Tax Wv GovDocumentssstStreamlined Sales Tax Certificate of Exemption Form

Understanding the Kentucky Tax Exemption Form

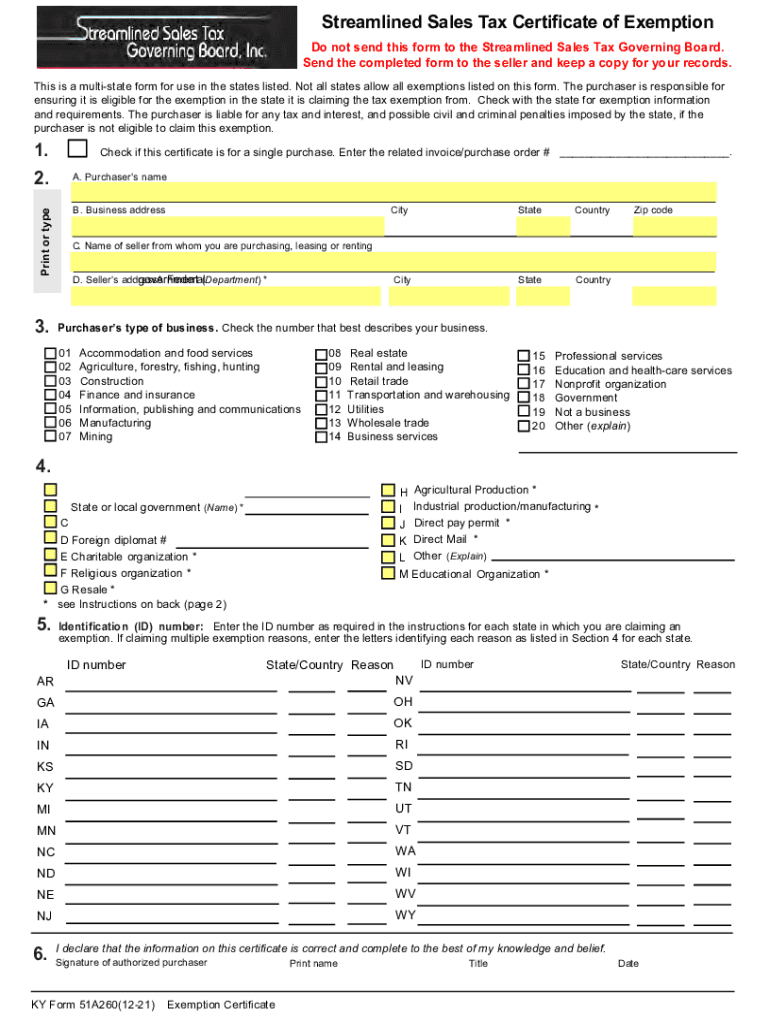

The Kentucky tax exemption form, often referred to as the Kentucky sales tax exempt form, is essential for businesses and individuals seeking to avoid paying sales tax on eligible purchases. This form allows qualifying entities, such as non-profit organizations and certain government agencies, to make tax-exempt purchases. Understanding the purpose and requirements of this form is crucial for compliance with state tax regulations.

Steps to Complete the Kentucky Tax Exemption Form

Filling out the Kentucky tax exemption form involves several clear steps to ensure accuracy and compliance. Here’s a simplified process:

- Obtain the Form: Access the Kentucky sales tax exemption form, officially known as Form 51A260, from the Kentucky Department of Revenue website or authorized sources.

- Provide Basic Information: Fill in your name, address, and contact information. If applicable, include your organization’s name and tax identification number.

- Specify the Purpose: Clearly indicate the reason for the exemption, such as being a non-profit organization or a government entity.

- List Exempt Purchases: Detail the types of purchases that will be made tax-exempt under this certificate.

- Signature and Date: Sign and date the form to validate your request for tax exemption.

Eligibility Criteria for the Kentucky Tax Exemption Form

Not all purchases qualify for tax exemption under the Kentucky tax exemption form. Eligibility typically includes:

- Non-profit organizations recognized under Section 501(c)(3) of the Internal Revenue Code.

- Government entities, including federal, state, and local agencies.

- Certain educational institutions that meet specific criteria.

It is important to review the specific eligibility requirements to ensure compliance and avoid potential penalties.

Legal Use of the Kentucky Tax Exemption Form

The Kentucky tax exemption form is legally binding when completed correctly. To ensure its validity:

- Ensure all information is accurate and up-to-date.

- Use the form solely for eligible purchases as defined by Kentucky tax law.

- Maintain a copy of the completed form for your records, as it may be required for audits or verification purposes.

Form Submission Methods

Once the Kentucky tax exemption form is completed, it can be submitted through various methods:

- Online: Some organizations may allow for electronic submission through their websites.

- Mail: Send the completed form to the appropriate Kentucky Department of Revenue address.

- In-Person: Deliver the form directly to a local revenue office for immediate processing.

Common Penalties for Non-Compliance

Failure to comply with the regulations surrounding the Kentucky tax exemption form can result in significant penalties, including:

- Back taxes owed on exempt purchases.

- Fines imposed by the Kentucky Department of Revenue.

- Potential legal action for fraudulent use of the exemption.

Understanding these penalties emphasizes the importance of accurate completion and proper use of the form.

Quick guide on how to complete taxwvgovdocumentssststreamlined sales tax certificate of exemption

Complete Tax wv govDocumentssstStreamlined Sales Tax Certificate Of Exemption effortlessly on any gadget

Digital document management has gained traction among companies and individuals alike. It offers an excellent eco-conscious substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Tax wv govDocumentssstStreamlined Sales Tax Certificate Of Exemption on any platform using airSlate SignNow's Android or iOS applications, and simplify any document-related process today.

The easiest way to modify and electronically sign Tax wv govDocumentssstStreamlined Sales Tax Certificate Of Exemption with ease

- Access Tax wv govDocumentssstStreamlined Sales Tax Certificate Of Exemption and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form—via email, text message (SMS), or invitation link, or download it directly to your computer.

Eliminate the hassles of lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Tax wv govDocumentssstStreamlined Sales Tax Certificate Of Exemption to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Kentucky tax exemption form?

The Kentucky tax exemption form is a document used by businesses and organizations in Kentucky to claim exemptions from specific taxes. Completing this form accurately is essential for ensuring that eligible entities do not pay unnecessary taxes.

-

How can airSlate SignNow help with the Kentucky tax exemption form?

airSlate SignNow provides an efficient platform for creating, signing, and managing your Kentucky tax exemption form. With our easy-to-use tools, you can ensure that all necessary signatures are collected securely and seamlessly.

-

What features does airSlate SignNow offer for managing tax exemption forms?

airSlate SignNow offers features such as customizable templates, secure eSignature capabilities, and automated workflows specifically designed for handling the Kentucky tax exemption form. These features simplify the process and enhance efficiency.

-

Is airSlate SignNow affordable for businesses needing the Kentucky tax exemption form?

Yes, airSlate SignNow offers cost-effective pricing plans tailored for businesses of all sizes. Our competitive pricing includes comprehensive features suited for managing documents like the Kentucky tax exemption form without breaking the bank.

-

Can I integrate airSlate SignNow with other software for managing tax documents?

Absolutely! airSlate SignNow integrates seamlessly with various software platforms, allowing you to manage your Kentucky tax exemption form alongside other business applications. Popular integrations include CRM systems and accounting software, enhancing your workflow.

-

How does airSlate SignNow ensure the security of the Kentucky tax exemption form?

airSlate SignNow prioritizes security with advanced encryption and compliance measures to protect the integrity of your Kentucky tax exemption form. Our platform is designed to safeguard sensitive information while maintaining ease of access.

-

What benefits does airSlate SignNow provide for using the Kentucky tax exemption form?

Using airSlate SignNow for your Kentucky tax exemption form offers numerous benefits, including faster processing times, reduced paperwork, and improved accuracy in submissions. This allows businesses to focus more on their core operations.

Get more for Tax wv govDocumentssstStreamlined Sales Tax Certificate Of Exemption

Find out other Tax wv govDocumentssstStreamlined Sales Tax Certificate Of Exemption

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease