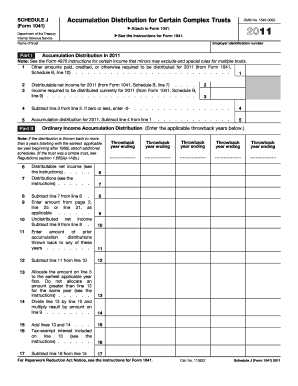

Form 1041 Schedule J Forms

What is the Form 1041 Schedule J Forms

The Form 1041 Schedule J is a tax form used in the United States by estates and trusts to calculate and report income distribution deductions. This schedule is an attachment to Form 1041, which is the U.S. Income Tax Return for Estates and Trusts. The purpose of Schedule J is to allow fiduciaries to determine the amount of income that can be distributed to beneficiaries, thereby reducing the taxable income of the estate or trust. Understanding this form is essential for proper tax compliance and effective estate planning.

How to use the Form 1041 Schedule J Forms

Using the Form 1041 Schedule J involves several steps. First, the fiduciary must gather all relevant financial information regarding the estate or trust, including income and distributions made to beneficiaries. Next, the fiduciary fills out the form by providing details such as the total income of the estate or trust and the amounts distributed to beneficiaries. This information enables the fiduciary to calculate the income distribution deduction, which can significantly impact the overall tax liability. Once completed, the form should be submitted alongside Form 1041 to the IRS.

Steps to complete the Form 1041 Schedule J Forms

Completing the Form 1041 Schedule J requires careful attention to detail. Follow these steps for accurate completion:

- Gather all financial documents related to the estate or trust.

- Determine the total income earned by the estate or trust during the tax year.

- Calculate the total distributions made to beneficiaries.

- Fill in the required fields on Schedule J, including income and distribution amounts.

- Calculate the income distribution deduction based on the information provided.

- Review the completed form for accuracy before submission.

Legal use of the Form 1041 Schedule J Forms

The legal use of the Form 1041 Schedule J is critical for ensuring compliance with IRS regulations. This form must be filled out accurately to reflect the true financial activities of the estate or trust. Failure to comply with the requirements can lead to penalties and interest on unpaid taxes. Additionally, the fiduciary must ensure that all distributions are documented and that the form is submitted by the appropriate deadlines to avoid any legal complications.

Filing Deadlines / Important Dates

Filing deadlines for Form 1041 and Schedule J are crucial for compliance. Generally, the due date for filing Form 1041 is the fifteenth day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year basis, this typically falls on April fifteenth. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is important to keep track of these dates to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

Form 1041 Schedule J can be submitted to the IRS through various methods. The most common submission methods include:

- Online filing through approved tax software that supports Form 1041 and Schedule J.

- Mailing a paper copy of the completed form to the appropriate IRS address based on the estate or trust's location.

- In-person submission at designated IRS offices, although this method is less common.

Quick guide on how to complete 2011 form 1041 schedule j forms

Complete [SKS] seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed paperwork, as you can easily find the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to edit and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and carries the same legal weight as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure exceptional communication at all stages of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1041 Schedule J Forms

Create this form in 5 minutes!

How to create an eSignature for the 2011 form 1041 schedule j forms

The way to make an e-signature for a PDF document in the online mode

The way to make an e-signature for a PDF document in Chrome

The way to generate an e-signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The way to make an e-signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What are Form 1041 Schedule J Forms?

Form 1041 Schedule J Forms are used to determine the income distribution to beneficiaries for estates and trusts. This form helps in calculating the income tax liability based on the income accumulated during the tax year. By utilizing airSlate SignNow for your Form 1041 Schedule J Forms, you can ensure accurate and efficient preparation and submission.

-

How can airSlate SignNow assist with Form 1041 Schedule J Forms?

With airSlate SignNow, you can easily create, customize, and eSign your Form 1041 Schedule J Forms online. The platform provides templates and features that streamline the completion process, ensuring that the forms are filled out correctly and efficiently. It's an effective solution for both individuals and professionals handling estate and trust tax returns.

-

Is there a cost associated with using airSlate SignNow for Form 1041 Schedule J Forms?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. The cost is structured to provide value based on the number of users and features you require. By opting for airSlate SignNow, you gain access to a cost-effective solution for managing your Form 1041 Schedule J Forms efficiently.

-

What features does airSlate SignNow offer for Form 1041 Schedule J Forms?

airSlate SignNow offers a variety of features for Form 1041 Schedule J Forms, including document templates, secure eSigning, and cloud storage. Additionally, users can track document status and set reminders for deadlines. These features enhance the overall user experience and ensure smooth handling of your tax obligations.

-

Are there any integrations available with airSlate SignNow for managing Form 1041 Schedule J Forms?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to import and export your Form 1041 Schedule J Forms effortlessly. You can connect with popular software like Google Drive, Dropbox, and many others to streamline your document management. This integration greatly enhances productivity for users who frequently deal with tax forms.

-

Can multiple users collaborate on Form 1041 Schedule J Forms using airSlate SignNow?

Absolutely! airSlate SignNow supports collaboration, allowing multiple users to work on Form 1041 Schedule J Forms simultaneously. This feature is particularly beneficial for teams and professionals looking to manage tax documentation efficiently. With real-time updates, everyone involved stays aligned throughout the process.

-

How secure is the information handled with airSlate SignNow for Form 1041 Schedule J Forms?

Security is a top priority for airSlate SignNow. The platform employs strong encryption and robust security measures to protect your data while completing your Form 1041 Schedule J Forms. Users can feel confident that their sensitive tax information is safe during document management and eSigning.

Get more for Form 1041 Schedule J Forms

Find out other Form 1041 Schedule J Forms

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple