Arizona Form 309

What is the AFSC Form 309?

The AFSC Form 309 is a document used primarily within the United States Air Force to facilitate various administrative processes. This form serves as a record of actions taken regarding personnel matters, including evaluations, awards, and other significant updates in a service member's career. Understanding the purpose and structure of this form is essential for both service members and administrative personnel, as it ensures compliance with military regulations and supports effective record-keeping.

How to Obtain the AFSC Form 309

Accessing the AFSC Form 309 is straightforward. Service members can typically obtain this form through their unit's administrative office or the official Air Force website. It is important to ensure that the most current version of the form is being used, as updates may occur. Additionally, personnel may also find the form available through various military resource centers or by consulting with their commanding officer for guidance.

Steps to Complete the AFSC Form 309

Completing the AFSC Form 309 involves several key steps to ensure accuracy and compliance with Air Force regulations. First, gather all necessary information, including personal details and relevant service history. Next, carefully fill out each section of the form, ensuring that all entries are clear and legible. It is advisable to double-check the information for any errors before submission. Finally, submit the completed form to the appropriate administrative office, either electronically or in person, as per the guidelines provided by your unit.

Legal Use of the AFSC Form 309

The AFSC Form 309 holds legal significance within the military context. When properly completed and submitted, it serves as an official record that can impact a service member's career progression, evaluations, and eligibility for awards. Compliance with the regulations governing this form is crucial, as any discrepancies or inaccuracies may lead to administrative issues or delays in processing. Understanding the legal implications of this form helps ensure that service members maintain accurate and up-to-date records.

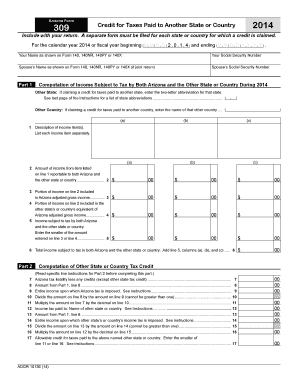

Key Elements of the AFSC Form 309

Several key elements are essential to the AFSC Form 309. These include the service member's personal information, such as rank, name, and AFSC (Air Force Specialty Code). Additionally, the form requires detailed sections for documenting specific actions, evaluations, and recommendations. Each element must be filled out with precision to ensure that the form accurately reflects the service member's status and achievements. Familiarity with these elements can aid in the efficient completion of the form.

Form Submission Methods

The AFSC Form 309 can be submitted through various methods, depending on the policies of the service member's unit. Common submission methods include electronic submission via secure military portals, mailing the form to the designated administrative office, or delivering it in person. It is important to follow the specific submission guidelines provided by the unit to ensure timely processing and compliance with military protocols.

Quick guide on how to complete arizona form 309

Prepare Arizona Form 309 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to easily find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Arizona Form 309 on any device using airSlate SignNow’s Android or iOS applications and simplify your document-related tasks today.

How to edit and eSign Arizona Form 309 with ease

- Find Arizona Form 309 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of your documents or obscure sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Arizona Form 309 and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form 309

The best way to generate an electronic signature for a PDF document online

The best way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

The best way to make an electronic signature right from your smart phone

The way to make an e-signature for a PDF document on iOS

The best way to make an electronic signature for a PDF on Android OS

People also ask

-

What is AFSC Form 309 and why is it important?

AFSC Form 309 is a crucial document used in the military for various administrative processes. It ensures that personnel maintain compliance and organizational standards. Understanding how to fill out and manage the AFSC Form 309 can streamline operations within military branches.

-

How can airSlate SignNow help with AFSC Form 309 management?

airSlate SignNow provides an efficient platform for electronically signing and sending AFSC Form 309. This allows for faster processing and reduces the need for physical paperwork. The platform’s user-friendly interface makes it easy for users to manage their documents in a seamless manner.

-

Is airSlate SignNow cost-effective for managing AFSC Form 309?

Yes, airSlate SignNow is a cost-effective solution for handling AFSC Form 309. With competitive pricing plans, businesses can reduce expenses associated with traditional paper-based document management. This affordability makes it accessible for both small and large organizations.

-

What features does airSlate SignNow offer for AFSC Form 309?

airSlate SignNow offers several features that enhance the management of AFSC Form 309, including electronic signatures, document templates, and tracking capabilities. These tools help ensure that documents are completed accurately and can be easily shared among stakeholders. Additionally, users can integrate other applications to streamline their workflow.

-

Can airSlate SignNow integrate with other software for AFSC Form 309 processing?

Absolutely! airSlate SignNow supports integrations with various software tools that can assist with AFSC Form 309 processing. This flexibility allows users to build a customized workflow that meets their specific needs and enhances overall efficiency. Popular integrations include CRMs, ERPs, and cloud storage services.

-

What are the benefits of using airSlate SignNow for AFSC Form 309?

Using airSlate SignNow for AFSC Form 309 can lead to signNow improvements in speed and efficiency. Electronic signatures reduce turnaround times, and the ability to manage documents online enhances accessibility. Overall, this results in improved productivity and less opportunity for errors compared to traditional methods.

-

Is it secure to use airSlate SignNow for AFSC Form 309?

Yes, airSlate SignNow prioritizes security, ensuring that your AFSC Form 309 and other documents are protected. The platform employs robust encryption and complies with industry standards to safeguard sensitive information. Users can feel confident in the security of their electronic transactions.

Get more for Arizona Form 309

Find out other Arizona Form 309

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy