MI Form 382 Fill Out Tax Template OnlineUS

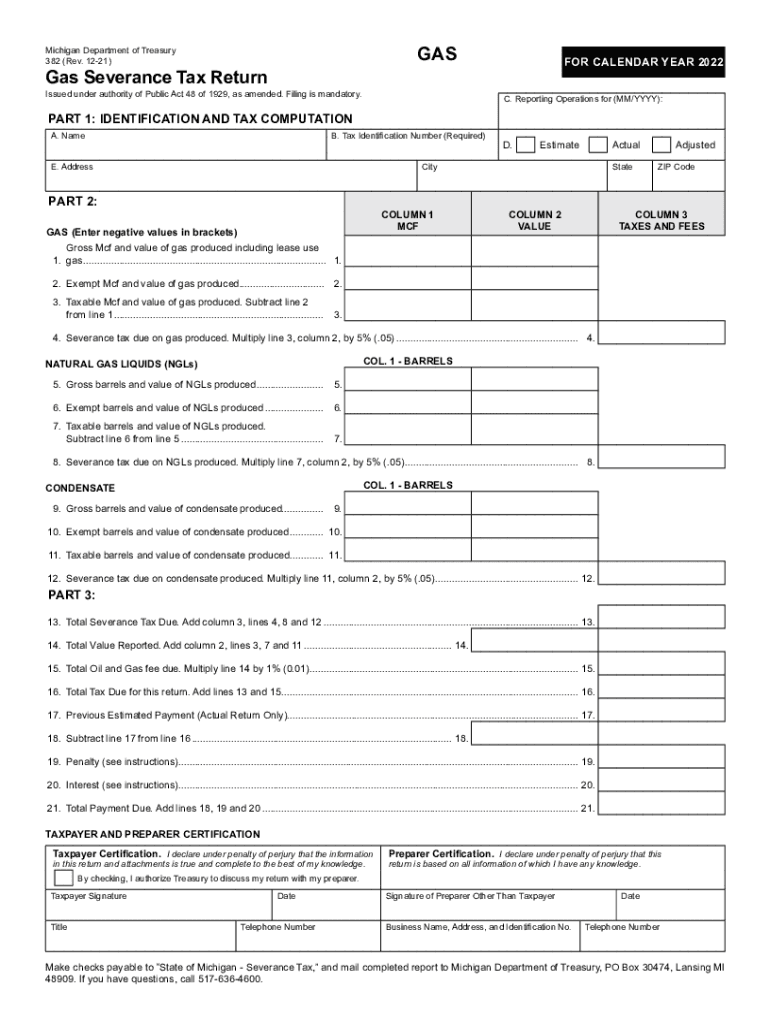

What is the MI Form 382?

The MI Form 382, also known as the Michigan Treasury 382 Return, is a tax form used by individuals and businesses in Michigan to report certain income and calculate the associated state tax obligations. This form is particularly relevant for taxpayers who have received severance payments or other specific types of income that require reporting to the Michigan Department of Treasury. Understanding the purpose and requirements of this form is essential for compliance and accurate tax reporting.

Steps to Complete the MI Form 382

Completing the MI Form 382 involves several key steps to ensure accuracy and compliance with state regulations. Follow these steps for a smooth filing process:

- Gather necessary documentation, including income statements, severance agreements, and any other relevant financial records.

- Access the MI Form 382 online or obtain a physical copy from the Michigan Department of Treasury.

- Fill out the form with accurate information, including personal details, income amounts, and any applicable deductions.

- Review the completed form for any errors or omissions before submission.

- Submit the form electronically or by mail, ensuring it is sent to the correct address as specified by the Michigan Department of Treasury.

Legal Use of the MI Form 382

The MI Form 382 is legally recognized for reporting income to the state of Michigan. It must be completed in accordance with the guidelines set forth by the Michigan Department of Treasury. Failure to accurately report income using this form can lead to penalties or legal repercussions. It is crucial to ensure that all information provided is truthful and complete to maintain compliance with state tax laws.

Key Elements of the MI Form 382

The MI Form 382 includes several important sections that taxpayers must complete. Key elements of the form typically include:

- Taxpayer Information: Personal details such as name, address, and Social Security number.

- Income Reporting: Sections to report severance payments and other relevant income sources.

- Deductions: Areas to claim any applicable deductions that may reduce taxable income.

- Signature: A declaration that the information provided is accurate, requiring the taxpayer's signature.

Filing Deadlines / Important Dates

Timely filing of the MI Form 382 is essential to avoid penalties. The deadline for submitting this form typically aligns with the state tax filing deadline, which is usually April 15 for individual taxpayers. It is important to stay informed about any changes to deadlines or additional requirements that may arise, especially during tax season.

Form Submission Methods

The MI Form 382 can be submitted through various methods to accommodate taxpayer preferences. Options include:

- Online Submission: Taxpayers can complete and submit the form electronically through the Michigan Department of Treasury's online portal.

- Mail: The completed form can be printed and mailed to the designated address provided by the state.

- In-Person: Taxpayers may also choose to deliver the form in person at local Michigan Department of Treasury offices.

Quick guide on how to complete mi form 382 2021 2022 fill out tax template onlineus

Prepare MI Form 382 Fill Out Tax Template OnlineUS easily on any device

Online document management has become popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage MI Form 382 Fill Out Tax Template OnlineUS on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign MI Form 382 Fill Out Tax Template OnlineUS effortlessly

- Locate MI Form 382 Fill Out Tax Template OnlineUS and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Highlight pertinent parts of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign MI Form 382 Fill Out Tax Template OnlineUS and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Treasury 382 return PDF?

The Treasury 382 return PDF is a specific tax form used for reporting certain types of return information to the IRS. This document is essential for businesses looking to comply with federal regulations and ensure accurate reporting. Using airSlate SignNow, you can easily fill out and eSign the Treasury 382 return PDF.

-

How can I create a Treasury 382 return PDF using airSlate SignNow?

To create a Treasury 382 return PDF with airSlate SignNow, simply upload the form to our platform. You can fill out the required fields, add your digital signature, and send it directly to recipients. Our user-friendly interface makes it easy for anyone to complete the Treasury 382 return PDF efficiently.

-

Is airSlate SignNow a cost-effective solution for eSigning documents like the Treasury 382 return PDF?

Yes, airSlate SignNow offers a cost-effective solution for eSigning documents like the Treasury 382 return PDF. Our pricing plans are designed to fit various business needs, ensuring you get the best value as you manage your document workflows. With airSlate SignNow, you save both time and resources.

-

What features does airSlate SignNow offer for managing Treasury 382 return PDFs?

airSlate SignNow provides a variety of features for managing Treasury 382 return PDFs, including customizable templates, workflow automation, and document tracking. These capabilities streamline the signing process and ensure that your documents are secured and compliant. With these features, completing the Treasury 382 return PDF has never been easier.

-

Can I integrate airSlate SignNow with other applications for my Treasury 382 return PDF?

Absolutely! airSlate SignNow offers seamless integrations with numerous applications, enabling you to manage your Treasury 382 return PDF alongside other essential tools. Whether you’re using CRMs, document storage, or communication platforms, our integrations help simplify your workflow. This connectivity enhances productivity while handling important documents.

-

What are the benefits of eSigning a Treasury 382 return PDF with airSlate SignNow?

eSigning a Treasury 382 return PDF with airSlate SignNow offers numerous benefits, including increased security, reduced turnaround time, and improved document accuracy. Additionally, our platform allows for easy storage and retrieval of signed documents, making compliance management more efficient. Businesses can also enhance their professionalism with a smooth eSigning experience.

-

Is the Treasury 382 return PDF legally binding when signed electronically with airSlate SignNow?

Yes, the Treasury 382 return PDF is legally binding when signed electronically using airSlate SignNow. Our platform complies with e-signature laws, ensuring that your signed documents are valid and enforceable. This means you can have full confidence that your electronic signatures hold the same weight as traditional signatures.

Get more for MI Form 382 Fill Out Tax Template OnlineUS

- Mississippi note form

- Mississippi deed form

- Mississippi renunciation and disclaimer of property received by intestate succession mississippi form

- Quitclaim deed by two individuals to corporation mississippi form

- Ms warranty deed 497313741 form

- Promissory note deed form

- Ms trustee form

- Deed of trust security agreement and financing statement mississippi form

Find out other MI Form 382 Fill Out Tax Template OnlineUS

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online