Federal Income Tax Deduction Worksheet Standard Deduction Revenue Alabama Form

Understanding the Federal Income Tax Deduction Worksheet

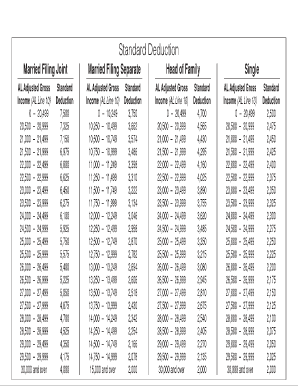

The Federal Income Tax Deduction Worksheet is a crucial tool for taxpayers in the United States, particularly when determining the standard deduction for the 2024 tax year. This worksheet helps individuals calculate their eligibility for the standard deduction, which reduces taxable income. The standard deduction amount varies based on filing status, age, and whether the taxpayer is blind. For 2024, it is essential to refer to the latest IRS guidelines to ensure accurate calculations.

Steps to Complete the Federal Income Tax Deduction Worksheet

Completing the Federal Income Tax Deduction Worksheet involves several steps:

- Gather necessary documents, including your income statements and previous tax returns.

- Identify your filing status, as this affects the standard deduction amount.

- Follow the instructions on the worksheet, filling in your total income and any adjustments.

- Calculate your adjusted gross income (AGI) and determine your eligibility for the standard deduction.

- Review your entries for accuracy before finalizing your calculations.

IRS Guidelines for the Standard Deduction in 2024

The IRS provides specific guidelines regarding the standard deduction for the 2024 tax year. Taxpayers should be aware of the following:

- The standard deduction amounts are adjusted annually for inflation.

- Different amounts apply based on filing status: single, married filing jointly, married filing separately, and head of household.

- Taxpayers aged sixty-five or older or those who are blind may qualify for a higher deduction.

Eligibility Criteria for the Standard Deduction

To qualify for the standard deduction in 2024, taxpayers must meet specific eligibility criteria:

- Must be a U.S. citizen or resident alien for the entire year.

- Cannot be claimed as a dependent on someone else's tax return.

- Must choose between the standard deduction and itemizing deductions, as both cannot be claimed simultaneously.

Filing Deadlines for Tax Returns

Understanding the filing deadlines is essential for taxpayers. For the 2024 tax year, the following dates are important:

- The deadline for filing individual tax returns is typically April fifteenth.

- Taxpayers can request an extension, but any owed taxes must be paid by the original deadline to avoid penalties.

Form Submission Methods

Taxpayers can submit their completed Federal Income Tax Deduction Worksheet through various methods:

- Online submission through the IRS e-file system, which is secure and efficient.

- Mailing a paper return to the appropriate IRS address, based on the taxpayer's location.

- In-person submission at designated IRS offices, though appointments may be required.

Quick guide on how to complete 2024 standard deduction chart

Complete 2024 standard deduction chart seamlessly on any device

Managing documents online has gained traction among businesses and users alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the correct format and securely maintain it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage standard deduction 2024 on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

Ways to alter and eSign signnow com fill and sign pdf form effortlessly

- Find standard deduction chart 2024 and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive details with features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all information thoroughly and then click the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from your preferred device. Alter and eSign 2024 standard deduction to ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to alabama state tax form 2024

Create this form in 5 minutes!

How to create an eSignature for the 2024 standard deduction worksheet for dependents

How to make an electronic signature for a PDF in the online mode

How to make an electronic signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

How to make an electronic signature from your smart phone

The best way to generate an e-signature for a PDF on iOS devices

How to make an electronic signature for a PDF file on Android OS

People also ask alabama standard deduction

-

What is the standard deduction for 2024?

The standard deduction for 2024 is signNowly set to help taxpayers reduce their taxable income. For single filers, it will be increased, ensuring that individuals can benefit from a higher amount before taxes are calculated. It's an important aspect to consider when planning your financial year.

-

How can airSlate SignNow help with tax document management regarding the standard deduction 2024?

AirSlate SignNow streamlines the process of sending and eSigning tax documents, making it easy to prepare for the standard deduction 2024. With our platform, you can ensure that all your tax-related documents are accurately signed and submitted on time. This efficiency helps avoid any last-minute issues during tax season.

-

What features does airSlate SignNow offer for managing tax documents?

Our platform includes features such as template creation, document tracking, and secure eSigning, all tailored for efficiency. These tools can simplify the management of documents related to the standard deduction 2024, enabling you to focus on maximizing your tax benefits. The ease of use also means less time spent on paperwork.

-

Is airSlate SignNow cost-effective for small businesses looking at standard deduction 2024?

Yes, airSlate SignNow offers a cost-effective solution for businesses of all sizes, providing essential features without breaking the bank. This affordability is particularly beneficial for small businesses aiming to optimize their tax strategies around the standard deduction 2024. Investing in our service can lead to signNow time and cost savings.

-

Can airSlate SignNow integrate with accounting software to manage the standard deduction 2024?

Absolutely! AirSlate SignNow seamlessly integrates with popular accounting software to help manage your finances and prepare for the standard deduction 2024. This integration allows for easy transfer of documents and information, ensuring a smooth and efficient tax filing process.

-

What benefits does airSlate SignNow provide for tax professionals regarding the standard deduction 2024?

For tax professionals, airSlate SignNow enhances client service through efficient document management and secure eSignatures. This capability allows tax experts to focus on providing strategic advice and maximizing their clients' benefits for the standard deduction 2024. Our tools are designed to facilitate a hassle-free experience.

-

How does airSlate SignNow ensure the security of documents pertaining to the standard deduction 2024?

Security is a top priority for airSlate SignNow, which employs advanced encryption and compliance measures to safeguard your documents. When managing sensitive tax-related materials such as those for the standard deduction 2024, you can trust that your information is protected. Our secure platform helps you maintain confidentiality and peace of mind.

Get more for standard deduction worksheet

Find out other irs publication 17 pdf

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement