendly interface allows you to eSign documents, upload files, and track their status from your smartphone or tablet. This flexibility ensures you can handle your tax obligations anytime, anywhere.

Get more for Fillable Online MARYLAND FORM 510E FILE PASS THROUGH

- Change registered agent form

- New resident guide florida form

- Satisfaction release or cancellation of mortgage by corporation florida form

- Satisfaction release or cancellation of mortgage by individual florida form

- Partial release of property from mortgage for corporation florida form

- Partial release of property from mortgage by individual holder florida form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy florida form

- Warranty deed for parent to child reserving life estates to parent florida form

Find out other Fillable Online MARYLAND FORM 510E FILE PASS THROUGH

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple