Get the Where to Mail 740v Ky Tax Form Revenue Ky

Understanding the 2021 Kentucky Voucher

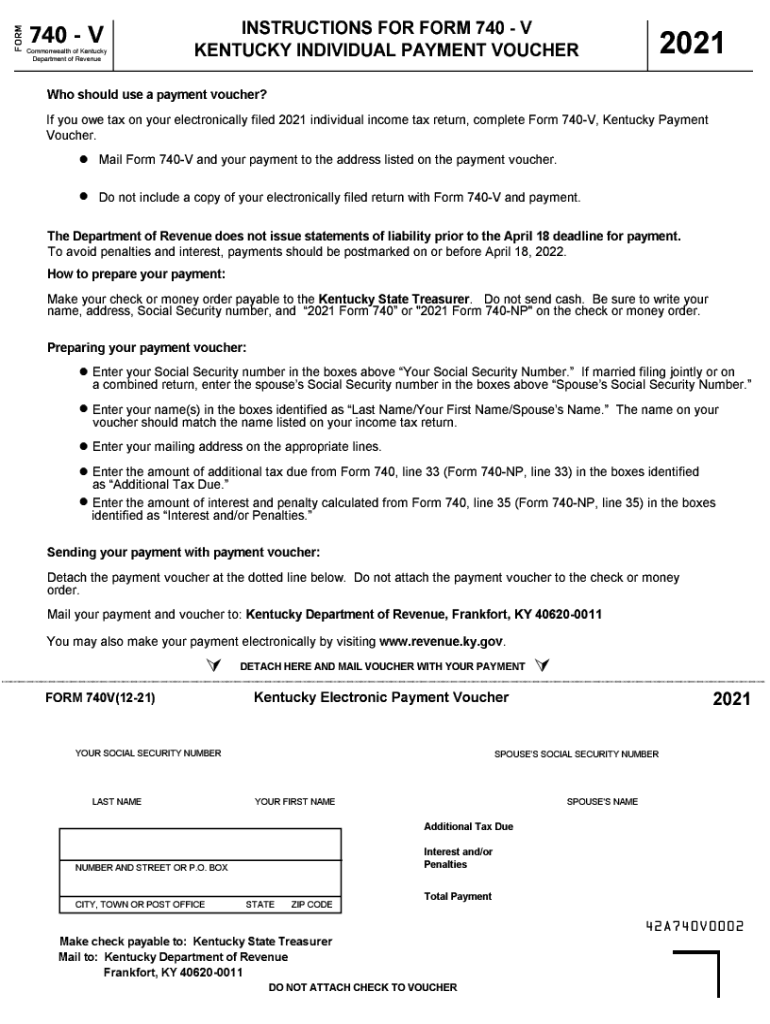

The 2021 Kentucky voucher, also known as the 2021 740v form, is a critical document for individuals filing their state income taxes. This form serves as a payment voucher, allowing taxpayers to submit their tax payments directly to the Kentucky Department of Revenue. It is essential for ensuring that payments are processed accurately and on time. Understanding the purpose and requirements of this form can help taxpayers avoid penalties and ensure compliance with state tax laws.

Steps to Complete the 2021 Kentucky Voucher

Completing the 2021 Kentucky voucher involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including your Social Security number, tax year, and payment amount.

- Fill out the form with your personal details, ensuring all information is accurate and legible.

- Calculate the total amount due and verify it against your records.

- Sign and date the voucher to validate your submission.

- Keep a copy of the completed voucher for your records.

Form Submission Methods for the 2021 Kentucky Voucher

The 2021 Kentucky voucher can be submitted through various methods, providing flexibility for taxpayers:

- Online Submission: Taxpayers can submit payments electronically through the Kentucky Department of Revenue's online portal.

- Mail: Completed vouchers can be mailed to the appropriate address specified by the Kentucky Department of Revenue.

- In-Person: Payments can also be made in person at designated state revenue offices.

Legal Use of the 2021 Kentucky Voucher

The 2021 Kentucky voucher is legally binding when completed and submitted according to state regulations. It is essential to ensure that the form is filled out accurately, as errors can lead to delays in processing or penalties. The voucher must be signed by the taxpayer, affirming the accuracy of the information provided. Compliance with the Kentucky Department of Revenue guidelines is crucial to avoid any legal issues.

Filing Deadlines for the 2021 Kentucky Voucher

Timely submission of the 2021 Kentucky voucher is vital to avoid penalties. The filing deadline typically aligns with the federal tax deadline, which is usually April 15. However, taxpayers should verify specific dates for the current tax year, as extensions or changes may apply. It is advisable to submit the voucher well before the deadline to ensure processing and avoid last-minute complications.

Key Elements of the 2021 Kentucky Voucher

When completing the 2021 Kentucky voucher, several key elements must be included:

- Taxpayer Information: Full name, address, and Social Security number.

- Payment Amount: Total amount being submitted for the tax year.

- Tax Year: Indicate the tax year for which the payment is being made.

- Signature: Required to validate the submission.

Quick guide on how to complete get the free where to mail 740v ky tax form revenue ky

Effortlessly Prepare Get The Where To Mail 740v Ky Tax Form Revenue Ky on Any Device

Managing documents online has gained increasing popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents swiftly without interruptions. Handle Get The Where To Mail 740v Ky Tax Form Revenue Ky on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered process today.

The easiest method to modify and eSign Get The Where To Mail 740v Ky Tax Form Revenue Ky with ease

- Find Get The Where To Mail 740v Ky Tax Form Revenue Ky and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with the tools airSlate SignNow supplies specifically for those tasks.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Get The Where To Mail 740v Ky Tax Form Revenue Ky to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 2021 Kentucky voucher program?

The 2021 Kentucky voucher program is designed to provide financial assistance to eligible families for educational expenses. It allows parents to use vouchers to choose the best educational options for their children, including private schools or homeschooling resources. Understanding the 2021 Kentucky voucher can help you make informed decisions regarding your child's education.

-

How can I apply for a 2021 Kentucky voucher?

To apply for a 2021 Kentucky voucher, you need to fulfill specific eligibility criteria set forth by the state. The application process typically involves submitting required documentation to your local education authority. Make sure to check the deadlines to ensure you successfully apply for the 2021 Kentucky voucher before they close.

-

What are the benefits of using the 2021 Kentucky voucher?

The 2021 Kentucky voucher offers several benefits, such as increased parental choice in education and financial support for underserved families. This program enables families to personalize their children's education based on individual needs and preferences. Leveraging the 2021 Kentucky voucher can greatly enhance educational outcomes for eligible children.

-

Are there any specific requirements for the 2021 Kentucky voucher?

Yes, there are specific requirements for the 2021 Kentucky voucher, including income limits and residency criteria. Families must demonstrate financial need and reside in Kentucky to be eligible. Understanding these requirements is essential to ensuring your eligibility for the 2021 Kentucky voucher.

-

What types of educational institutions accept the 2021 Kentucky voucher?

The 2021 Kentucky voucher can typically be used at various educational institutions, including private schools, charter schools, and certain homeschooling programs. However, not all institutions may participate in the program, so it's important to verify acceptance before enrolling. Researching these options can help you maximize the benefits of the 2021 Kentucky voucher.

-

How does the 2021 Kentucky voucher impact school funding?

The 2021 Kentucky voucher has the potential to shift funding from public schools to participating private institutions. This can create both advantages and challenges within the educational landscape, particularly in terms of resource allocation. Understanding the implications of the 2021 Kentucky voucher can provide insights into the broader effects on school funding.

-

What documents do I need to gather for the 2021 Kentucky voucher application?

For the 2021 Kentucky voucher application, you may need to gather documents such as proof of income, residency verification, and previous school records. It's advisable to check any specific document requirements in advance to ensure a smooth application process. Having all necessary paperwork prepared will help speed up your 2021 Kentucky voucher application.

Get more for Get The Where To Mail 740v Ky Tax Form Revenue Ky

Find out other Get The Where To Mail 740v Ky Tax Form Revenue Ky

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed