Tax Table Revenue Alabama Form

What is the Tax Table Revenue Alabama

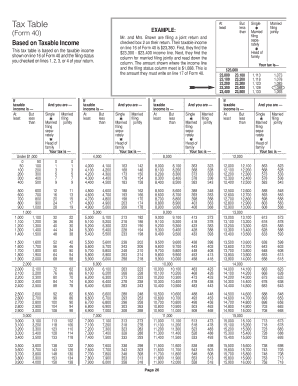

The Tax Table Revenue Alabama is a crucial document used by individuals and businesses to determine their tax obligations in the state of Alabama. It provides a structured overview of the various tax rates applicable based on income levels. This table is essential for ensuring compliance with state tax regulations and helps taxpayers accurately calculate the amount owed to the state. Understanding this table is vital for effective financial planning and tax preparation.

How to Use the Tax Table Revenue Alabama

Using the Tax Table Revenue Alabama involves a straightforward process. Taxpayers should first identify their income level from the table, which is organized into various brackets. Each bracket corresponds to a specific tax rate. After locating the appropriate bracket, taxpayers can calculate their tax liability by applying the rate to their taxable income. It is important to refer to the most current version of the table to ensure accuracy in calculations.

Steps to Complete the Tax Table Revenue Alabama

Completing the Tax Table Revenue Alabama requires several key steps:

- Gather your financial documents, including income statements and any deductions.

- Locate the most recent version of the Tax Table Revenue Alabama.

- Identify your income level and find the corresponding tax bracket.

- Apply the tax rate from the table to your taxable income.

- Calculate any additional taxes or credits that may apply.

Following these steps ensures that you accurately determine your tax liability and remain compliant with state regulations.

Legal Use of the Tax Table Revenue Alabama

The legal use of the Tax Table Revenue Alabama is governed by state tax laws. Taxpayers must ensure they are using the correct version of the table, as outdated information may lead to incorrect tax calculations. Compliance with the tax table is essential for avoiding penalties and ensuring that all tax obligations are met. The table serves as an official guideline recognized by the Alabama Department of Revenue.

State-Specific Rules for the Tax Table Revenue Alabama

Alabama has specific rules that govern the use of the Tax Table Revenue Alabama. These rules include:

- Income thresholds that determine tax brackets.

- Applicable deductions and credits that may affect tax liability.

- Filing requirements and deadlines specific to Alabama residents.

Understanding these state-specific rules helps taxpayers navigate their obligations effectively and avoid common pitfalls.

Examples of Using the Tax Table Revenue Alabama

Examples of using the Tax Table Revenue Alabama can help clarify its application:

- If a taxpayer has a taxable income of $50,000, they would locate the corresponding bracket in the tax table to determine their tax rate.

- A self-employed individual may need to consider additional taxes, such as self-employment tax, alongside the rates in the tax table.

These examples illustrate how the tax table functions in various scenarios, aiding in accurate tax calculations.

Quick guide on how to complete tax table revenue alabama

Effortlessly prepare Tax Table Revenue Alabama on any device

The management of online documents has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Handle Tax Table Revenue Alabama on any device using airSlate SignNow apps for Android or iOS and streamline any document-related tasks today.

Edit and electronically sign Tax Table Revenue Alabama easily

- Find Tax Table Revenue Alabama and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with the tools airSlate SignNow provides for this specific purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to share your form, such as email, SMS, or invitation link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Tax Table Revenue Alabama and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax table revenue alabama

How to generate an e-signature for your PDF document online

How to generate an e-signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is the Tax Table Revenue Alabama and how does it affect my business?

The Tax Table Revenue Alabama is a guide that outlines the tax rates applicable to various business transactions in Alabama. Understanding this table is crucial for businesses to ensure compliance and optimize their tax liabilities. Utilizing tools like airSlate SignNow can help streamline document management related to tax obligations, making it easier to maintain accurate records.

-

How can airSlate SignNow assist with managing tax documents related to the Tax Table Revenue Alabama?

airSlate SignNow simplifies the signing and management of tax documents, ensuring that you can efficiently handle forms that pertain to the Tax Table Revenue Alabama. With electronic signatures and secure document storage, you can organize your tax documents in one place, reducing the risk of errors and non-compliance. This helps businesses remain organized and focused on their growth.

-

What are the pricing options for using airSlate SignNow for tax-related documents?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs. You can choose from different packages that include features ideal for handling tax-related documents, including those associated with the Tax Table Revenue Alabama. This cost-effective solution ensures that all your signing and document management requirements are covered without breaking the bank.

-

Are there any integrations available with airSlate SignNow that can help manage tax documentation?

Yes, airSlate SignNow integrates seamlessly with various platforms that can enhance your tax documentation process. These integrations enable businesses to connect their financial software with airSlate SignNow to ensure consistency and accuracy in relation to the Tax Table Revenue Alabama. This interconnected approach streamlines data flow and reduces potential errors in tax filings.

-

What features does airSlate SignNow offer to streamline the tax document signing process?

airSlate SignNow provides essential features such as customizable signing workflows, templates for tax documents, and automated reminders. These features are particularly beneficial for businesses dealing with the Tax Table Revenue Alabama, as they help ensure timely and compliant submissions. The intuitive interface also makes the eSigning process easy for all parties involved.

-

Can airSlate SignNow help me track tax documents related to the Tax Table Revenue Alabama?

Absolutely! airSlate SignNow includes document tracking features, allowing you to see the status of tax documents in real-time. This is especially useful for managing compliance with the Tax Table Revenue Alabama, as it ensures you are aware of any outstanding documents. The ability to track progress helps mitigate the risk of missed deadlines.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security with robust encryption and compliance with industry regulations. This ensures that all documents, including those related to the Tax Table Revenue Alabama, are handled with the utmost care. You can have peace of mind knowing that sensitive information is protected during the signing and storage process.

Get more for Tax Table Revenue Alabama

Find out other Tax Table Revenue Alabama

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple