Form IL 1120, Corporation Income and Replacement Tax Return

What is the Form IL 1120, Corporation Income And Replacement Tax Return

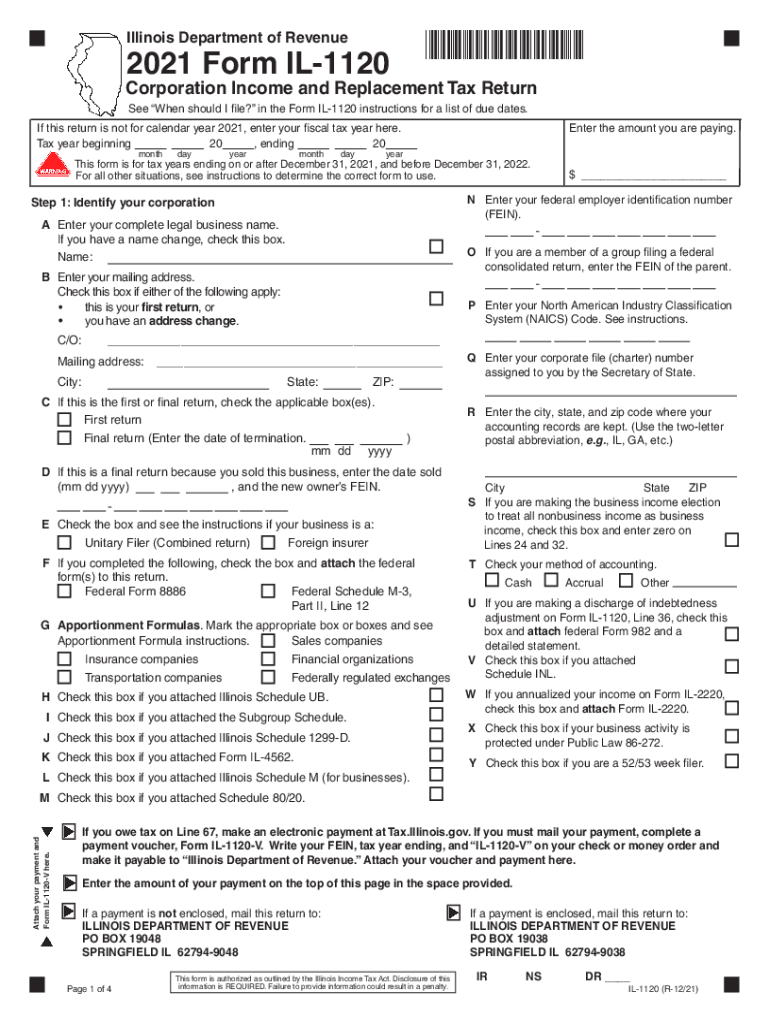

The Form IL 1120 is a tax return specifically designed for corporations operating in Illinois. This document is essential for reporting the corporation's income and calculating the associated replacement tax. The Illinois corporation tax applies to various types of business entities, including C corporations and S corporations. The form captures critical financial information, including gross income, deductions, and credits, which ultimately determine the corporation's tax liability.

Steps to complete the Form IL 1120, Corporation Income And Replacement Tax Return

Completing the Form IL 1120 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including income statements and expense reports. Next, fill out the form by entering your corporation's gross income, allowable deductions, and any applicable credits. It is crucial to double-check all entries for accuracy. After completing the form, sign it and retain a copy for your records. Finally, submit the form to the Illinois Department of Revenue by the specified deadline to avoid penalties.

Legal use of the Form IL 1120, Corporation Income And Replacement Tax Return

The Form IL 1120 is legally binding when completed accurately and submitted on time. To ensure its legal standing, the form must be signed by an authorized representative of the corporation. Additionally, compliance with Illinois tax laws is necessary for the form to be recognized as valid. Using a reliable electronic signature platform can enhance the legal validity of the submission, as it ensures that the signature meets all necessary legal requirements.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form IL 1120 is crucial for compliance. Generally, the form is due on the 15th day of the third month following the close of the corporation's tax year. For corporations operating on a calendar year, this means the form is typically due by March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations may also request an extension, but any taxes owed must still be paid by the original due date to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form IL 1120 can be submitted through various methods, providing flexibility for corporations. Online submission is available through the Illinois Department of Revenue's website, allowing for quick processing. Alternatively, corporations can mail the completed form to the appropriate address listed on the form instructions. For those who prefer in-person submission, visiting a local Department of Revenue office is also an option. Regardless of the method chosen, ensuring that the form is submitted by the deadline is essential.

Required Documents

To complete the Form IL 1120, several documents are required to support the information reported. These may include financial statements, such as balance sheets and income statements, as well as records of any deductions or credits claimed. Additionally, corporations should have documentation related to any adjustments made to income or expenses. Keeping these documents organized and readily available can streamline the filing process and help ensure compliance with tax regulations.

Quick guide on how to complete 2021 form il 1120 corporation income and replacement tax return

Complete Form IL 1120, Corporation Income And Replacement Tax Return effortlessly on any device

The management of online documents has gained traction among businesses and individuals alike. It serves as a remarkable eco-friendly substitute to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Administer Form IL 1120, Corporation Income And Replacement Tax Return on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to alter and electronically sign Form IL 1120, Corporation Income And Replacement Tax Return smoothly

- Obtain Form IL 1120, Corporation Income And Replacement Tax Return and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or conceal sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you would prefer to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhaustive form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form IL 1120, Corporation Income And Replacement Tax Return to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2021 form il 1120 corporation income and replacement tax return

The way to generate an electronic signature for a PDF file in the online mode

The way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your smartphone

The best way to make an e-signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF on Android

People also ask

-

What is the Illinois 1120 tax?

The Illinois 1120 tax refers to the state income tax form used by corporations and organizations that operate within Illinois. This form is essential for reporting income and determining tax liabilities based on the state's specific tax regulations. Understanding how to properly file the Illinois 1120 tax can save businesses from potential penalties.

-

How can airSlate SignNow help with filing the Illinois 1120 tax?

airSlate SignNow provides a seamless platform for eSigning documents, making it easier to prepare and submit the Illinois 1120 tax form. Our tool allows users to collect signatures remotely, accelerating the filing process. By streamlining document management, airSlate SignNow ensures that all tax-related forms, including the Illinois 1120 tax, are handled efficiently.

-

What are the pricing options for using airSlate SignNow for Illinois 1120 tax filing?

airSlate SignNow offers competitive pricing plans to fit various business needs, including those specifically focused on Illinois 1120 tax filing. Our flexible subscription plans allow users to choose the best option based on their volume of documents. This cost-effective solution ensures that businesses can manage their eSigning needs without overspending.

-

What features does airSlate SignNow offer for managing Illinois 1120 tax documents?

Our platform offers features including document templates, secure cloud storage, and customizable workflows to facilitate the management of Illinois 1120 tax documents. These tools help ensure that all necessary information is correctly incorporated, reducing errors during submission. Additionally, users can track the status of documents, streamlining the filing process.

-

Can airSlate SignNow integrate with accounting software for Illinois 1120 tax?

Yes, airSlate SignNow integrates with various accounting software programs, simplifying the process of preparing and filing the Illinois 1120 tax. These integrations allow users to import data directly into the tax forms, minimizing manual entry errors. By connecting your accounting tools with our eSigning platform, you can enhance your tax workflow.

-

What benefits does airSlate SignNow provide for businesses filing Illinois 1120 tax?

Businesses using airSlate SignNow for their Illinois 1120 tax filings benefit from enhanced efficiency and improved compliance. Our platform helps reduce turnaround times for document signing and filing, enabling timely submissions. Additionally, the secure storage of signed documents ensures that businesses have easy access to important tax records when needed.

-

Is airSlate SignNow secure for handling sensitive Illinois 1120 tax documents?

Absolutely, airSlate SignNow takes security seriously, implementing robust measures to protect sensitive Illinois 1120 tax documents. Our platform uses encryption protocols and complies with industry standards to safeguard user data. You can confidently eSign and manage your tax documents, knowing that your information is protected.

Get more for Form IL 1120, Corporation Income And Replacement Tax Return

Find out other Form IL 1120, Corporation Income And Replacement Tax Return

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document