Part Year and NonresidentDepartment of Revenue Taxation Form

Understanding Part-Year and Nonresident Taxation in Colorado

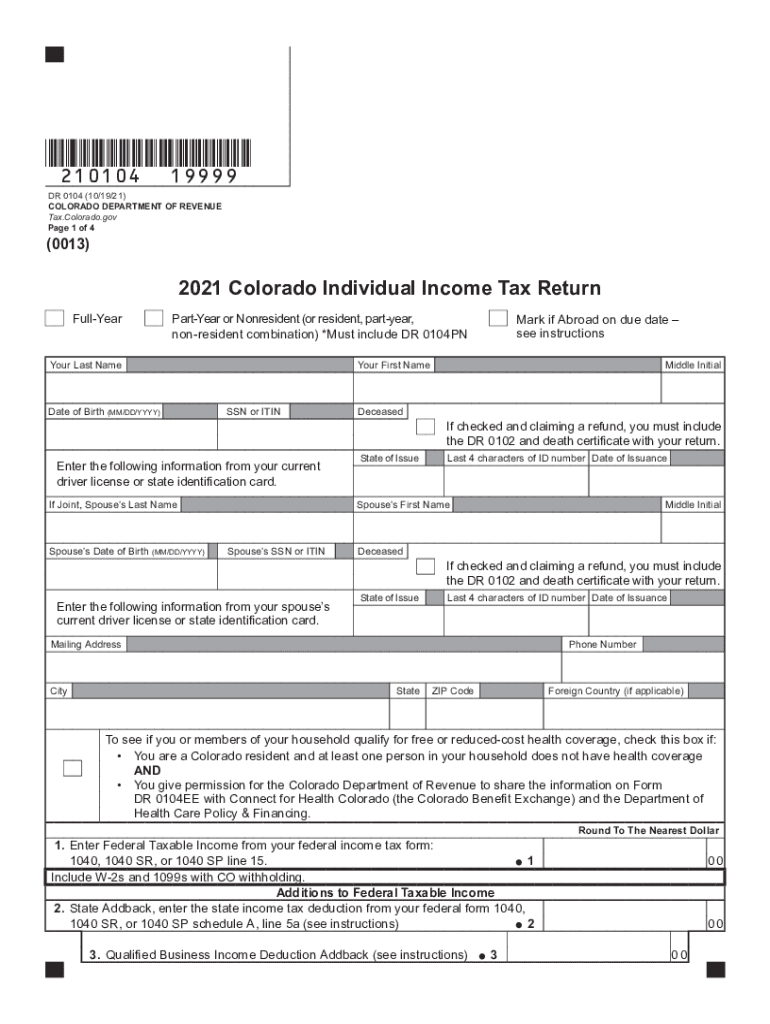

The Colorado state income tax system includes specific provisions for individuals who are part-year residents or nonresidents. Part-year residents are individuals who live in Colorado for only part of the year, while nonresidents do not reside in the state but earn income from Colorado sources. Understanding the nuances of this taxation is essential for accurate filing and compliance.

For part-year residents, the tax is calculated based on the income earned while residing in Colorado, as well as any income sourced from the state during the time they were not residents. Nonresidents are taxed only on income earned from Colorado sources, which may include wages, rental income, or business income generated within the state.

Steps to Complete the Part-Year and Nonresident Tax Form

Filing the Colorado state income tax as a part-year resident or nonresident requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather all necessary income documents, including W-2s, 1099s, and any other relevant income statements.

- Determine your residency status for the tax year, noting the dates you were a resident and any income earned while residing in Colorado.

- Complete the appropriate tax form, which for part-year and nonresidents is typically the 104 Colorado state tax form.

- Calculate your taxable income based on the guidelines for your residency status, ensuring to include only Colorado-sourced income for nonresidents.

- Review the form for accuracy, ensuring all calculations are correct and all necessary information is included.

- Submit the completed form by the designated filing deadline, either electronically or via mail.

Required Documents for Filing

When filing the Colorado state income tax as a part-year resident or nonresident, you will need to prepare several key documents:

- W-2 forms from employers for all income earned.

- 1099 forms for any freelance or contract work.

- Records of any other income received, such as rental income or dividends.

- Documentation supporting your residency status, including dates of residence in Colorado.

- Any previous tax returns that may provide context for your current filing.

Filing Deadlines for Colorado State Income Tax

It is crucial to be aware of the filing deadlines for the Colorado state income tax to avoid penalties. Typically, the deadline for filing is April 15 of the following year for most taxpayers. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Part-year residents and nonresidents should ensure they file their taxes by this date to remain compliant.

Penalties for Non-Compliance

Failing to file your Colorado state income tax return, or filing late, can result in significant penalties. The state may impose fines based on the amount of tax owed, and interest will accrue on any unpaid tax. Additionally, taxpayers who do not comply with filing requirements may face legal actions, including liens on property or garnishment of wages. It is essential to file accurately and on time to avoid these consequences.

Eligibility Criteria for Part-Year and Nonresident Taxation

To qualify as a part-year resident or nonresident for Colorado state income tax purposes, individuals must meet specific criteria:

- Part-year residents must have established residency in Colorado for part of the tax year.

- Nonresidents must not have established residency in Colorado but must have earned income from Colorado sources.

- Both categories must report all relevant income and adhere to the state's tax regulations.

Quick guide on how to complete part year and nonresidentdepartment of revenue taxation

Effortlessly Prepare Part Year And NonresidentDepartment Of Revenue Taxation on any device

Digital document management has gained traction among organizations and individuals alike. It offers a fantastic eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without delays. Manage Part Year And NonresidentDepartment Of Revenue Taxation on any device with the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Part Year And NonresidentDepartment Of Revenue Taxation effortlessly

- Find Part Year And NonresidentDepartment Of Revenue Taxation and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method to send your form—via email, SMS, or invite link—or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Part Year And NonresidentDepartment Of Revenue Taxation and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the part year and nonresidentdepartment of revenue taxation

The way to make an electronic signature for a PDF document in the online mode

The way to make an electronic signature for a PDF document in Chrome

The best way to generate an e-signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your mobile device

The way to generate an e-signature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the impact of Colorado state income tax on my business?

Understanding Colorado state income tax is crucial for budgeting and compliance. The amount of tax you owe can affect your cash flow and overall financial health. Properly managing these taxes can lead to signNow savings and benefits for your business.

-

How does airSlate SignNow help with managing Colorado state income tax documentation?

AirSlate SignNow simplifies the process of sending and eSigning important documents related to Colorado state income tax. Our intuitive platform allows you to create and manage tax forms seamlessly, ensuring you stay organized and compliant. With our solution, you can easily track, store, and access your tax-related documents.

-

Is there a pricing plan specifically for businesses dealing with Colorado state income tax?

AirSlate SignNow offers flexible pricing plans suitable for businesses of all sizes, including those navigating Colorado state income tax. Our competitive pricing ensures you receive an efficient eSigning solution without breaking the bank. You can choose the plan that best fits your needs while staying compliant with Colorado tax regulations.

-

What features does airSlate SignNow provide to help with tax compliance in Colorado?

AirSlate SignNow includes features that enhance compliance with Colorado state income tax requirements. From customizable templates for tax documents to secure storage solutions, our platform ensures you are always prepared for tax season. Additionally, our audit trails provide transparency and accountability, crucial for tax compliance.

-

Can airSlate SignNow integrate with accounting software to help manage Colorado state income tax?

Yes, airSlate SignNow integrates seamlessly with various accounting software solutions, making it easier to manage Colorado state income tax. These integrations allow for streamlined document sharing and effective management of financial records. By connecting all your systems, you can ensure accurate tax reporting and compliance.

-

How can airSlate SignNow benefit small businesses facing Colorado state income tax?

AirSlate SignNow provides small businesses a cost-effective way to manage their Colorado state income tax documentation. Our cloud-based solution reduces the need for physical storage and simplifies the eSigning process, saving time and resources. This efficiency enables small businesses to focus more on growth and less on paperwork.

-

What are the benefits of using airSlate SignNow for eSigning Colorado tax documents?

Using airSlate SignNow for eSigning Colorado tax documents ensures a faster and more efficient process. You can send and receive signed documents in minutes, reducing delays associated with traditional signing methods. This expediency is crucial during tax filing periods, allowing businesses to meet deadlines promptly.

Get more for Part Year And NonresidentDepartment Of Revenue Taxation

- Insulation contract for contractor missouri form

- Paving contract for contractor missouri form

- Site work contract for contractor missouri form

- Siding contract for contractor missouri form

- Refrigeration contract for contractor missouri form

- Missouri drainage form

- Foundation contract for contractor missouri form

- Plumbing contract for contractor missouri form

Find out other Part Year And NonresidentDepartment Of Revenue Taxation

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple