Sales & Use Tax Forms State of Michigan

Understanding the Missouri Addition Modification

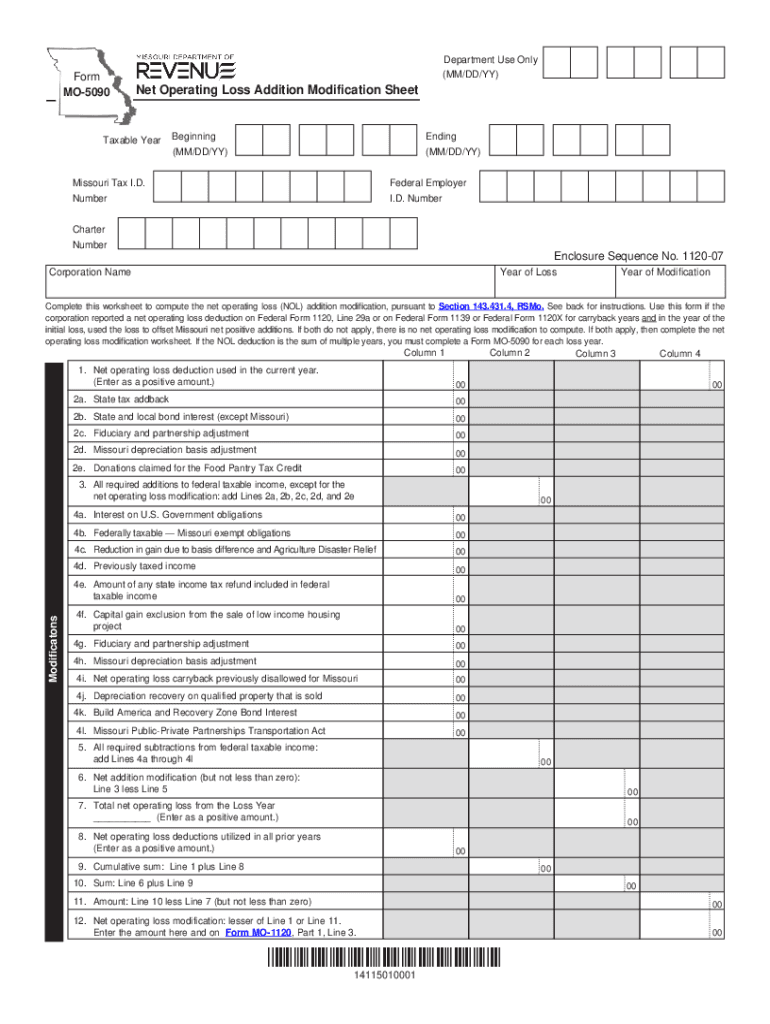

The Missouri addition modification is a crucial component for taxpayers who need to adjust their taxable income. This modification allows individuals and businesses to add specific amounts to their federal adjusted gross income. These additions often include items such as income from certain tax-exempt sources and other adjustments as outlined by Missouri tax regulations. Understanding these additions is essential for accurate tax reporting and compliance.

Steps to Complete the Missouri Addition Modification Form

Completing the Missouri addition modification form, often referred to as the MO-5090, involves several key steps. First, gather all necessary documents, including your federal tax return and any supporting documentation for the additions. Next, accurately fill out the MO-5090 form by entering the required information, ensuring that all additions are correctly calculated. Pay close attention to the instructions provided with the form, as they detail specific line items and potential adjustments. After completing the form, review it thoroughly for accuracy before submission.

Key Elements of the Missouri Addition Modification

Several key elements must be understood when dealing with the Missouri addition modification. These include the types of income that can be added, the specific calculations required, and any relevant deadlines for submission. Taxpayers should be aware of the various adjustments that may apply to their situation, such as income from state and local bonds or certain retirement distributions. Familiarizing oneself with these elements can help ensure compliance and optimize tax outcomes.

