Arizona Form 140ptc

What is the Arizona Form 140ptc

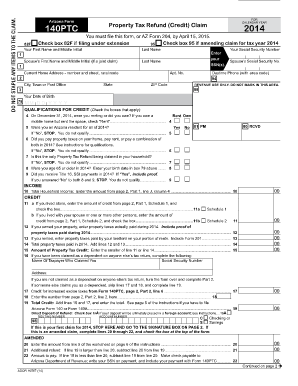

The Arizona Form 140ptc, also known as the Arizona 140ptc 2020, is a state tax form used by individuals to claim the property tax credit for the tax year. This form is specifically designed for residents of Arizona who meet certain eligibility criteria, allowing them to receive a credit based on the amount of property taxes paid on their primary residence. The form is essential for taxpayers seeking to reduce their overall tax liability and ensure compliance with state tax regulations.

How to use the Arizona Form 140ptc

Using the Arizona Form 140ptc involves several key steps. First, ensure you have all necessary documentation, including proof of property taxes paid and personal identification information. Next, accurately complete the form by entering your details, including your name, address, and the amount of property tax paid. It is crucial to review the instructions provided with the form to ensure all sections are filled out correctly. Once completed, submit the form according to the guidelines, either online or by mail, to ensure timely processing.

Steps to complete the Arizona Form 140ptc

Completing the Arizona Form 140ptc requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary documents, including proof of property tax payments.

- Fill in personal information, such as your name and address.

- Enter the total amount of property taxes paid during the tax year.

- Check for any additional credits or deductions that may apply to your situation.

- Review the form for accuracy and completeness.

- Submit the form by the filing deadline, either electronically or via mail.

Legal use of the Arizona Form 140ptc

The Arizona Form 140ptc is legally recognized as a valid document for claiming property tax credits. To ensure its legal use, it must be filled out accurately and submitted within the designated time frame. Compliance with state tax laws is essential, as improper use or submission of the form can lead to penalties or denial of the credit. The form must also adhere to the guidelines set forth by the Arizona Department of Revenue to maintain its validity.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Form 140ptc are crucial for taxpayers to keep in mind. Typically, the form must be submitted by the annual tax filing deadline, which is usually April 15 of the following year. However, it is advisable to check for any updates or changes to the deadlines each tax year. Late submissions may result in the forfeiture of the property tax credit, so timely filing is essential for all eligible taxpayers.

Required Documents

To successfully complete the Arizona Form 140ptc, certain documents are required. These include:

- Proof of property taxes paid, such as tax statements or receipts.

- Identification information, including your Social Security number.

- Any additional documentation that supports your eligibility for the property tax credit.

Having these documents ready will streamline the process and help ensure that your form is completed accurately.

Quick guide on how to complete arizona form 140ptc 2020

Prepare Arizona Form 140ptc effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly without any hold-ups. Handle Arizona Form 140ptc on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Arizona Form 140ptc smoothly

- Obtain Arizona Form 140ptc and select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Forge your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, shareable link, or download it to your computer.

Eliminate the hassle of missing or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any chosen device. Alter and eSign Arizona Form 140ptc to ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form 140ptc 2020

The best way to create an e-signature for a PDF in the online mode

The best way to create an e-signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

The way to generate an e-signature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the Arizona Form 140PTC 2020?

The Arizona Form 140PTC 2020 is a tax form used by Arizona residents to claim the property tax credit. It helps reduce the amount of state tax owed based on property taxes paid. Understanding this form is essential for maximizing your tax benefits in Arizona.

-

How can airSlate SignNow help with the Arizona Form 140PTC 2020?

airSlate SignNow simplifies the process of filling out and eSigning the Arizona Form 140PTC 2020. With our platform, users can easily create, edit, and send documents securely, helping to ensure that your form is submitted accurately and on time.

-

Is there a cost associated with using airSlate SignNow for the Arizona Form 140PTC 2020?

Yes, there is a cost associated with using airSlate SignNow; however, it offers cost-effective solutions designed for businesses. Depending on your needs, you can choose from different pricing plans that suit the frequency and number of documents you need to handle, including tax forms like the Arizona Form 140PTC 2020.

-

What features does airSlate SignNow offer for managing the Arizona Form 140PTC 2020?

airSlate SignNow offers a range of features designed to streamline document management, including templates, real-time collaboration, and secure eSignature capabilities. These tools are particularly useful for ensuring that the Arizona Form 140PTC 2020 is accurately completed and signed by all required parties.

-

Are there any integrations available for airSlate SignNow that can assist with the Arizona Form 140PTC 2020?

Yes, airSlate SignNow integrates with various applications, including cloud storage and productivity tools. These integrations facilitate easy access to the forms and documents needed for the Arizona Form 140PTC 2020, enhancing efficiency and helping you manage your tax documents effectively.

-

How secure is airSlate SignNow when handling forms like the Arizona Form 140PTC 2020?

airSlate SignNow prioritizes security with end-to-end encryption and compliance with industry standards. This ensures that your sensitive information, including details related to the Arizona Form 140PTC 2020, is protected during the entire signing and submission process.

-

Can I track the status of my Arizona Form 140PTC 2020 submission using airSlate SignNow?

Yes, airSlate SignNow provides users with tracking features that allow you to monitor the status of your documents, including the Arizona Form 140PTC 2020. You can receive real-time notifications when your form is viewed, signed, or completed, helping you stay informed every step of the way.

Get more for Arizona Form 140ptc

Find out other Arizona Form 140ptc

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple