Layout 1 Investment Interest Expense Deduction Blank Form

What is the Layout 1 Investment Interest Expense Deduction Blank

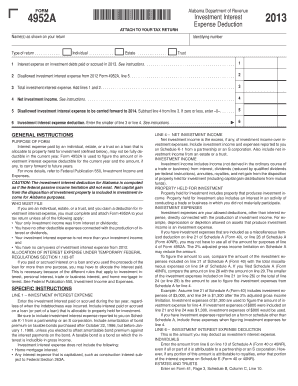

The Layout 1 Investment Interest Expense Deduction Blank is a specific form used by taxpayers to report and deduct investment interest expenses on their federal income tax returns. This form allows individuals and businesses to claim a deduction for interest paid on loans used to purchase taxable investments. Understanding this form is essential for ensuring accurate tax reporting and maximizing potential deductions.

How to use the Layout 1 Investment Interest Expense Deduction Blank

Using the Layout 1 Investment Interest Expense Deduction Blank involves several key steps. First, gather all relevant financial documents, including records of interest paid on loans for investment purposes. Next, accurately fill out the form by entering the required information, such as the total amount of investment interest expense and any carryover amounts from previous years. Once completed, the form should be included with your tax return when filing.

Steps to complete the Layout 1 Investment Interest Expense Deduction Blank

Completing the Layout 1 Investment Interest Expense Deduction Blank requires careful attention to detail. Follow these steps:

- Gather necessary documentation, including interest statements and investment records.

- Enter your personal information at the top of the form, including your name and Social Security number.

- Input the total amount of interest paid on investments during the tax year.

- Calculate any carryover amounts from previous years, if applicable.

- Review the completed form for accuracy before submission.

Legal use of the Layout 1 Investment Interest Expense Deduction Blank

The legal use of the Layout 1 Investment Interest Expense Deduction Blank is governed by IRS regulations. To be considered valid, the form must be filled out accurately and submitted alongside your tax return. It is essential to retain copies of all supporting documentation, as the IRS may request these during an audit. Compliance with all relevant tax laws is crucial to avoid penalties and ensure the legitimacy of your deductions.

Filing Deadlines / Important Dates

Filing deadlines for the Layout 1 Investment Interest Expense Deduction Blank align with the standard tax return deadlines. Typically, individual tax returns are due on April 15 each year. If you require an extension, you may file for an extension, but the payment of any taxes owed is still due by the original deadline. Keeping track of these dates is vital to avoid late fees and ensure timely processing of your tax return.

Examples of using the Layout 1 Investment Interest Expense Deduction Blank

Examples of using the Layout 1 Investment Interest Expense Deduction Blank include scenarios where an individual has taken out a loan to invest in stocks or bonds. For instance, if a taxpayer borrows money to purchase shares in a corporation and pays interest on that loan, they can report this interest expense on the form. Another example is a business that incurs interest on a loan used to acquire investment property, which can also be deducted using this form.

Quick guide on how to complete layout 1 investment interest expense deduction blank

Complete [SKS] seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or conceal sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text (SMS), invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Revise and eSign [SKS] and ensure excellent communication at every step of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Layout 1 Investment Interest Expense Deduction Blank

Create this form in 5 minutes!

How to create an eSignature for the layout 1 investment interest expense deduction blank

How to make an electronic signature for your PDF online

How to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to create an e-signature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The best way to create an e-signature for a PDF on Android

People also ask

-

What is the Layout 1 Investment Interest Expense Deduction Blank?

The Layout 1 Investment Interest Expense Deduction Blank is a customizable document designed to help individuals and businesses deduct investment interest expenses on their tax returns. This form streamlines the deduction process, ensuring accuracy and compliance with tax regulations. By utilizing this blank template, users can effectively manage their investment interest expenses.

-

How can airSlate SignNow help with the Layout 1 Investment Interest Expense Deduction Blank?

AirSlate SignNow provides a user-friendly platform for sending and signing the Layout 1 Investment Interest Expense Deduction Blank securely. With our electronic signature feature, you can ensure that all necessary parties have authorized their consent digitally. This improves efficiency and maintain records that are easily accessible.

-

Is the Layout 1 Investment Interest Expense Deduction Blank customizable?

Yes, the Layout 1 Investment Interest Expense Deduction Blank can be easily customized to meet specific needs. AirSlate SignNow allows users to modify fields, add logos, and adjust layouts, making it a versatile tool for various investment scenarios. Customization ensures that all relevant details are accurately captured.

-

What pricing options does airSlate SignNow offer for using the Layout 1 Investment Interest Expense Deduction Blank?

AirSlate SignNow offers competitive pricing plans that cater to different business needs. You can choose from monthly or annual subscriptions, with a focus on affordability while accessing essential features like the Layout 1 Investment Interest Expense Deduction Blank. For detailed pricing, visit our website to view current options.

-

Does the Layout 1 Investment Interest Expense Deduction Blank integrate with other software?

Absolutely! The Layout 1 Investment Interest Expense Deduction Blank seamlessly integrates with various accounting and document management software. Integrating with tools you already use will enhance productivity and maintain accurate records. AirSlate SignNow supports popular applications to ensure a smooth workflow.

-

What are the key benefits of using the Layout 1 Investment Interest Expense Deduction Blank?

Using the Layout 1 Investment Interest Expense Deduction Blank simplifies the process of claiming investment interest expenses, reducing the risk of errors. It allows businesses and individuals to maintain compliance easily and enhances document security and tracking when used with airSlate SignNow. These benefits ultimately save time and improve organization.

-

Can I share the Layout 1 Investment Interest Expense Deduction Blank with multiple recipients?

Yes, airSlate SignNow allows you to share the Layout 1 Investment Interest Expense Deduction Blank with multiple recipients simultaneously. This feature ensures that all relevant stakeholders can review and sign the document in one go, streamlining communication and approvals. The process is designed to be efficient and straightforward.

Get more for Layout 1 Investment Interest Expense Deduction Blank

Find out other Layout 1 Investment Interest Expense Deduction Blank

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure