Arizona Form 140PY Azdor

What is the Arizona Form 140PY Azdor

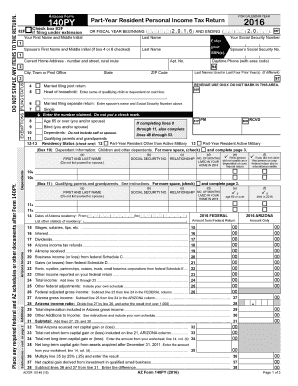

The Arizona Form 140PY Azdor is a state tax form specifically designed for part-year residents of Arizona. It allows individuals who have moved in or out of the state during the tax year to report their income accurately. This form is essential for ensuring that taxpayers only pay taxes on income earned while residing in Arizona, thus aligning with state tax laws. It is important for part-year residents to understand how to correctly fill out this form to avoid potential issues with the Arizona Department of Revenue.

How to use the Arizona Form 140PY Azdor

Using the Arizona Form 140PY Azdor involves several steps to ensure accurate reporting of your income. First, gather all necessary financial documents, including W-2s and 1099s, that reflect your earnings during the time you lived in Arizona. Next, complete the form by entering your personal information, income details, and any deductions or credits you may qualify for. It is crucial to review the instructions provided with the form to ensure compliance with state regulations. Once completed, the form can be submitted electronically or via mail, depending on your preference.

Steps to complete the Arizona Form 140PY Azdor

Completing the Arizona Form 140PY Azdor requires careful attention to detail. Follow these steps:

- Start by entering your personal information, including your name, address, and Social Security number.

- Report your income by listing all sources of income earned while a resident of Arizona.

- Calculate your deductions and credits, ensuring you meet the eligibility criteria for each.

- Complete the tax calculation section to determine your tax liability.

- Review the form for accuracy before submitting it to the Arizona Department of Revenue.

Legal use of the Arizona Form 140PY Azdor

The Arizona Form 140PY Azdor is legally binding when filled out correctly and submitted according to state regulations. To ensure its legal validity, it must be signed and dated by the taxpayer. Electronic signatures are accepted, provided they comply with the relevant eSignature laws. Adhering to these legal requirements is essential to avoid penalties or issues with the Arizona Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Form 140PY Azdor are crucial for compliance. Typically, the form must be filed by the tax deadline, which is usually April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may apply, allowing for additional time to file without incurring penalties. Staying informed about these dates helps ensure timely submission and avoids potential complications.

Form Submission Methods (Online / Mail / In-Person)

The Arizona Form 140PY Azdor can be submitted through various methods, providing flexibility for taxpayers. The form can be filed online through the Arizona Department of Revenue's e-filing system, which offers a convenient way to submit your tax information securely. Alternatively, taxpayers may choose to mail the completed form to the appropriate address listed on the form's instructions. In-person submissions are also possible at designated tax offices, allowing for direct interaction with tax professionals if needed.

Quick guide on how to complete arizona form 140py azdor

Effortlessly Prepare Arizona Form 140PY Azdor on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, as it allows you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and easily. Manage Arizona Form 140PY Azdor on any device using the airSlate SignNow applications for Android or iOS, and enhance any document-focused process today.

Simple Steps to Modify and Electronically Sign Arizona Form 140PY Azdor with Ease

- Locate Arizona Form 140PY Azdor and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or conceal sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes mere moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to secure your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your chosen device. Modify and eSign Arizona Form 140PY Azdor, ensuring excellent communication throughout every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form 140py azdor

The best way to generate an e-signature for your PDF file in the online mode

The best way to generate an e-signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF on Android

People also ask

-

What is the Arizona Form 140PY Azdor used for?

The Arizona Form 140PY Azdor is a tax form specifically designed for part-year residents who need to report income earned while residing in Arizona. It allows individuals to accurately calculate their state tax liability based on the time they lived in the state. Using this form ensures compliance with Arizona tax laws and helps avoid potential fines.

-

How can airSlate SignNow help with the Arizona Form 140PY Azdor?

airSlate SignNow offers an efficient platform for filling out, signing, and submitting your Arizona Form 140PY Azdor electronically. With its easy-to-use interface, you can quickly complete the form and ensure all required signatures are secured. This streamlines your tax filing process, saving you time and reducing errors.

-

Is there a cost associated with using airSlate SignNow to manage the Arizona Form 140PY Azdor?

Yes, airSlate SignNow operates on a subscription model with various pricing plans to suit different needs. By using airSlate SignNow for your Arizona Form 140PY Azdor, you're investing in a reliable, secure way to manage your documents. The pricing is competitive and offers great value for the services provided.

-

Can I integrate airSlate SignNow with other software for handling Arizona Form 140PY Azdor?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and business applications, enhancing your workflow when managing the Arizona Form 140PY Azdor. You can easily connect it with tools you already use, simplifying the process of document handling and tax preparation.

-

What features does airSlate SignNow offer for Arizona Form 140PY Azdor users?

airSlate SignNow provides several features that aid users in completing the Arizona Form 140PY Azdor, including document templates, e-signature capabilities, and real-time tracking. These tools facilitate collaboration and ensure that all parties involved can access and sign the document efficiently. This results in a more organized and timely filing process.

-

Is it safe to use airSlate SignNow for my Arizona Form 140PY Azdor?

Yes, airSlate SignNow takes security seriously and employs advanced encryption methods to protect your data while you fill out or submit the Arizona Form 140PY Azdor. Your information is stored securely, and the platform is compliant with industry regulations. You can trust that your sensitive tax information is well-guarded.

-

Can I access airSlate SignNow from my mobile device for the Arizona Form 140PY Azdor?

Yes, airSlate SignNow is accessible from mobile devices, allowing you to manage the Arizona Form 140PY Azdor on the go. The mobile-friendly interface ensures that you can complete, sign, and send your tax documents anytime, anywhere. This level of flexibility is ideal for busy professionals who need to handle their taxes across different locations.

Get more for Arizona Form 140PY Azdor

Find out other Arizona Form 140PY Azdor

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later