Legal Use of the Missouri Addition Modification Form

The legal use of the Missouri addition modification form is governed by state tax laws and regulations. It is essential for taxpayers to ensure that they are using the most current version of the MO-5090 form, as outdated forms may not be accepted by the state. Additionally, the information provided on the form must be accurate and complete to avoid penalties or issues with the Missouri Department of Revenue. Understanding the legal framework surrounding the form helps ensure that taxpayers meet their obligations responsibly.

Filing Deadlines for the Missouri Addition Modification

Filing deadlines for the Missouri addition modification form are critical for compliance. Typically, the MO-5090 must be filed by the same deadline as the federal tax return. For most taxpayers, this means submitting the form by April fifteenth of each year. However, extensions may be available, and it is important to check for any changes to deadlines that may occur due to state regulations or specific circumstances. Staying informed about these deadlines helps prevent late filing penalties.

Common Scenarios for Using the Missouri Addition Modification

There are various scenarios in which taxpayers may need to utilize the Missouri addition modification. For instance, individuals who receive income from tax-exempt sources, such as certain municipal bonds, may need to report these amounts as additions. Similarly, businesses claiming deductions for specific expenses may find that they need to adjust their income accordingly. Understanding these scenarios can help taxpayers navigate their tax responsibilities more effectively.

Quick guide on how to complete 2021 sales ampamp use tax forms state of michigan

Prepare Sales & Use Tax Forms State Of Michigan effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage Sales & Use Tax Forms State Of Michigan on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to edit and eSign Sales & Use Tax Forms State Of Michigan with ease

- Obtain Sales & Use Tax Forms State Of Michigan and click on Get Form to initiate.

- Utilize the tools available to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, via email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign Sales & Use Tax Forms State Of Michigan to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2021 sales ampamp use tax forms state of michigan

The way to generate an electronic signature for your PDF online

The way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

What is Missouri addition modification?

Missouri addition modification refers to the process of amending a document to include additional terms or clauses specific to Missouri regulations. This modification is crucial for ensuring compliance and clarity in legal agreements.

-

How does airSlate SignNow support Missouri addition modification?

airSlate SignNow provides a seamless platform for creating, editing, and eSigning documents, including Missouri addition modifications. Our solution simplifies the amendment process with user-friendly tools that keep you compliant with state laws.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers several pricing plans tailored to your business needs. Each plan includes features that support document modification, ensuring you can efficiently handle Missouri addition modifications at a competitive price.

-

What features does airSlate SignNow provide for document modifications?

Our platform enhances document modifications with features like drag-and-drop editing, customizable templates, and real-time collaboration tools. These features make it easy to execute a Missouri addition modification smoothly and efficiently.

-

Can I use airSlate SignNow on mobile devices for Missouri addition modifications?

Yes, airSlate SignNow is fully optimized for mobile use, allowing you to manage Missouri addition modifications on-the-go. Whether you’re in the office or out in the field, you can easily edit, sign, and send documents from your smartphone or tablet.

-

Does airSlate SignNow integrate with other software for Missouri addition modification processes?

Absolutely! airSlate SignNow integrates with popular software like Google Drive, Salesforce, and more. This ensures that your workflow for Missouri addition modifications is streamlined and efficient, connecting all the tools you already use.

-

What benefits does airSlate SignNow offer for Missouri addition modification users?

Using airSlate SignNow for Missouri addition modification allows businesses to expedite processes, reduce errors, and maintain legal compliance. Our platform ensures security and traceability throughout the modification process, enhancing user confidence.

Get more for Sales & Use Tax Forms State Of Michigan

- General power of attorney for care and custody of child or children minnesota form

- Business accounting package form

- Mn guardian 497312797 form

- Company employment policies and procedures package minnesota form

- Revocation power attorney 497312799 form

- Designated caregiver agreement statutory form minnesota

- Newly divorced individuals package minnesota form

- Mn revocation 497312802 form

Find out other Sales & Use Tax Forms State Of Michigan

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later