Arizona Form 309 1040com

What is the Arizona Formcom

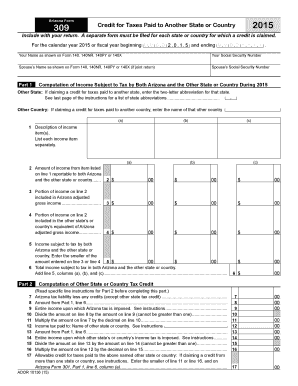

The Arizona Formcom is a state-specific tax form utilized by residents of Arizona for reporting income and calculating state tax obligations. This form is essential for individuals who need to reconcile their state taxes with their federal tax filings. It is designed to ensure compliance with Arizona tax laws and to facilitate the accurate assessment of tax liabilities.

How to use the Arizona Formcom

To effectively use the Arizona Formcom, individuals must first gather all necessary financial documents, including W-2s, 1099s, and any other income statements. After obtaining the form, taxpayers should carefully fill it out by entering their income details, deductions, and credits. It is crucial to review the completed form for accuracy before submission to avoid potential penalties or delays in processing.

Steps to complete the Arizona Formcom

Completing the Arizona Formcom involves several key steps:

- Gather all relevant financial documents, including income statements and deduction records.

- Download or obtain a copy of the Arizona Formcom.

- Fill in personal information, including name, address, and Social Security number.

- Report total income from all sources accurately.

- Claim applicable deductions and credits to reduce tax liability.

- Double-check all entries for accuracy and completeness.

- Submit the form by the designated deadline, either electronically or via mail.

Legal use of the Arizona Formcom

The legal use of the Arizona Formcom is governed by state tax regulations. This form must be completed accurately and submitted by the required deadlines to ensure compliance with Arizona tax law. Failure to properly use the form can result in penalties, including fines or interest on unpaid taxes. It is important to maintain a copy of the submitted form and any supporting documents for personal records.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Formcom typically align with federal tax deadlines. Taxpayers should be aware that the standard deadline for filing individual income tax returns is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check for any updates or changes to deadlines each tax year to ensure timely filing.

Form Submission Methods (Online / Mail / In-Person)

The Arizona Formcom can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Electronic filing through approved e-file providers, which is often the fastest method.

- Mailing a paper copy of the completed form to the appropriate Arizona Department of Revenue address.

- In-person submissions at designated state tax offices, although this method may require an appointment.

Quick guide on how to complete arizona form 309 1040com

Complete [SKS] effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without any hold-ups. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Mark signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, invitation link, or download it to your computer.

Bid farewell to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Arizona Form 309 1040com

Create this form in 5 minutes!

How to create an eSignature for the arizona form 309 1040com

The best way to generate an electronic signature for a PDF document in the online mode

The best way to generate an electronic signature for a PDF document in Chrome

The way to generate an e-signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The way to make an e-signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What is Arizona Form 309 1040com?

Arizona Form 309 1040com is a tax form specifically designed for Arizona residents to file their taxes. It helps taxpayers report income, deductions, and credits effectively. With airSlate SignNow, completing and signing this form becomes quick and user-friendly.

-

How does airSlate SignNow streamline the completion of Arizona Form 309 1040com?

airSlate SignNow allows users to fill out Arizona Form 309 1040com electronically, reducing the risk of errors. The platform also offers intuitive collaboration features, ensuring that you can easily share the form with tax professionals or family members for review and assistance.

-

Is there a cost associated with using airSlate SignNow for Arizona Form 309 1040com?

Yes, airSlate SignNow offers a subscription-based pricing model that provides excellent value for users filing Arizona Form 309 1040com. The pricing tiers are designed to cater to both individuals and businesses, making it an economical solution for document management while ensuring compliance.

-

What features does airSlate SignNow provide for Arizona Form 309 1040com?

airSlate SignNow includes several key features for Arizona Form 309 1040com, such as eSignature capabilities, document templates, and secure cloud storage. These features enhance user efficiency and help ensure that your tax filings are accurate and up-to-date.

-

Can I integrate airSlate SignNow with other software for Arizona Form 309 1040com?

Absolutely! airSlate SignNow offers integrations with various software applications that are beneficial for managing Arizona Form 309 1040com. You can connect it with popular tools like Salesforce, Google Drive, and Dropbox, allowing you to streamline your workflow.

-

What are the benefits of using airSlate SignNow for Arizona Form 309 1040com?

Using airSlate SignNow for Arizona Form 309 1040com provides several benefits, including time savings, improved accuracy, and enhanced security. The platform ensures that your sensitive tax information is protected while allowing you to complete forms efficiently.

-

Is airSlate SignNow compliant with Arizona tax regulations for Form 309 1040com?

Yes, airSlate SignNow is designed to comply with all Arizona tax regulations, including those related to Arizona Form 309 1040com. This compliance helps users feel confident that their tax filings adhere to state requirements while utilizing the platform.

Get more for Arizona Form 309 1040com

- Oregon general judgment of dissolution of marriage form

- Oregon ct 12 2015 form

- Oregon department of justice fund raising firm solicitation campaign notice pf 11pf 21 instructions on reverse ag model rules form

- Draft form 610 universal intake form state of oregon doj state or

- Part 822 4 communicable disease risk assessment form

- Part 822 4 individual treatmentrecovery plan review ta oasas oasas ny form

- Person parental form

- Nyc sacc license application form

Find out other Arizona Form 309 1040com

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple