D& E Revenue Alabama Form

What is the D & E Revenue Alabama

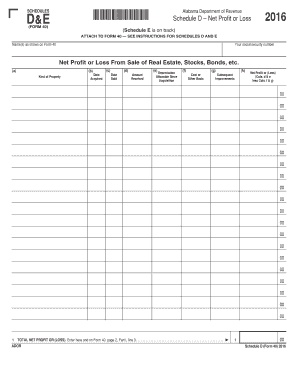

The D & E Revenue Alabama form is a specific document used for tax purposes within the state of Alabama. It is primarily utilized by businesses to report their revenue and calculate any applicable taxes owed to the state. This form is essential for maintaining compliance with Alabama's tax regulations and ensuring that businesses fulfill their financial obligations accurately. Understanding the purpose and requirements of this form is crucial for business owners to avoid penalties and ensure proper tax reporting.

How to use the D & E Revenue Alabama

Using the D & E Revenue Alabama form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense reports. Next, carefully fill out the form, providing detailed information about your business's revenue streams and any deductions you may qualify for. Once completed, review the form for accuracy before submission. It is essential to keep a copy for your records, as this documentation may be required for future reference or audits.

Steps to complete the D & E Revenue Alabama

Completing the D & E Revenue Alabama form requires a systematic approach. Follow these steps:

- Collect all relevant financial documents, including sales records and expense reports.

- Fill in the required fields on the form, ensuring all information is accurate.

- Calculate your total revenue and any allowable deductions.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either online or via mail.

Legal use of the D & E Revenue Alabama

The D & E Revenue Alabama form must be used in accordance with state laws and regulations. This means that businesses should ensure they are compliant with all applicable tax laws when completing the form. Failure to adhere to these legal requirements can result in penalties, including fines or additional tax liabilities. It is advisable for businesses to consult with a tax professional to ensure compliance and proper use of the form.

Filing Deadlines / Important Dates

Filing deadlines for the D & E Revenue Alabama form are critical for businesses to note. Typically, the form must be submitted by a specific date each year, often coinciding with the end of the fiscal year or the tax season. Failure to file by this deadline can result in late fees or penalties. It is important for businesses to stay informed about these dates to ensure timely compliance and avoid unnecessary costs.

Required Documents

To complete the D & E Revenue Alabama form, certain documents are required. These typically include:

- Income statements detailing revenue sources.

- Expense reports to support any deductions claimed.

- Previous tax returns for reference and accuracy.

Having these documents readily available will facilitate a smoother completion process and ensure that all information reported is accurate.

Quick guide on how to complete damp e revenue alabama

Complete D& E Revenue Alabama effortlessly on any device

Online document management has gained signNow popularity among businesses and individuals. It offers a perfect environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage D& E Revenue Alabama on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign D& E Revenue Alabama with ease

- Obtain D& E Revenue Alabama and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or conceal sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred way to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign D& E Revenue Alabama and ensure outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the damp e revenue alabama

How to make an e-signature for a PDF in the online mode

How to make an e-signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

The best way to create an e-signature straight from your smart phone

The best way to make an e-signature for a PDF on iOS devices

The best way to create an e-signature for a PDF document on Android OS

People also ask

-

What is D& E Revenue Alabama and how does it relate to airSlate SignNow?

D& E Revenue Alabama refers to the Department of Revenue in Alabama that oversees tax and revenue collection. Utilizing airSlate SignNow, businesses can streamline their document signing and submission processes related to D& E Revenue Alabama, ensuring compliance while saving time and resources.

-

How does airSlate SignNow ensure compliance with D& E Revenue Alabama regulations?

airSlate SignNow is designed to comply with various legal standards, including those relevant to D& E Revenue Alabama. Our platform utilizes advanced security measures and legally binding eSignatures that meet state and federal regulations, ensuring your documents are both secure and compliant.

-

What features does airSlate SignNow offer for handling D& E Revenue Alabama documents?

airSlate SignNow offers features such as customizable templates, automated workflows, and in-platform document tracking that specifically cater to D& E Revenue Alabama requirements. These capabilities not only enhance efficiency but also simplify the management of essential documents.

-

Is airSlate SignNow cost-effective for businesses dealing with D& E Revenue Alabama?

Yes, airSlate SignNow provides a cost-effective solution for businesses engaging with D& E Revenue Alabama. Our pricing plans are designed to fit various budgets, making it easy for any business to implement our services without overspending.

-

Can I integrate airSlate SignNow with other applications relevant to D& E Revenue Alabama?

Absolutely! airSlate SignNow offers integrations with several popular applications and systems that help manage financial records and communications with D& E Revenue Alabama. This seamless integration enhances your workflow and ensures that all your document management needs are met.

-

What are the benefits of using airSlate SignNow for D& E Revenue Alabama documentation?

Using airSlate SignNow for D& E Revenue Alabama documentation allows businesses to reduce turnaround times and streamline approval processes. Additionally, the platform's user-friendly design makes it easy for all team members to adopt, resulting in improved productivity.

-

Is there customer support available for airSlate SignNow users dealing with D& E Revenue Alabama?

Yes, airSlate SignNow offers robust customer support for all users, including those focused on D& E Revenue Alabama documentation. Our support team provides assistance through various channels, ensuring that you have the help you need whenever questions arise.

Get more for D& E Revenue Alabama

- Divorce worksheet and law summary for contested or uncontested case of over 25 pages ideal client interview form louisiana

- Louisiana termination form

- La lien form

- Louisiana husband wife form

- Warranty deed from husband and wife to llc louisiana form

- Louisiana notice lien rights form

- Notice to owner of obligation arising from contract individual louisiana form

- La landlord notice form

Find out other D& E Revenue Alabama

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online