Arizona Schedule APY Itemized Deductions for Part Year Residents Form

What is the Arizona Schedule APY Itemized Deductions For Part Year Residents

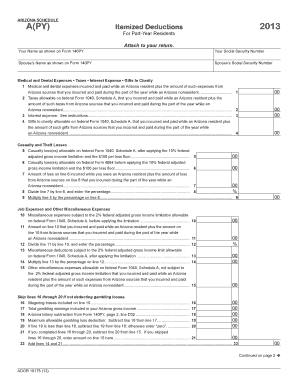

The Arizona Schedule APY Itemized Deductions for Part Year Residents is a tax form used by individuals who have lived in Arizona for only part of the tax year. This form allows taxpayers to itemize their deductions, which can lead to a lower taxable income. It is particularly important for those who may have moved into or out of Arizona during the year, as it ensures that only the appropriate deductions are claimed based on the time spent in the state.

How to use the Arizona Schedule APY Itemized Deductions For Part Year Residents

Using the Arizona Schedule APY involves several steps. First, gather all necessary documentation, including receipts for deductible expenses such as medical costs, mortgage interest, and property taxes. Next, complete the form by entering your personal information and detailing your itemized deductions. It is crucial to accurately calculate the portion of each deduction that applies to the time you were a resident of Arizona. Once completed, the form should be submitted along with your Arizona state tax return.

Steps to complete the Arizona Schedule APY Itemized Deductions For Part Year Residents

To complete the Arizona Schedule APY, follow these steps:

- Collect all relevant financial documents, including W-2s, 1099s, and receipts for deductible expenses.

- Determine your residency status and the duration of your stay in Arizona for the tax year.

- Fill out your personal information at the top of the form.

- List each itemized deduction, ensuring to prorate those that apply only to the time you were a resident.

- Review the completed form for accuracy and completeness.

- Attach the form to your Arizona state tax return before submission.

Key elements of the Arizona Schedule APY Itemized Deductions For Part Year Residents

Key elements of the Arizona Schedule APY include personal identification information, a section for itemized deductions, and specific lines for various types of deductions such as medical expenses, state and local taxes, and mortgage interest. Each deduction must be clearly documented and supported by appropriate records. Additionally, the form requires taxpayers to indicate the period of residency in Arizona, which directly affects the deductions claimed.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Schedule APY are typically aligned with federal tax deadlines. For most taxpayers, the deadline to file is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is essential to check for any updates or changes to deadlines, especially if you are filing for an extension or if there are specific circumstances affecting your filing status.

Legal use of the Arizona Schedule APY Itemized Deductions For Part Year Residents

The Arizona Schedule APY is legally binding when completed accurately and submitted in accordance with state tax laws. To ensure its legal validity, taxpayers must adhere to the guidelines set forth by the Arizona Department of Revenue. This includes providing truthful information, maintaining proper documentation for all deductions, and meeting all filing deadlines. Non-compliance with these regulations may result in penalties or additional scrutiny from tax authorities.

Quick guide on how to complete arizona schedule apy itemized deductions for part year residents

Complete [SKS] effortlessly on any device

Digital document handling has gained traction with companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, enabling you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any system with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal weight as a conventional wet ink signature.

- Verify the information and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign [SKS] and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Arizona Schedule APY Itemized Deductions For Part Year Residents

Create this form in 5 minutes!

How to create an eSignature for the arizona schedule apy itemized deductions for part year residents

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an e-signature for signing PDFs in Gmail

The best way to generate an e-signature from your smart phone

The way to create an e-signature for a PDF document on iOS

The best way to generate an e-signature for a PDF file on Android OS

People also ask

-

What is the Arizona Schedule APY Itemized Deductions For Part Year Residents?

The Arizona Schedule APY Itemized Deductions For Part Year Residents allows taxpayers who have lived in Arizona for only part of the year to claim specific deductions on their state taxes. This form ensures that residents can accurately report their itemized deductions based on their period of residence, making it an essential tool for part-year residents.

-

How can airSlate SignNow help with completing the Arizona Schedule APY Itemized Deductions For Part Year Residents?

airSlate SignNow streamlines the process of filling out and eSigning the Arizona Schedule APY Itemized Deductions For Part Year Residents. Our platform provides easy-to-use templates and secure document management, ensuring that you can organize and submit your deductions with ease and confidence.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers a suite of features designed to improve document management, including templates for tax forms like the Arizona Schedule APY Itemized Deductions For Part Year Residents, eSigning capabilities, and advanced tracking tools. These features help you stay organized and ensure timely submissions.

-

Is there a cost associated with using airSlate SignNow for tax forms?

airSlate SignNow offers a cost-effective solution for handling tax documents, including the Arizona Schedule APY Itemized Deductions For Part Year Residents. Pricing plans are flexible, allowing you to choose a plan that suits your business needs without breaking the bank.

-

What benefits do I gain by using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents like the Arizona Schedule APY Itemized Deductions For Part Year Residents provides several benefits, such as faster processing times, reduced paper use, and enhanced security for sensitive information. Additionally, eSigning helps expedite the approval process, making it easier to meet deadlines.

-

Does airSlate SignNow integrate with other software for tax preparation?

Yes, airSlate SignNow integrates seamlessly with a variety of accounting and finance software, facilitating a smooth workflow when dealing with tax forms like the Arizona Schedule APY Itemized Deductions For Part Year Residents. This integration allows users to import data easily, reducing data entry errors and saving time.

-

Can I use airSlate SignNow from multiple devices?

Absolutely, airSlate SignNow is designed to be accessible from multiple devices, including desktops, tablets, and smartphones. This flexibility ensures you can work on your Arizona Schedule APY Itemized Deductions For Part Year Residents form from anywhere, anytime.

Get more for Arizona Schedule APY Itemized Deductions For Part Year Residents

- Registration form dominican university jicsweb1 dom

- Dominican university transcript request form 16195635

- Drake tuition rebate form

- Travel itinerary fillable form

- Walgreens tb test documentation form

- Fnu withdrawal online form

- College pastor recommendation form

- Re enrollment form nyack college nyack

Find out other Arizona Schedule APY Itemized Deductions For Part Year Residents

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation