For the Calendar Year or Fiscal Year Beginning M M D D 2 0 1 6 and Ending M M D D Y Y Y Y Azdor Form

What is the For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor

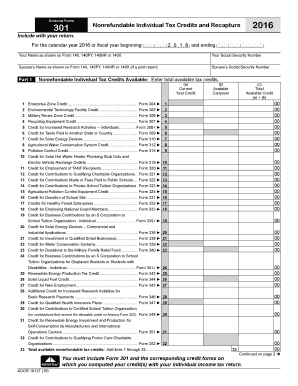

The form referred to as For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor is a specific document used primarily for tax purposes in the United States. It is designed to report income, deductions, and credits for a designated fiscal year or calendar year. This form is crucial for businesses and individuals who need to comply with federal and state tax regulations. Understanding the details of this form is essential for accurate reporting and to avoid penalties.

Steps to complete the For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor

Completing the For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor form involves several key steps:

- Gather necessary financial documents, including income statements, expense records, and any relevant tax forms.

- Fill in the required fields accurately, ensuring that all income and deductions are reported.

- Review the completed form for any errors or omissions.

- Sign and date the form, ensuring compliance with eSignature laws if submitting electronically.

- Submit the form by the designated deadline, either electronically or via mail.

Legal use of the For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor

The legal use of the For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor form is governed by various laws, including the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). These laws ensure that electronic signatures and documents are legally binding, provided that specific requirements are met. This includes the necessity for a secure signing process and the ability to retain a record of the signed document.

Key elements of the For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor

Key elements of the For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor form include:

- Identification of the taxpayer, including name, address, and taxpayer identification number.

- Reporting of total income, including wages, dividends, and other earnings.

- Details of deductions and credits that may apply to the taxpayer.

- Signature lines for the taxpayer and any authorized representatives.

- Instructions for submission, including deadlines and acceptable methods.

How to obtain the For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor

Obtaining the For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor form can be done through several methods:

- Visit the official website of the relevant tax authority to download the form directly.

- Request a physical copy from a local tax office or authorized distributor.

- Utilize tax preparation software that includes this form as part of its offerings.

Filing Deadlines / Important Dates

Filing deadlines for the For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor form are critical to ensure compliance. Generally, the deadline for filing is April 15 of the following year for calendar year filers. Fiscal year filers must submit their forms by the 15th day of the fourth month following the end of their fiscal year. It is essential to keep track of these dates to avoid penalties and interest on late submissions.

Quick guide on how to complete for the calendar year 2016 or fiscal year beginning m m d d 2 0 1 6 and ending m m d d y y y y azdor

Complete [SKS] effortlessly on any device

Web-based document handling has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, as you can obtain the correct form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The most efficient way to edit and electronically sign [SKS] without stress

- Locate [SKS] and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive content with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your updates.

- Choose how you would like to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that necessitate printing additional document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure effective communication at every stage of the form preparation experience with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the for the calendar year 2016 or fiscal year beginning m m d d 2 0 1 6 and ending m m d d y y y y azdor

The best way to create an e-signature for your PDF in the online mode

The best way to create an e-signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an e-signature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The best way to make an e-signature for a PDF on Android OS

People also ask

-

What is airSlate SignNow and how does it work?

airSlate SignNow is a digital solution that enables businesses to send and electronically sign documents efficiently. Designed for documents relevant to 'For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor,' it streamlines the eSigning process, ensuring documents are signed securely and promptly.

-

How much does airSlate SignNow cost?

The pricing for airSlate SignNow is competitive and tailored to businesses of all sizes. Subscriptions are available on a monthly or annual basis, and specific plans cater to needs for 'For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor.' Contact our sales team for detailed pricing tailored to your organization.

-

What are the key features of airSlate SignNow?

Key features of airSlate SignNow include customizable templates, secure electronic signatures, and integration capabilities with various applications. These features are particularly useful for handling documents related to 'For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor.'

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers integration with numerous software solutions, including CRM and project management tools. This ensures that workflows remain seamless and effective, especially for managing documents tied to 'For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor.'

-

How secure is the eSigning process with airSlate SignNow?

The eSigning process with airSlate SignNow is highly secure, employing encryption and authentication protocols to protect sensitive data. This level of security is essential for documents concerning 'For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor.' We ensure that your information remains confidential and protected.

-

What devices can I use to access airSlate SignNow?

airSlate SignNow is accessible on various devices, including desktops, tablets, and smartphones. This flexibility is advantageous for users who need to handle documents for 'For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor' while on the go, ensuring they can sign and manage documents anytime, anywhere.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows potential users to explore its features and capabilities. This trial is an excellent opportunity to evaluate how airSlate SignNow can meet your needs for 'For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor' before committing to a subscription.

Get more for For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor

Find out other For The Calendar Year Or Fiscal Year Beginning M M D D 2 0 1 6 And Ending M M D D Y Y Y Y Azdor

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document