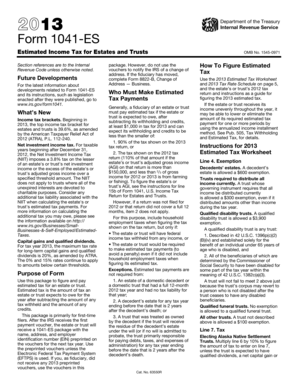

Form 1041 ES Internal Revenue Service

What is the Form 1041 ES Internal Revenue Service

The Form 1041 ES is a tax form used by estates and trusts to make estimated tax payments to the Internal Revenue Service (IRS). This form is essential for fiduciaries who are responsible for managing the financial affairs of an estate or trust. The estimated payments help ensure that the estate or trust meets its tax obligations throughout the year, rather than waiting until the annual tax return is filed. Understanding the purpose and requirements of Form 1041 ES is crucial for compliance with federal tax regulations.

How to use the Form 1041 ES Internal Revenue Service

Using the Form 1041 ES involves a few straightforward steps. First, the fiduciary must determine the estimated tax liability for the estate or trust. This estimation is based on the income expected to be generated during the tax year. Once the estimated tax is calculated, the fiduciary can complete the form, providing necessary information such as the estate or trust name, address, and Employer Identification Number (EIN). After filling out the form, the fiduciary submits it along with the estimated tax payments to the IRS by the specified deadlines.

Steps to complete the Form 1041 ES Internal Revenue Service

Completing the Form 1041 ES requires careful attention to detail. Here are the steps to follow:

- Gather financial information related to the estate or trust, including income sources and deductions.

- Calculate the estimated tax liability based on the projected income.

- Fill out the Form 1041 ES with the required information, including the estate or trust name and EIN.

- Determine the payment amounts and due dates for the estimated taxes.

- Submit the completed form and payments to the IRS by the deadlines specified for estimated taxes.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1041 ES are crucial for avoiding penalties. Generally, estimated tax payments are due on the 15th day of April, June, September, and January of the following year. It is important to keep track of these dates to ensure timely submissions. The IRS provides specific guidelines regarding any adjustments to these dates, especially if they fall on a weekend or holiday.

Legal use of the Form 1041 ES Internal Revenue Service

The legal use of the Form 1041 ES is governed by IRS regulations. The form must be completed accurately and submitted on time to avoid penalties. The IRS requires that fiduciaries maintain proper records of all estimated tax payments made on behalf of the estate or trust. This documentation is essential in case of an audit or review by the IRS. Compliance with these legal requirements ensures that the estate or trust remains in good standing with tax obligations.

Penalties for Non-Compliance

Failure to comply with the requirements of the Form 1041 ES can result in significant penalties. These may include fines for late payments, interest on unpaid taxes, and potential legal consequences for the fiduciary. It is important for fiduciaries to understand the implications of non-compliance and to take proactive steps to ensure that all estimated tax payments are made accurately and on time.

Quick guide on how to complete 2013 form 1041 es internal revenue service 39931831

Complete [SKS] seamlessly on any device

Virtual document management has become favored by companies and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your alterations.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1041 ES Internal Revenue Service

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 1041 es internal revenue service 39931831

The way to make an e-signature for your PDF document online

The way to make an e-signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is Form 1041 ES and how does it relate to the Internal Revenue Service?

Form 1041 ES is an estimated tax payment form specifically designed for trusts and estates, and is submitted to the Internal Revenue Service (IRS). This form allows fiduciaries to report and pay estimated taxes on the income earned during the year. Understanding how to properly use Form 1041 ES is crucial for compliance with IRS requirements.

-

How can airSlate SignNow assist with completing Form 1041 ES for the Internal Revenue Service?

airSlate SignNow offers an efficient way to manage and eSign Form 1041 ES digitally. Our platform streamlines the document workflow, allowing users to quickly fill out, sign, and send Form 1041 ES to the Internal Revenue Service with ease. This not only saves time but also ensures that your tax documents are submitted in a professional manner.

-

What are the benefits of using airSlate SignNow for Form 1041 ES submissions?

By using airSlate SignNow for Form 1041 ES submissions, you gain access to a user-friendly interface and secure eSignature options. This enhances efficiency by reducing the need for physical paperwork and allows for faster processing. Additionally, our platform ensures compliance with the Internal Revenue Service guidelines, minimizing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for Form 1041 ES?

Yes, airSlate SignNow offers various pricing plans to fit different business needs. Our plans are competitively priced and designed to provide signNow value, especially for those frequently handling forms like Form 1041 ES for the Internal Revenue Service. We also offer free trials so you can explore our features before making a commitment.

-

Can airSlate SignNow integrate with other tax software when filing Form 1041 ES?

Absolutely! airSlate SignNow seamlessly integrates with various tax software solutions, ensuring a smooth workflow for filing Form 1041 ES. This means you can import necessary tax data directly into your forms and submit them to the Internal Revenue Service without any hassle, enhancing productivity and accuracy.

-

What features does airSlate SignNow offer to simplify the process of filing Form 1041 ES?

Our platform provides features such as document templates, automated reminders, and a secure signing process that simplifies filing Form 1041 ES. With these tools, users can ensure that all necessary information is captured correctly and submitted to the Internal Revenue Service on time, allowing for a more efficient tax process.

-

How does eSigning Form 1041 ES with airSlate SignNow work?

eSigning Form 1041 ES with airSlate SignNow is a straightforward process. Users can upload their filled-out form electronically, add signers, and send it for signature. The internal revenue service accepts electronically signed documents, ensuring your Form 1041 ES is legally binding and quickly processed.

Get more for Form 1041 ES Internal Revenue Service

Find out other Form 1041 ES Internal Revenue Service

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter