Ben Royten Wi Z Tab to Navigate within Form Use Mouse to

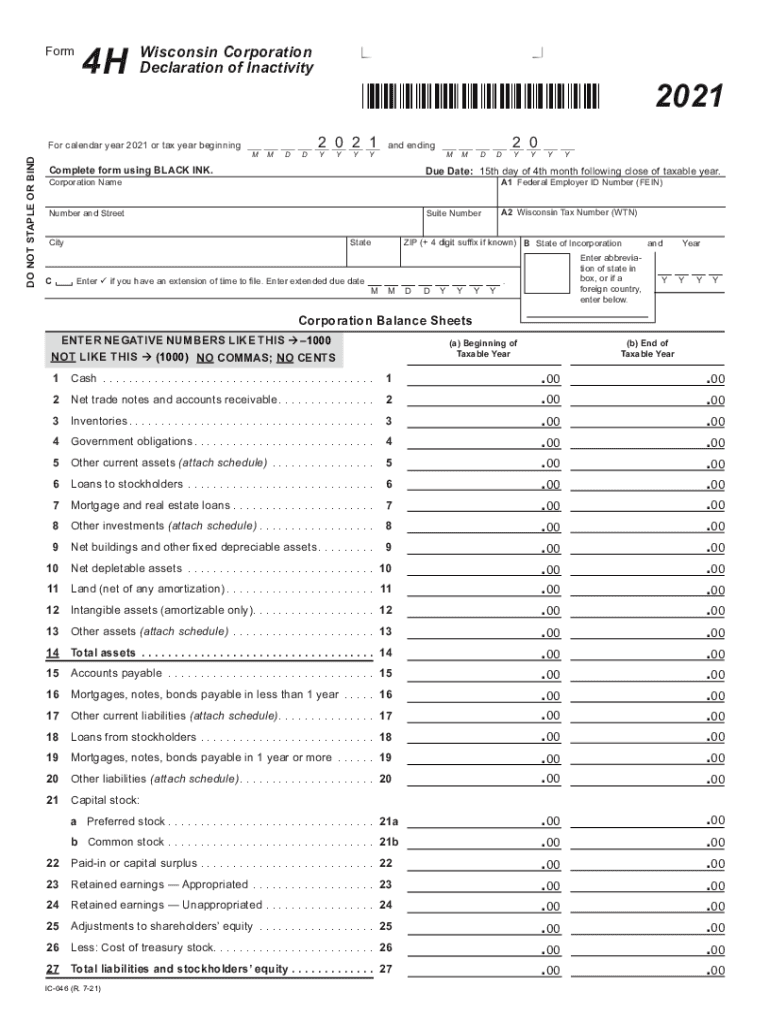

Understanding the Wisconsin Form 4H

The Wisconsin Form 4H is a crucial document used for reporting and claiming various tax credits and deductions related to agricultural activities. This form is specifically designed for farmers and agricultural businesses operating within Wisconsin. It allows them to accurately report their income, expenses, and any applicable tax benefits. Understanding the purpose and requirements of the Wisconsin Form 4H is essential for ensuring compliance with state tax regulations.

Steps to Complete the Wisconsin Form 4H

Completing the Wisconsin Form 4H involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense receipts, and any prior year tax returns. Next, carefully fill out each section of the form, ensuring that all figures are accurate and reflect your current financial situation. Pay special attention to the sections related to deductions and credits, as these can significantly impact your tax liability. After completing the form, review it thoroughly for errors before submitting it to the Wisconsin Department of Revenue.

Legal Use of the Wisconsin Form 4H

The Wisconsin Form 4H is legally binding when completed and submitted according to state guidelines. It is important to ensure that all information provided is truthful and accurate, as discrepancies can lead to penalties or audits. The form must be filed by the designated deadline to avoid late fees and maintain compliance with Wisconsin tax laws. Utilizing an electronic signature solution, like signNow, can streamline the submission process while ensuring that the document remains legally valid.

Filing Deadlines for the Wisconsin Form 4H

Filing deadlines for the Wisconsin Form 4H typically align with the state’s tax return deadlines. It is essential to submit the form by April 15 of the following tax year to avoid penalties. If additional time is needed, taxpayers may apply for an extension, but it is crucial to ensure that any taxes owed are paid by the original deadline to prevent interest and penalties from accruing.

Required Documents for the Wisconsin Form 4H

To complete the Wisconsin Form 4H accurately, several documents are required. These include:

- Income statements from agricultural activities

- Receipts for all business-related expenses

- Prior year tax returns for reference

- Any supporting documentation for tax credits claimed

Having these documents ready will facilitate a smoother filing process and help ensure compliance with state regulations.

Form Submission Methods for the Wisconsin Form 4H

The Wisconsin Form 4H can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file the form electronically using secure eSignature solutions, which can expedite processing times. Alternatively, the form can be printed and mailed directly to the Wisconsin Department of Revenue. In-person submissions are also accepted at designated state offices, providing flexibility for those who prefer face-to-face interactions.

Quick guide on how to complete ben royten wi z tab to navigate within form use mouse to

Effortlessly Prepare Ben Royten Wi z Tab To Navigate Within Form Use Mouse To on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Ben Royten Wi z Tab To Navigate Within Form Use Mouse To on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Modify and eSign Ben Royten Wi z Tab To Navigate Within Form Use Mouse To Seamlessly

- Obtain Ben Royten Wi z Tab To Navigate Within Form Use Mouse To and click Get Form to initiate.

- Utilize the tools we provide to finish your form.

- Emphasize key sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, and mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Ben Royten Wi z Tab To Navigate Within Form Use Mouse To and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ben royten wi z tab to navigate within form use mouse to

The way to make an e-signature for your PDF document in the online mode

The way to make an e-signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is a 4h form and how can airSlate SignNow help?

A 4h form is a document used for various administrative purposes, including legal and business documentation. airSlate SignNow simplifies the process of filling out and sending your 4h form by allowing you to eSign quickly and securely, making document management more efficient.

-

How much does it cost to use airSlate SignNow for 4h forms?

airSlate SignNow offers flexible pricing plans to cater to different business needs. Pricing for using airSlate SignNow to manage 4h forms starts with a free trial, after which you can choose a plan that best fits your usage and features required.

-

Can I integrate other tools with airSlate SignNow for my 4h forms?

Yes, airSlate SignNow provides seamless integrations with various software tools that enhance your document management processes. Whether you are using CRMs, cloud storage, or other applications, you can easily incorporate them to streamline your 4h form handling.

-

What are the key features of airSlate SignNow for handling 4h forms?

Key features of airSlate SignNow include easy document creation, customizable templates, and robust eSignature capabilities. These features ensure that your 4h forms are processed quickly and efficiently, improving your overall workflow.

-

How secure is airSlate SignNow in handling 4h forms?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption protocols to protect your documents, including 4h forms, ensuring that sensitive information is kept safe from unauthorized access.

-

Can I track the status of my 4h form with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your 4h forms in real-time. You will receive notifications when your document is viewed, signed, or completed, allowing you to manage your workflows effectively.

-

Is it easy to create a 4h form with airSlate SignNow?

Yes, creating a 4h form with airSlate SignNow is straightforward. You can start from scratch or use customizable templates that facilitate quick document creation, making it user-friendly for all levels of users.

Get more for Ben Royten Wi z Tab To Navigate Within Form Use Mouse To

- Warranty deed from husband and wife to llc missouri form

- Unconditional waiver release final form

- Landlord tenant notice 497313135 form

- Mo notice 497313136 form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497313137 form

- Missouri letter notice form

- Mo tenant notice form

- Letter from tenant to landlord with demand that landlord repair broken windows missouri form

Find out other Ben Royten Wi z Tab To Navigate Within Form Use Mouse To

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document